Jaime Vasil is Group VP of Candidates and Causes at Basis

Political advertising’s connected TV (CTV) evolution was in full effect during the 2024 US elections. The trend that started to show life two cycles ago is now a regular part of the media plan for candidates, campaigns, PACs, and other organizations looking to reach and influence voters.

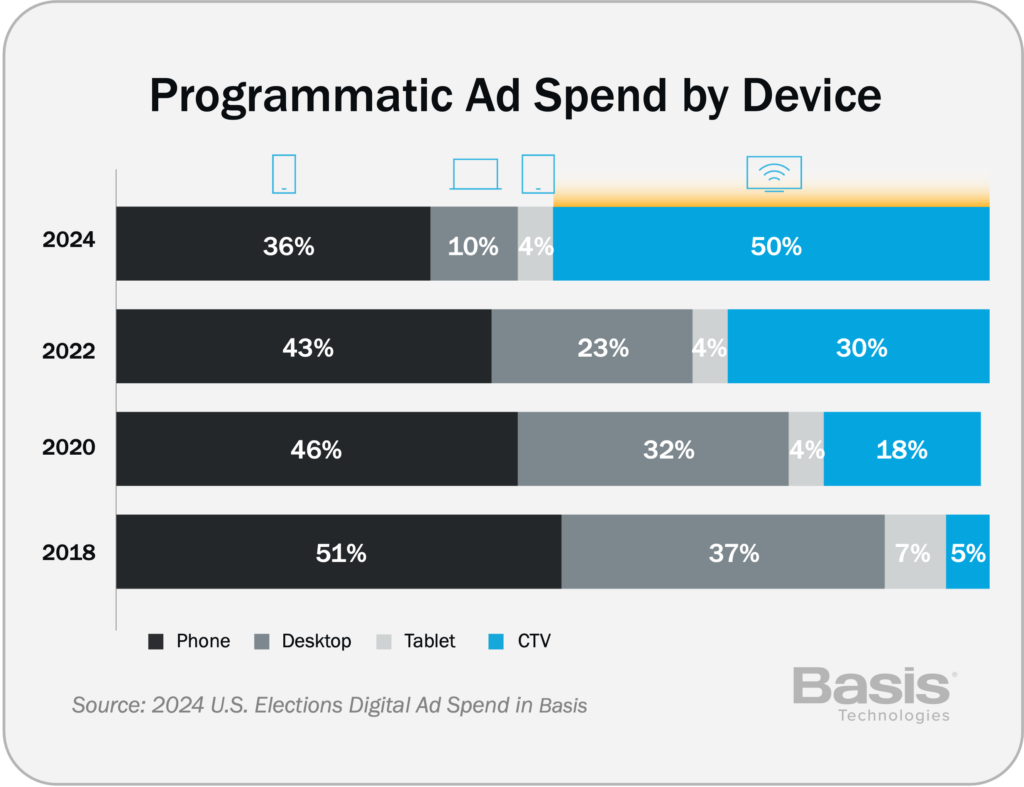

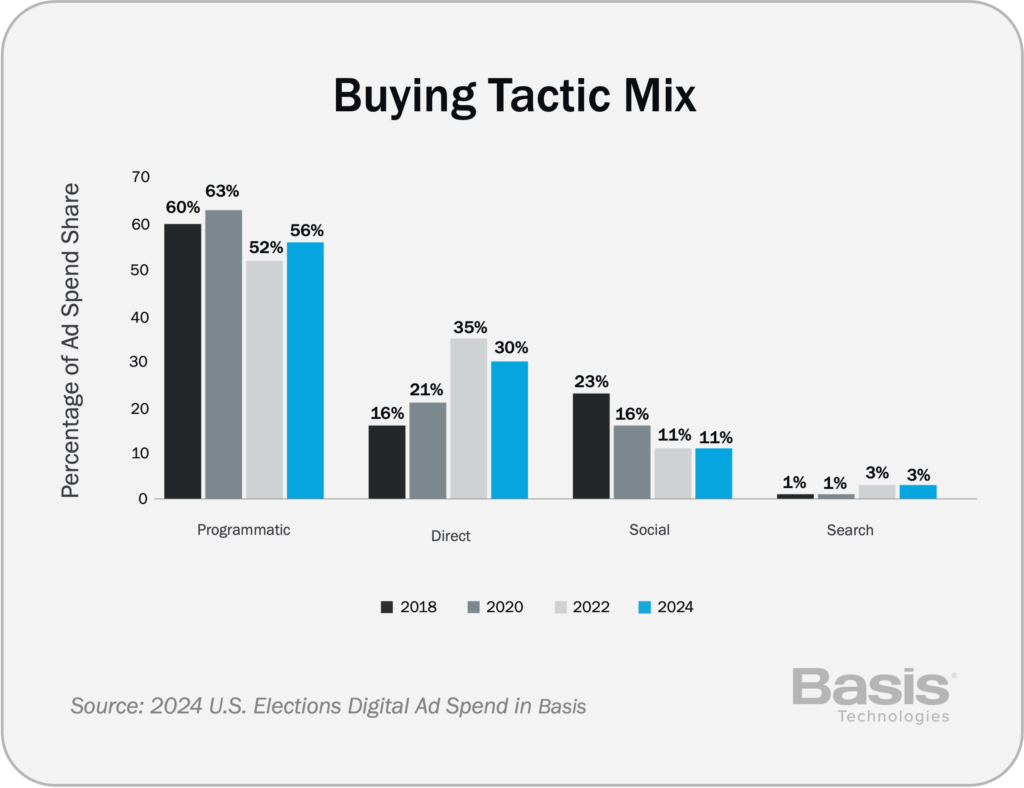

CTV’s emergence as a political powerhouse has been developing steadily over the last four election cycles. In 2020, we saw a dramatic rise in programmatic