Technology

Services

Resources

Have you heard the news? The future is cookieless, and it’s coming up fast—in the second half of 2024, to be precise!

To prepare for a world without third-party cookies, it’s important that members of the advertising industry understand what’s changing and embrace new ideas and collaboration. The success of any identity solution is heavily dependent on scale, and so partnering with an independent owner of a solution with the most scale—or, better yet, partnering with multiple—is likely to be the best option when the dust settles. Working as a group, evaluating options, and sharing principles is the best course we can take to minimize the impact on customers.

With that in mind, here’s a look at the current and future state of third-party cookie deprecation and how groups are working toward innovative identity solutions.

Yes, third-party cookies are on their way out. That said, it's not an all-at-once farewell: Firefox and Safari have already eliminated cookies, while Google, over the past few years, has announced, then delayed, then again delayed Chrome’s third-party cookie deprecation. Despite these postponements, the day will eventually come when third-party cookies are no longer supported in Chrome. However, the transition will be an incremental one, starting in Q1 2024 with about 1% of Chrome users, and progressing gradually from there.

The demise of third-party cookies stems from concerns over consumer privacy and data protection. 86% of people in the US say data privacy is a growing concern for them, and with consumers demanding more control over their online footprint, legislators have stepped in, enacting privacy regulations such as GDPR, CCPA, and CPRA. At the same time, tech giants and browsers are taking proactive steps to rebuild trust by putting an end to the cross-site tracking that third-party cookies enabled.

Cookieless tracking monitors user activity on websites without relying on browser cookies. These tracking tools allow marketers to measure cookieless click-through conversions, granting them the ability to track performance, report on campaigns, and maximize ROAS without compromising consumer privacy.

Unfortunately, there’s no “silver bullet” replacement for third-party cookies (yet). Savvy marketers are leaning into a mix of privacy-friendly solutions to minimize the impact of third-party cookie loss on their campaigns, including (but not limited to) cookieless tracking, first-party data, contextual targeting, anonymized data sources, premium inventory, and audience profiling.

New identity solutions have also emerged, offering ways to glean insights from and target messaging to audiences while adhering to privacy-first principles. What do these burgeoning identity solutions look like? Let’s dig in:

In February 2020, the International Advertising Bureau (IAB) introduced Project Rearc, a global initiative designed to get stakeholders across the digital advertising and media supply chain together to re-architect digital marketing in a consolidated effort to harmonize personalization and consumer privacy. And in June 2022, as part of this initiative, IAB Tech Lab released its Global Privacy Platform, a mechanism for transmitting consumer choice signals from websites and mobile apps to advertising technology companies.

Along with other industry leaders, Basis has been an active participant in Project Rearc—reviewing the proposals, evaluating specs, and providing feedback. It proposes rigorous technical standards and guidelines that inform how companies collect and use such an identifier so that:

LiveRamp introduced IdentityLink in 2016. The technology, now known as RampID, allows resolving hundreds of different identifiers for consumers used on devices and marketing platforms in a privacy-compliant manner. It doesn’t matter if data is offline or online, first-party CRM or third-party behavioral, online exposure data or mobile app download data—all of it can be tied back to a unique, privacy-safe identifier at the consumer level.

The digital media ecosystem is a dynamic one, with new methodologies, tools, and opportunities emerging every day. The third-party cookie has been a protagonist for the last 20 years, but it’s not the only character in this story. And with the third-party cookie going the way of MySpace, we are at the dawn of a new era for adtech—one filled with opportunity and room for innovation in the way we connect with our audiences.

Advertisers who focus on making the most of their first-party data and cookieless media alternatives, optimizing campaigns based on real-time learnings, and embracing identity solutions that are high-performing and privacy compliant, are sure to be well-positioned for the cookieless future.

As we go through these changes together, it’s important that industry players stay committed to working together, listening to the market, collaborating with regulatory bodies, adapting and developing new products, and keeping customers/users abreast of changes as they develop. If we can do that, we’ll all emerge from a place of strength and primed for success in our new, cookieless world.

—

Want to learn more about how to embrace the cookieless future? Check out Beyond Third-Party Cookies: Your Guide to Overcoming the Identity Crisis.

For much of its history, the digital advertising world has been something of an iceberg: its surface shiny and bright, lighting up internet users’ screens while supporting organizational growth and powering the digital economy. Adtech largely ran out of the public’s site—back before the average Joe understood the connection between a morning Google search for lampshades and an afternoon ad for a home goods store.

But further down, below the surface, cookies and third-party data and a web of interconnected platforms and ad networks and publishers and advertisers intertwined to serve targeted ads to customers who had little idea as to why they were seeing them—and even less of an idea of how much of their personal data was being used in the process.

For better or worse, it sure seems like those days are behind us for good.