advertising and the awakening of CTV for elections. In 2022, candidates and causes began taking CTV more seriously and lifting direct spending, as that was the primary tactic for buying inventory at the time. This development continued to evolve in 2024.

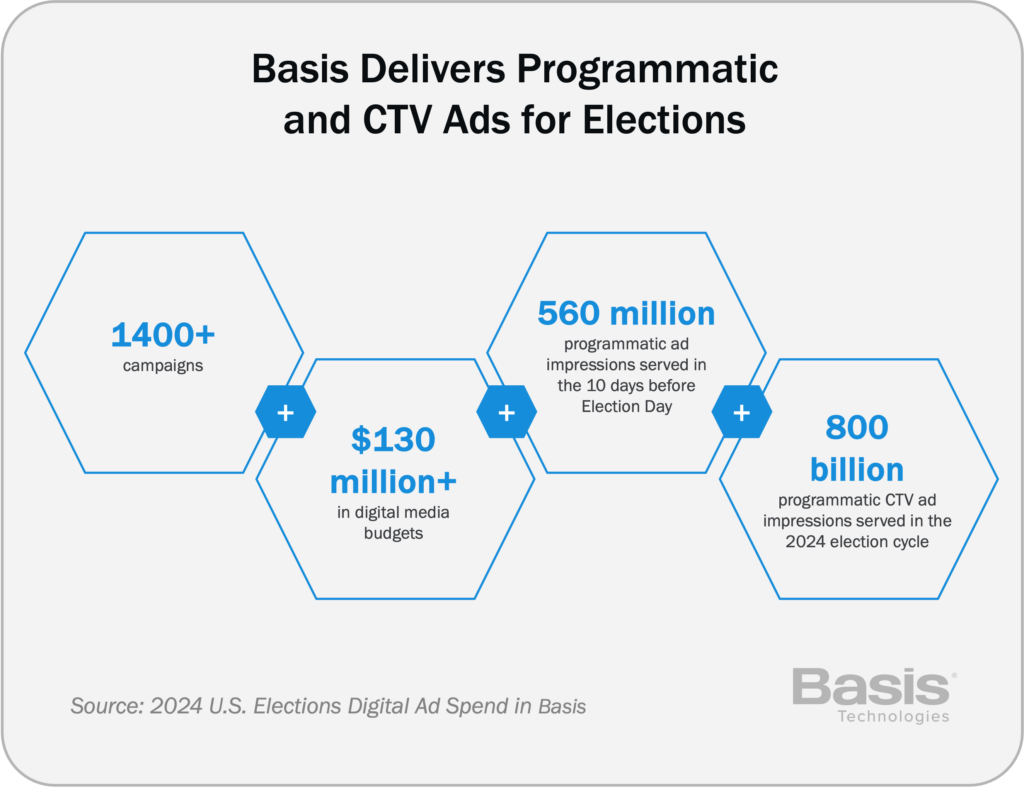

Based on an evaluation of more than 1,400 campaigns for state, local and national races that managed their digital ad buying through Basis’ advertising automation platform—accounting for more than $130 million in political ad spend across video, display, native, audio, and text ads—we saw that:

We may not need to wait until 2026 to see how these trends develop further. With key state and local races in 2025, and seemingly ever-increasing political spending, political marketing practitioners can apply and optimize what they’ve learned recently. There is no rest in political campaigning, and this may well be the new normal.

Key Takeaways:

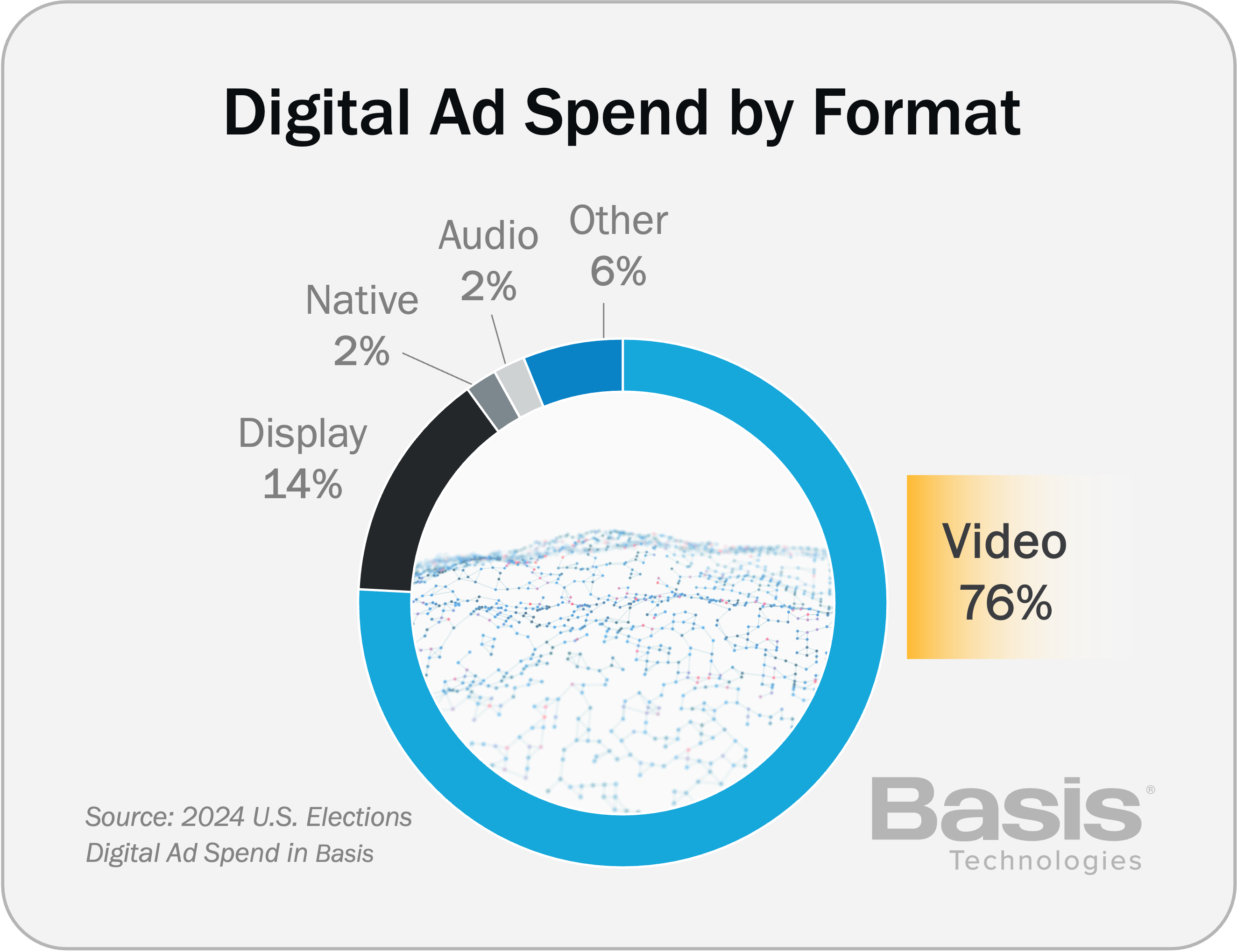

Video ads in their multiple forms are a staple for political advertising as it allows for rich story telling about candidates, opponents and issues. It has been the majority of ad spend ever since we started tracking it in 2018. With CTV ad opportunities growing faster than ever, more availability through programmatic buying, and multiple targeting and measurement options, there may still be more room to expand video’s ad spend share.