While the mechanics of digital advertisers long stayed out of the spotlight, most modern consumers now have at least a baseline understanding of how cookies work, how apps try to track them on their mobile devices, and how their social media and search activities are the fuel that powers the data economy. And, with that knowledge in hand, the majority of those consumers are increasingly invested in the privacy and ethical use of their data: Between March 2022 and March 2023, 85% of consumers reported deleting a mobile app, 82% opted not to share their personal data, 78% avoided a certain website, and 67% didn’t make an online purchase as a result of privacy concerns. Regulators, in tandem, have passed and enacted (and enforced) a variety of privacy-minded digital advertising laws in states across the US— from California, to Virginia, to Connecticut.

Of course, data privacy isn’t the only aspect of digital advertising that’s being pulled into the spotlight. A slew of Justice Department lawsuits and FTC activity now show that the world is paying very, very close attention to the inner workings of digital advertising and many of its major players. And while the coming deprecation of third-party cookies might seem like all the massive change that advertisers can handle right now, marketers will need to read the writing on the wall if they want to position themselves for success in this new era of heightened scrutiny.

For those keeping track at home: Trust + Advertising = Essential. Anti-trust + Advertising = Huge, Existential Problem.

A handful of high profile antitrust lawsuits are currently poised to impact two of digital advertising’s biggest players—tech titans Google and Amazon—and, depending on the results of those suits, reshape the entire industry.

Let’s take a closer look at each:

The US Justice Department, together with 11 state Attorneys General, is taking Google to court over its alleged violation of US antitrust laws, claiming the company—which owns a 90% market share in search—made anticompetitive deals to secure and maintain its status as the preeminent search engine on phones and web browsers. These included multibillion-dollar agreements with Apple and Firefox-maker Mozilla ensuring their products would use Google as the default search engine on consumers’ phones and browsers. The Justice Department’s argument is that Google's made these deals to maintain its dominance and eliminate opportunities for competition from other search rivals. Meanwhile, Google maintains that the company’s longtime search market supremacy is due simply to the fact that its search engine is just better than everyone else’s, and that consumers are going with the best option out there.

A key part of the government's case is focused on how Google has long leaned on its search dominance to fuel its $162.5 billion paid search empire and to harvest reams and reams of consumer data, which it then uses to power its larger ad business and, of course, to keep people using its platform and its products. But it’s that overall ad business that’s the focus of yet another lawsuit facing the tech giant.

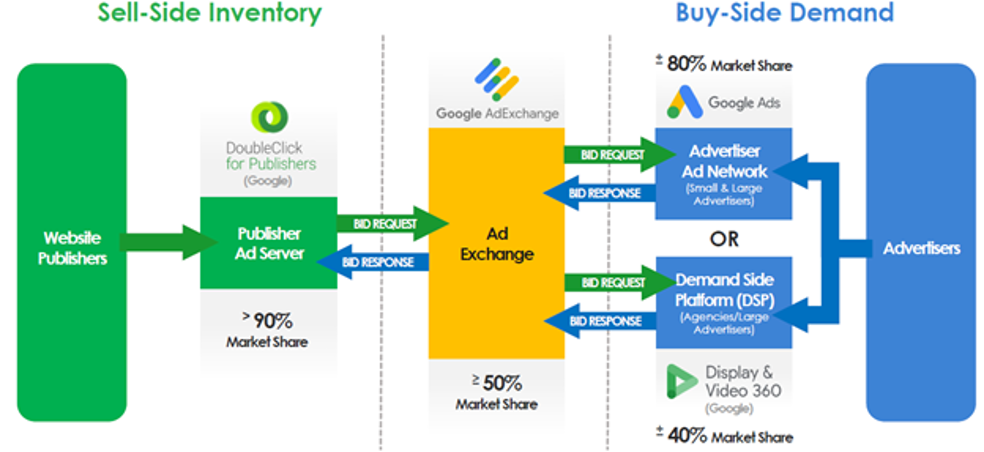

The Justice Department’s second suit against Google (which, like the other case, is also supported by several state Attorneys General) pertains to the company’s digital advertising presence more broadly. In this case, the Justice Department is arguing that Google is so deeply involved with every aspect of the digital advertising ecosystem that they have an anticompetitive and monopolistic hold on the space. The following visual from the Justice Department illustrates Google’s dominating presence on both the sell-side and the buy-side of the digital advertising business (and, for good measure, its ad exchange):

If the Justice Department is successful in either of these antitrust cases against Google, the outcome will likely result in massive fines or, potentially, the forced breakup of Google’s advertising business. Whether that means a negotiated deal with prosecutors where Google spins off some or all of their ad business into its own separate entity, or whether it means that selling certain parts that ad business to other folks in the industry, remains to be seen. But no matter the outcome, if the Justice Department is successful, it will mean monumental implications for everyone in the digital advertising industry.

Before we dive into all of those implications, though, let’s look at one final antitrust lawsuit for good measure, this one targeting Amazon:

Lastly, we have the lawsuit against Amazon by the Federal Trade Commission (FTC). Here, the FTC has filed a suit against Amazon alleging an anticompetitive hold of the online “e-tail” space, where Amazon has an enormous advantage over most of its “competitors” (if you can even call any other American online retailers “competitors” to Amazon). While this case only just filed, Amazon will likely point to brands like Walmart or Kroger as suitable adversaries and question why those retail and grocery giants aren’t being sued, too. It remains to be seen how this case will play out, but it's certainly worth keeping an eye on, especially given Amazon's Prime dominant position in the retail media space.

The convergence of these three cases, along with the increased scrutiny over data privacy in digital advertising and Meta’s ongoing struggles with regulators in both the US and the EU, reveals some inconvenient but essential truths about the current state of digital advertising and the larger digital ecosystem in which advertisers participate.

First, it shows that regulation of digital advertising is starting to pick up here in the US, much more so than we have seen in previous years or under previous administrations. Combined with the continued rollout of state-level privacy laws (not to mention the industry’s own self-regulation in cutting down on third-party cookies), we are starting to see more regulation in the US around these platforms and large tech companies in a way that could lead to an industry-wide sea change.

Second, it shows that the digital advertising industry has a big, bright spotlight on it for the first time since…well, pretty much ever. Historically, much of digital advertising industry has felt like a black box, and that has led to some fairly understandable criticism—from complaints about insufficient transparency within programmatic advertising, to the too-often-covert ways in which many companies have gathered user data, to the subsequent difficulties users have had in trying to manage that data. But with government entities and consumers alike showing new levels of interest in the digital advertising ecosystem, how it works, who the main players are, and what exactly they’re doing with people's data, that black box is being pried wide open for the world to see.

Add it all together, and it’s very possible that we’re entering a new era of digital advertising—one defined by a level of scrutiny this industry has never before had to feel. Consumers are pushing for increased transparency, and regulators are cracking down on giants like Google and Amazon in ways that could significantly reshape the landscape. Advertisers will need to prepare accordingly.

So, how can digital advertisers best situate themselves for adapting to all this change? A few recommendations:

At a minimum, digital advertisers should make sure they’re keeping an eye on regulatory developments. It’s not yet clear how these three cases will play out—they could lead to anything from the indefinite continuation of the status quo up to (and including)a radically and permanently altered digital advertising landscape. Regardless, it's critical for digital advertisers to keep tabs on what’s going on so that they can make informed decisions based on the latest developments.

Next, advertisers must prioritize consumer data privacy—not only because of the challenges posed by signal loss, but because consumers (and government regulators) are demanding it. Marketers would do well to examine the questions behind the identity crisis, integrate privacy-friendly solutions like contextual and first-party data-based targeting, and make sure their teams invest in learning everything they can about privacy-friendly advertising. Investments in first-party data hygiene (and things like CDPs) are likely to prove particularly critical—especially if advertisers end up needing to work with new partners due to the result of these antitrust suits—and finding reliable partners with access to lots of high-quality inventory and data will be essential in the years ahead.

If these lawsuits do, in fact, lead to a world in which there is even more media fragmentation and complexity, marketers will need to ensure they have the requisite tools and systems to navigate that complexity efficiently and effectively. And don’t forget the importance of the company you keep: Finding and establishing good relationships with your vendors, and aligning with future-forward partners (aka people who value data compliance and consumer trust as much as you do), will be key.

Finally, this spotlight on digital advertising creates a great opportunity for advertisers to step back and take stock of their strategies, partnerships, and systems to ensure that they’re not just using whatever the default partner or technology is simply because it’s the default. If advertising via Google or Amazon makes sense for you and your organization, that’s great! But it's still worth taking that step back to identify whether and where there might be other opportunities. And in a world where we may end up seeing major changes at major players in the digital advertising space, now is the perfect time to start that evaluation process with the comfort of knowing that it will likely be at least a year or two before the result of these cases start having real world implications.

With a variety of forces at work to put a spotlight on the industry, the scale of all these potential changes to the digital advertising ecosystem can feel a bit overwhelming. But with change comes opportunity, and this new focus on our industry offers marketers a rare moment to take that aforementioned step back and ensure that all their advertising practices are aligned with what consumers are asking for and, ultimately, are what make the most sense for you and/or your clients.

At the same time, this is an enormous opportunity for the industry as a whole. If the Justice Department and the FTC win their cases against Google and Amazon, the digital advertising world could well wake up to a more competitive playing field, ushering in new space for challengers to generate more of the thing that’s driven our industry from the very start: innovation.

—

Want to ensure that you’re regularly keeping tabs on all the most important industry developments, with just one click? Sign up for the Basis Scout newsletter to get a monthly digest of all the best digital marketing articles, POVs, and reports delivered straight to your inbox each month.

Picture this: The weekend is finally here, it’s game time, and you’ve got your homemade nachos all set to go (your secret ingredient: home-pickled jalapenos!). You plop down on the couch, crack open your first beer, turn on the big screen and...shoot. Where’s the game? Didn’t you read something about Amazon securing the rights for this season? No wait, that was Peacock...or was it Apple TV+? ESPN+? Maybe TBS? Or TNT? One of the Ts? Fox? CBS? Hulu? YouTube TV? Why can’t you find it?! Was there ever even a game today? THE NACHOS ARE GETTING COLD!

Tuning in to live sports used to be so simple. And we’re not even talking about 50+ years ago, when that meant “going to the game” or “turning on the radio” for 95% of your live sports consumption. As recently as the 2000s, when it came to sports broadcasts, there were the major networks, ESPN, an occasional game on one of the Turner channels, and that pretty much was it.

Today, sports leagues are scattering their broadcast rights around like digital Johnny Appleseeds, adding to an already-complex CTV and streaming video environment and creating new challenges for advertisers and consumers alike. The clear reason for this shift? Money—big money. US sports TV and streaming rights will hit $25.6 billion this year and are projected to climb to nearly $30 billion next year—nearly double what they were just nine years earlier. All this has taken place in the face of (or, perhaps, helped fuel) cord cutting that drives essential revenue away from traditional broadcasters and into the pockets of streaming services.

In light of these dramatic shifts, how can digital advertisers effectively reach and connect with sports fans? And is navigating the disparate live sports landscape worth all the trouble? (Spoiler alert: yes, yes it is!) Read on to learn all about it.

First off, let’s look at some of those new (or, at least, new-ish) sports broadcast partnerships, an area that’s seen some significant departures from the “old normal” in recent years:

The most impactful developments may prove to be the NFL’s Amazon and Google deals and MLB’s Apple TV+ package—both because of the players involved (known more for their e-commerce and tech than their streaming prowess) and for the fact that each deal represents a major American sports entity granting exclusive broadcast rights to streaming platforms. These may well be the first shots that usher in a larger streaming-first revolution in sports broadcasting.

Just as meaningful is the price those companies paid for their live sports streaming rights: $85 million a year from Apple for baseball, $1 billion per year from Amazon for their weekly regular season NFL matchup, and a reported $2+ billion per year from Google for Sunday Ticket. To make up for these kinds of skyrocketing costs, linear broadcasters and streaming video platforms alike are turning to two main revenue sources: subscription price hikes and—you guessed it!—advertising. So, without further ado, let’s take a look at how (and why) advertisers can make the most of this evolving landscape.

Surveys show that 7 out of 10 US adults are sports fans. And people who watch sports aren’t going to catch a replay of the game once it hits Netflix in a few months—they’re going to watch it live. This is a valuable “guaranteed” audience upon which platforms and advertisers alike can place outsized value compared to other broadcasts (no wonder sports tend to dominate lists of the most-watched US broadcasts year after year). When brands want to ensure they are meeting a large, built-in audience all at once, there are few opportunities quite like live sports.

Which is not to say that brands can’t benefit from advertising against other sports content, such as highlights, clips, and replays. Those often represent prime contextual advertising opportunities, whether via contextual partners like Comscore and DoubleVerify, or with specific publishers such as the AP, Gannett, or (of course) ESPN.

On the more local level, no matter what embarrassment, scandal, or years-long losing streak might afflict their favorite team, fans tend to “root root root for the home team” through thick and thin. For advertisers that want to geotarget, sporting events often post remarkable ratings in specific markets—and fan loyalty can translate to brand loyalty. No wonder organizations of all kinds pay out top dollars to be the official beer, official pizza, official bank, official cryptocurrency platform, or even official HR/payroll provider of your hometown team.

Another key factor that’s fueling sports viewership? Gambling, which has gone from being illegal almost everywhere in the US just four years ago to being all over American sports coverage today. As legalized sports gambling has come to more and more states, total consumer spending on gambling has skyrocketed—rising by 50% between 2020-2022—and it’s forecast to soar from $172.76 billion this year to $207.93 billion by 2027.

This growing excitement around sports betting is delivering new, passionate audiences to live sports. 40% of consumers say they’re interested in sports betting in 2023—a 9% increase from 2022— with 75% of sports betters making wagers at least once a month and nearly half (47%) saying they do so at least once a week. And if someone is spending money on the game, they’re a whole lot more likely to tune in, with 49% of consumers saying that betting makes watching or following a game more interesting.

As for where and how they're watching...

More than 160 million Americans regularly watch live sports—nearly 50% of the total population. But perhaps even more notably, more than 78 million of those viewers currently tune in on digital devices, and that number is projected to rise to over 126 million by 2027. In fact, 79% of sports fans say that, if they could, they would watch live events exclusively on streaming platforms. Yep: just like the rest of the video world, the future of live sports advertising is digital.

Of course, as is the case with that larger digital video environment, the increasingly disparate nature of sports broadcast agreements is only adding to the complexity and fragmentation that mark the digital video and CTV space. Nearly half of paid video consumers say they’ve had difficulty finding specific video content because of how many different streaming services there are out there, and you can only imagine how frustrating that must be when the start of the game is rapidly approaching (and your nachos are getting cold...) And for advertisers, the evolution from a few reliable live sports hubs to numerous broadcasters across multiple channels can mean added complexity in campaigns targeting these audiences. So as streaming becomes the norm for live sports, advertisers and viewers alike are adapting to some growing pains.

That said, to their credit, the big tech companies that have waded into the live sports streaming wars are taking crucial steps toward optimizing benefits for advertisers. Amazon has a deal in place with Nielsen to measure the Thursday Night Football streaming numbers using the same panel-based national TV ratings system that it applies to linear programming, so advertisers will have some good transparency into viewership numbers on the property. Amazon has also said it will give advertisers access to sales and behavioral information to further target their TNF ads. Meanwhile, Apple is reportedly looking to vastly expand its ad business, steadily adding headcount to its Ad Platforms division, and has already worked advertising into its Friday Night Baseball broadcasts.

Even the more traditional homes of live sports—the major broadcast networks and ESPNs of the world—have readily embraced the potential of streaming those events for maximum impact. Fox, for example, included viewership numbers from Fox, Fox Deportes, and its streaming services when it reported the ratings from Super Bowl LVII—the most-watched TV broadcast of all time besides the 1969 moon landing. And annual events like the Masters golf championship and NCAA men’s basketball tournament have long had authorized (and ad-filled) streams as part of their overall broadcast packages. As viewers increasingly flock to OTT and CTV for their live sports consumption, brands will have new ways to personalize and target these consumers as part of their cross-channel marketing strategies.

Speaking of which...

The digital evolution of live sports broadcasts goes beyond individual devices.

Even as more and more fans are watching the game on digital platforms, 46% of live sports consumers say they prefer to stream sporting events on a big screen, which means connected TV (CTV) should be a major player in the future of sports advertising. And if you’re a brand that’s trying to connect with millennial and/or Gen Z viewers—audiences that are saturated with cord-cutters and cord-nevers—CTV may already be your best bet.

But the real secret weapon for advertisers may be resting in your pocket (or your hand) right now: smartphones. Sports broadcasts present a unique cross-platform marketing opportunity, with 71% of US adults saying they use second screens) while watching live sports—mostly via smartphones. Cryptocurrency exchange Coinbase became the talk of the 2022 Super Bowl ad scene with its 60-second, $14 million spot that featured nothing more than a floating QR code. That spot got more than 20 million people to pull out their phones and scan the code within one minute of its airing, driving so many people to a site offering $15 in Bitcoin to anyone who registered for a new Coinbase account that it crashed the app itself.

While few cross-channel efforts will lead to those kinds of jaw-dropping results, the strategy behind it shows the potential of cross-channel advertising during sporting events. Additionally, sports fans are a widely targetable audience segment through private marketplaces (PMPs) like Tapjoy and can be further segmented via top data providers like Alliant (golf), eXelate (NBA), and Cuebiq (NHL), helping advertisers continue to market to viewers even after the game clock hits 0:00. Put it all together, and sports programming represents a great way to consistently reach and remarket to specific target audiences across multiple devices.

Sporting events are a fixture of American culture. From Super Bowl Sunday every winter to the WNBA Finals every summer, live sports are a reliable way to bring people together in front of their TVs, laptops, and other streaming devices to catch the action (and, of course, the commercials). And even as the way fans consume their sports continues to evolve hand-in-hand with the rest of the video realm, advertisers will look to live sports as a pillar of their omnichannel marketing strategies. In short: it’s a home run opportunity for brands to hit their goals, assist in the revenue-driving process, and score some big wins.

(And yes, there were seven sports puns in that last sentence. Touchdown.)

As noted above, the role of CTV in live sports advertising is expected to dramatically increase in the years ahead. But sports are not the only programming powering CTV’s rise, and advertisers are taking notice: US CTV ad spend hit $18.89 billion in 2022, and it’s projected to soar to $38.83 billion by 2026.

Want to learn more about CTV advertising? Check out our guide for tips on everything from CTV campaign best practices, to safeguards against CTV ad fraud, to effective targeting tactics, and much, much more.

Looking for an edge with your Q4 campaigns? This research report, based on a survey of 2,000 US consumers age 16+ and conducted in partnership with GWI, provides valuable insights into the evolving landscape of holiday shopping—giving you a strategic advantage when planning and fine-tuning your advertising efforts for the 2023 holiday season.

Insights include:

And that's just the start. Want access to all the insights, numbers, and forecasts for this year's holiday season? Download your copy of the report today.

Connected TV usage is skyrocketing as viewers increasingly turn to CTV to watch all their favorite content. And so it’s no surprise that political marketers are all over CTV: It provides the classic TV viewing experience that campaigns (and voters) love, but with more opportunities for precise targeting, measurement, and engagement than linear TV.

In fact, CTV accounted for 30% of all political programmatic ad spend during the 2022 election cycle—a 63% increase from 2020 and a 600% increase from 2018. And that trend is showing no signs of slowing: The 2024 presidential elections are forecast to see 80% more CTV/streaming ad spend than the 2022 midterms, hitting $1.8 billion.

How can political advertisers embrace this rapid growth and ensure they’re effectively connecting with voters where and when they’re watching video? In this guide, we analyze the latest data, trends, and research to help campaigns and political advertisers uncover everything they need to know about CTV advertising for candidates and causes.

In this guide, you’ll learn:

Ready to make the most of your CTV ad spend? Fill out the form to download your copy of the guide today!

From vibrant billboards in urban centers, to point-of-purchase screens, to digital screens at EV charging stations, digital out-of-home advertising is everywhere.

Also known as DOOH, the channel gives political advertisers a unique opportunity: Connect with voters when they’re on-the-go, in contextually relevant environments, when they may be less reachable on their personal devices. And, thanks to the inherent benefits of digital technology, it lets them do so in a way that allows for targeting, tracking, optimizing, and measuring the success of those campaigns.

DOOH is an emerging channel—and one that’s quickly gaining steam. As such, more and more political advertisers are embracing it as part of their larger omnichannel media strategies to reach target audiences in key moments of impact.

In this guide, crafted specifically for political advertisers, we explore how savvy political marketers can make the most of the DOOH opportunity. We dig into the latest trends, insights, and research to help political advertisers leverage the power of place in their DOOH campaigns.

Ready to level up your digital out-of-home advertising expertise? Fill out the form to download your copy of the guide today!

First off, let us provide a quick disclosure: This blog post was written by a human.

It’s a bit crazy to think that, this time last year, no such statement would have been necessary. Sure, if you got enough monkeys with keyboards together for an infinite amount of time, they would eventually have written this very piece (along with the complete works of William Shakespeare). That’s just science. But in 2023, there’s a new player in the content creation game, and it has the potential to disrupt just about every aspect of digital advertising: Generative AI.

The next generation artificial intelligence tech burst onto the scene late last year with the debut of ChatGPT and DALL-E 2, both from Silicon Valley AI pioneer OpenAI. ChatGPT, in particular, became an over(five)night sensation when it reached a million users in just five days. And in January 2023, ChatGPT was estimated to have 100 million active users—making it, at the time, the fastest-growing consumer app of all time. To put that in perspective, it took TikTok nine months (and Instagram two-and-a-half years) to hit 100 million users.

One of OpenAI’s biggest early investors, Microsoft, has since poured an additional $10 billion into the company and announced a host of new AI-powered features, including a ChatGPT-powered Bing search engine that launched in May 2023 to its million-plus person waiting list. And that interest could be a big (dollar) sign of what’s to come: Microsoft estimates that gaining just 1% more market share in search could translate to an additional $2 billion in ad revenue.

In turn, Google introduced the world to Bard, its own AI chatbot, and invited users to test its new Search Generative Engine, or SGE, which Google says “uses generative AI to give you more information and context to your searches.” Bard initially stumbled out of the gate upon its February 2023 release—pumping out inaccurate information that embarrassed its owner and rattled Alphabet’s stock price—but Google has turned things around in recent months as it introduced new AI-powered features in Google Docs and Gmail and rolled out Bard to new key markets, sending Alphabet stock soaring.

And another potential player, Meta, has spent nearly 10 years and billions of dollars on AI, but had to remove its new chatbot “Galactica” from the internet after just three days after receiving “an avalanche of complaints about Galactica’s mishaps”.

Altogether, AI is already proving to be a powerful disruptive force in the tech world, and the wider implications of this potential AI revolution could be extraordinary. Microsoft’s own founder, Bill Gates, has called AI as major a tech innovation as the internet or the PC, and also warned that AI’s emergence will inevitably result in the loss of white collar jobs. Or, as the Harvard Business Review put it, “The question isn’t whether AI will be good enough to take on more cognitive tasks but rather how we’ll adapt”.

But how will AI—be it generative or otherwise—affect marketing and media buying?

In some ways, AI already has its virtual fingerprints all over digital advertising. Machine learning, which most would consider falling under the larger “AI” umbrella, is at the heart of programmatic advertising and real-time bidding. And digital advertising platforms leverage AI to facilitate custom campaign optimizations, facilitate time savings, reduce ad spend waste to optimize media, increase conversions with best device type, placement, and price, and inform decision-making with real-time data and insights.

Top agencies and brands have relatively quickly found additional applications for generative AI today. According to a recent Basis survey, nearly three-quarters (72%) of marketing and advertising professionals say they currently use generative AI tools as part of their digital marketing/advertising work at least once a month—embracing the tech for everything from content creation to research to personalization. And that large group of early adopters may be the first domino to fall in a new, AI-driven future of marketing, with approximately four in five marketers saying they believe AI will radically transform digital advertising in the next 3-5 years.

Now, how will AI shape the future of the industry? To find out, we asked Basis Technologies’ April Weeks (EVP, Media Services & Operations), Amy Rumpler (SVP, Paid Search & Social), and Ryan Manchee (SVP, Brand Marketing) for their perspective on all the latest buzz surrounding AI and its potential impact on media, marketing, and digital advertising:

April Weeks: It's an interesting time to be in the industry. During a relatively short period of time, AI has become a consistent topic of conversation with what seem to be endless opportunities. The rate of evolution is fast. I believe benefits and opportunities will start to emerge across the advertising industry that enable more efficiency and potentially better work.

Amy Rumpler: I think they're very exciting, and honestly, not that surprising. AI has been integrated with media in various ways for a while now, although most of those developments have been on the back end, driving innovation like how ads are targeted to—and appear in front of—consumers.

Recently, those features have started to take more of a front seat for media buyers to explore and interact with. In social, for example, Meta's Advantage+ features use machine learning (or AI) to help you create campaigns that can efficiently and effectively reach the right audience with a variety of creative options and optimize in real-time to drive performance. ChatGPT and similar AI models are taking these concepts a step further by making the interaction between the person using the tool and the tool itself feel more conversational and less transactional. I'm interested to see if that helps build trust and confidence in AI and its ability to do the job requested of it. If people believe the machine can do what you're asking it to quickly, effectively, and to the standards of what you'd expect if a person was behind the controls, then adoption will rise—which benefits both the tools’ continuing to improve, and the individual’s ability to focus on other tasks.

At the same time, I think like any other evolving technology, there's a need for better understanding of how these tools will be used, policed, and controlled that's necessary to address (and probably should have happened before they became broadly available to begin with). For example, if we're using an AI app like ChatGPT to return search query results, then we need to be able to control what information these AI systems have access to, how they compile it, deem it credible or accurate, return it in a way that's not discriminatory, inflammatory or fictitious, and credit the original source (if available). Without a strong legal precedent, and an internet full of false information, I think this question has to be addressed immediately and should be a primary focus of this discussion.

Ryan Manchee: I’m absolutely fascinated. Twenty years ago, when I first started in the advertising industry, the most significant innovations were around rich media advertising, ad serving, and search. Mobile was nascent, and dial up was still commonplace. Seeing how the industry adapts and adopts new technology is what makes our jobs so much fun. I believe we are in the very early stages of AI, but seeing how the language models allow for greater accessibility and exploration of this technology is going to drive smart, creative ways to rethink approaches to marketing.

AW: The impact will be significant and likely on a similar scale to the emergence of the internet, and the disruption that resulted across the industry. Current processes, workflows, and performance insights will be automated and ultimately change how work is created, delivered, and possibly monetized.

AR: I hope that AI will help further streamline and automate the work we do to create, implement, and optimize campaigns so that strategists, creatives, and analysts can spend more time improving and ideating and less time on manual tasks. When it comes to search and social specifically, I fully believe AI will be integrated in how we develop and optimize content, research keywords and other targeting opportunities, identify new partners and placements for plans, and adjust things like budgets or flight dates in more automated ways than we can imagine based on our surface level experiences with AI thus far.

RM: I'm bullish on the possibilities, but I don't think anyone has it figured it out quite yet. My hope is that the hype around AI will bring a renaissance to creativity and redefine what we mean by “personalization”. Is a hyper-personalized ad really just swapping out the copy of a city name, distance to a location, and plugging in the weather while swapping a background image in an ad? Or is it about creating an experience that is inspiring in a unique and compelling manner? I don't view AI as a threat to anyone's job in the next three-to-five years, but I do believe it will take the place of responsibilities from three-to-five years ago (and today).

AW: Marketers should keep a close tab on AI developments within the industry, start to identify how AI could be leveraged within their organizations, and begin testing to gain early learning.

AR: The first thing marketers should do is take time to educate themselves on what's currently possible and test the tools that are publicly available to start to get familiar with them—including their capabilities and their limitations. There's a lot of speculation in the news right now, but I think the best way to start to envision how AI might change or benefit your current role is to experiment with it yourself.

RM: Explore, experiment, and get more people and teams involved. There are creative opportunities and challenges, there are legal challenges and opportunities, and there are operational workflow opportunities and challenges. Don't make rash decisions, but have some fun and stay curious.

AW: AI will drive increased automation and fundamentally shift how we work across the industry. What today takes a week will be compressed to a day with an increased level of insight and intelligence.

AR: I think it will revolutionize the way we as marketers think about creating and implementing advertising campaigns, and it will equally impact the way we as individual consumers of media interact with and experience content, entertainment, and the internet at large—and in a shorter period of time than some might think.

RM: While most of the focus right now is on the visual and content outputs of AI, the biggest innovations in the industry will come from how it helps marketers more smartly plan, execute, and optimize their digital media.

AW: The industry should embrace regulation at the onset. As we've seen, regulation is an important part of digital advertising, and establishing the right regulatory framework early will enable adoption and maximize the benefits of AI.

AR: Yes, absolutely.

RM: It's too early to regulate, but early adopters should be aware of potential legal challenges. With that said, my high school freshman son has classmates who have attempted to pass off AI generated essays as their own, and this is being regulated!

AR: Advancements in AI are going to cause a paradigm shift that causes younger generations to reconsider career focus areas, create rise to new fields of expertise, and reshape the future of how we use and support digital, connected, AR, VR, and internet-enabled devices and tools. But it's also going to require a deep understanding of how to get the most out of the machines powering the systems, as they've not yet developed to the point that they can 100% operate independently and return accurate information or recommendations without better inputs from their human users.

People need to understand that they can't assume these tools are going to return the same quality of outputs as they [humans] could. As an example: if you ask an AI to write a poem describing tulips, it might be factually correct, but it also might be nonsense that doesn't connect on an emotional level the way you or I might write a poem describing tulips. The same is true if you ask an AI program to develop an ad promoting a new brand of diapers to women who have just given birth. There are just some things that an AI program can't yet fully grasp or understand, but that a person maybe could.

RM: Watch out for the fakes. Both the companies that are jumping on the AI bandwagon calling their pseudo tech AI, and the fake information, fake visuals, and fake work. Our future will not be given over to AI, but these wonderful new tools and systems will help the smart, creative people in our industry continue to do amazing work.

__

With so much hype around generative AI’s applications in marketing and advertising, it can be hard to discern what current adoption looks like and how your peers and competitors are thinking about the future of this new technology. To provide some insights in this arena, we surveyed over 200 marketing and advertising professionals from top agencies, B2B and B2C companies, non-profits, and publishers. Download our report today to explore how marketers like you feel about generative AI and gain new insights on how it’s poised to shape the industry going forward.

Less than one year after its public debut, generative AI has the marketing and advertising world’s full attention.

The next-generation artificial intelligence tech burst onto the scene late last year with the debut of ChatCPT and DALL-E 2, both from Silicon Valley AI pioneer OpenAI. ChatGPT, in particular, has grown into a near-overnight sensation, reaching a million users in just five days and hitting 100 million active users faster than any consumer app in history to that point.

One of OpenAI’s biggest early investors, Microsoft, has since poured an additional $10 billion into OpenAI while beginning to introduce a host of new AI-powered features, including a ChatGPT-powered version of Bing search engine.

In turn, Google—a generative AI innovator in its own right and the first company to utilize large language models (LLMs)—has introduced its own AI chatbot, Bard, its own AI chatbot, while promising new, soon-to-launch AI-powered features in Google Search, Gmail and more. Another major player, Meta, has spent nearly 10 years and billions of dollars on AI and has taken to touting its LLaMA as a powerful open-source language model. And dozens of other companies have also begun introducing generative AI-powered tools into the marketplace.

Altogether, AI is already proving to be a powerful disruptive force in the marketing and advertising world, and the wider implications of this AI revolution could be extraordinary. Microsoft founder Bill Gates has called AI as major a tech innovation as the internet or the PC, while also warning that AI’s emergence will inevitably result in the loss of white-collar jobs. Or, as the Harvard Business Review put it, "The question isn’t whether AI will be good enough to take on more cognitive tasks but rather how we’ll adapt."

So, how will the next generation of AI affect marketing and advertising?

For this report, we surveyed over 200 marketing and advertising professionals from top agencies, B2B and B2C companies, non-profits, and publishers to see how marketers are feeling about AI today and how they believe it will shape the industry going forward.

Findings include:

With regulatory bodies, browser developers, and operating system owners continuing to focus on user data collection and sharing, the deprecation of third-party cookies—and other matters related to privacy—is inevitable.

Most of the conversations around adtech focus on a single direct impact area: the cookie-based audience targeting for demand side platforms (DSPs). Although it is the most visible one, there are other use-cases impacted by identity changes, primarily, frequency capping and attribution. The problem extends beyond DSPs to search and social buying platforms, affecting virtually all adtech providers.

What this means for the industry is a reimagining of how the impacted use-cases can be brought forward in a privacy-friendly manner. Audience targeting will continue, but with a significantly heavier reliance on contextual targeting than in the past. Where brands are well-positioned in capturing first-party data, most publishers are laggards; however, we expect publishers to begin to place higher importance on the capture and utilization of this data as the impact becomes more real. This presents an opportunity for companies that are well-positioned between the two to provide services that allow for greater fidelity in identifying overlapping populations to help guide the allocation of media spending from brands to publishers who speak to a higher population of the brands' desired audience for a particular campaign or initiative.

What can advertisers do to better prepare for the future of advertising? Download our guide to explore how you can overcoming the identity crisis.