Key Takeaways:

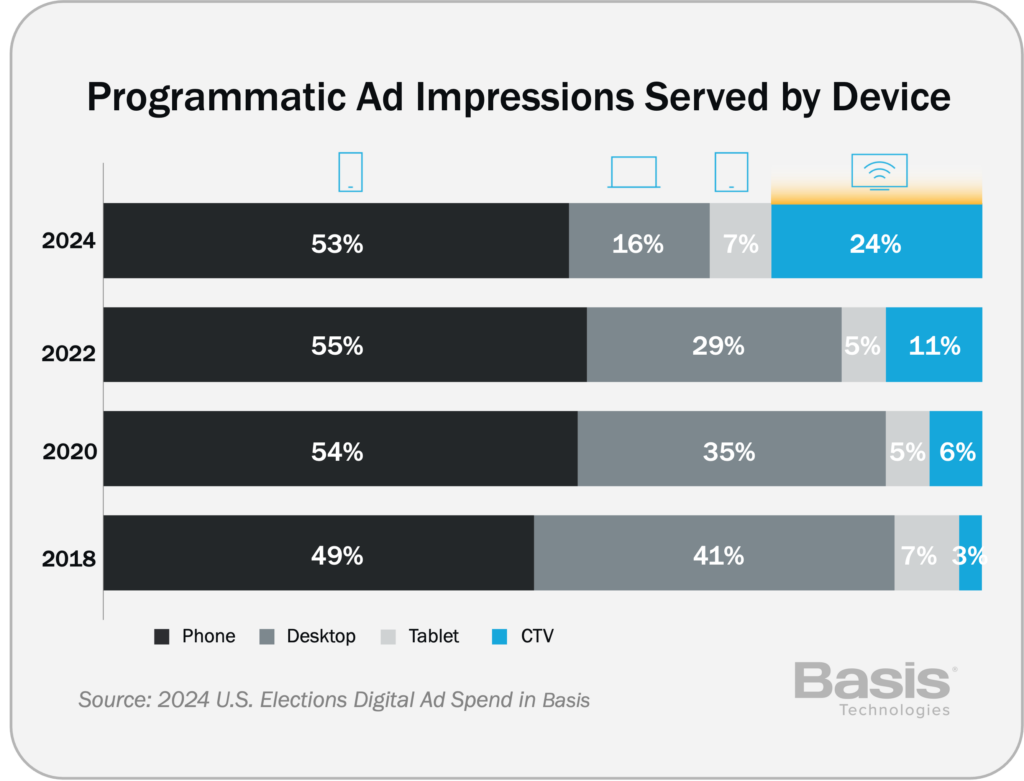

Availability of CTV ad opportunities is compelling political marketers to spend on these devices. There are more ways to buy it today than two years ago. In programmatic channels, marketers have more choices for publishers, vendors and tactics. With CTV, private marketplaces and programmatic guaranteed deals that are much more prevalent today may be suitable for campaigns that were buying ads through direct publisher engagement in 2022.

Key Takeaways:

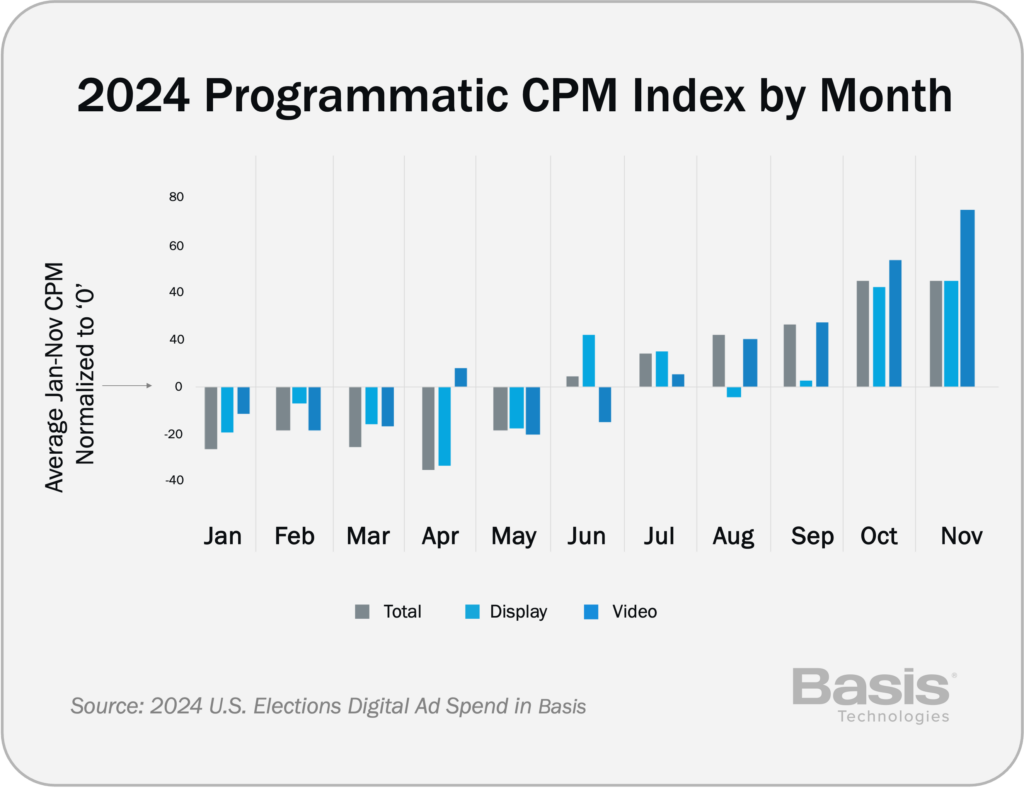

Basis’ programmatic CPM index showed steady, albeit below average, pricing in the first five months of 2024. It began increasing gradually beginning in July and then peaked in the last 35 days of the election. The index compares the average pricing per month to the average CPM for the whole election cycle for political marketers. Video was the driver of CPM increases, as display pricing dipped to average level in the summer and early fall.

Considering the competitive spending in the last months of the election, political advertisers could alleviate the inflation by locking in deals in programmatic channels through private marketplaces and programmatic guaranteed deals.

Key Takeaways:

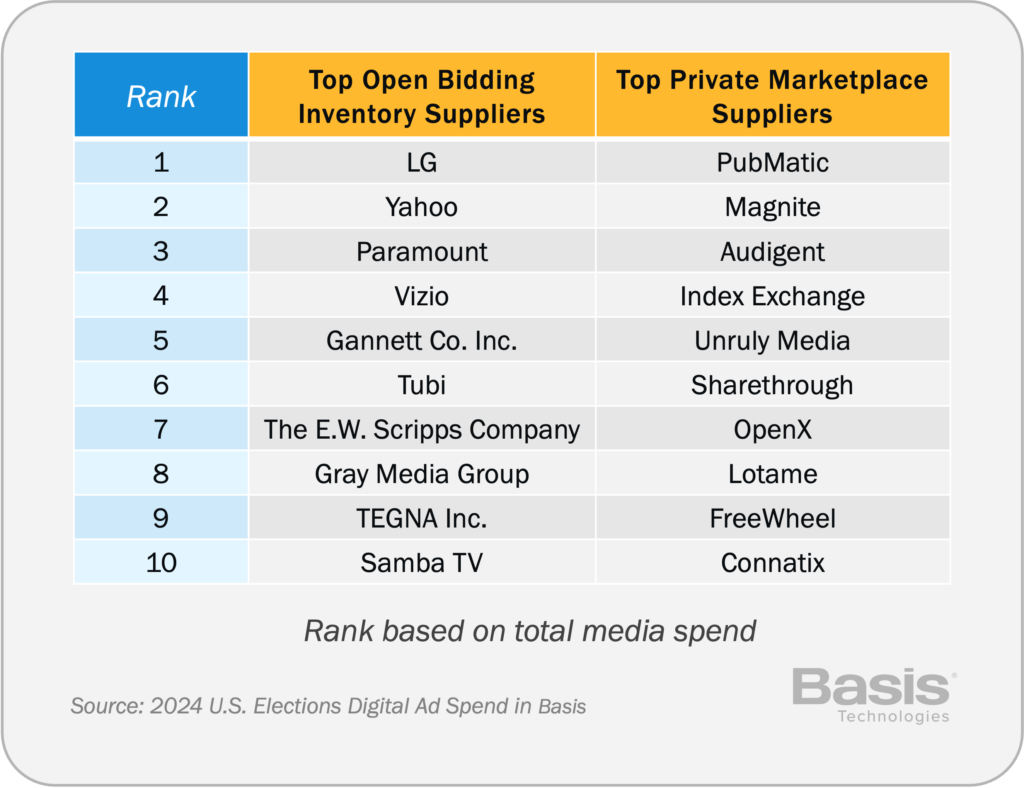

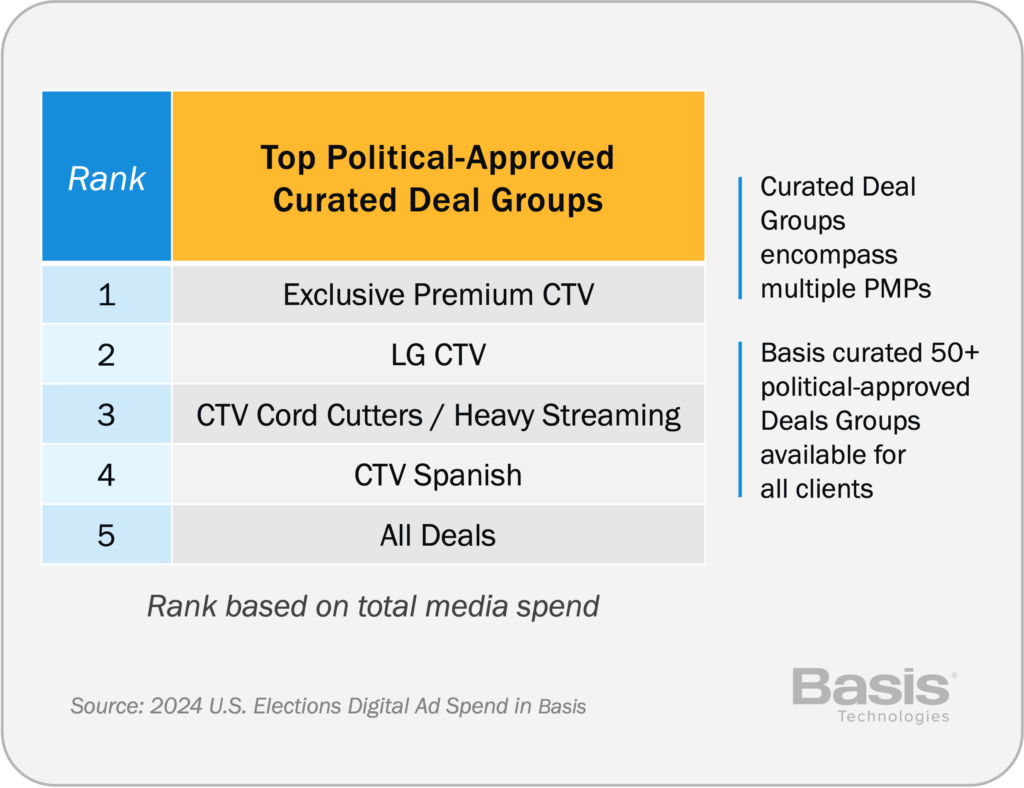

Based on political advertising sales, Basis data shows the top suppliers in open bidding programmatic, top exchanges and SSPs that sell PMPs, and top curated deal groups that Basis pre-arranged for all elections advertisers. The presence of CTV was spread throughout the leading suppliers.

Basis curated 50+ deal groups that were approved for political advertising. The deal groups were assembled from one publisher, multiple publishers, or multiple PMPs.

Our previous reports focused on direct sellers, which were dominated cycle-over-cycle by YouTube, Hulu and Facebook, and also showed the increasing popularity of CTV vendors.

Key Takeaways:

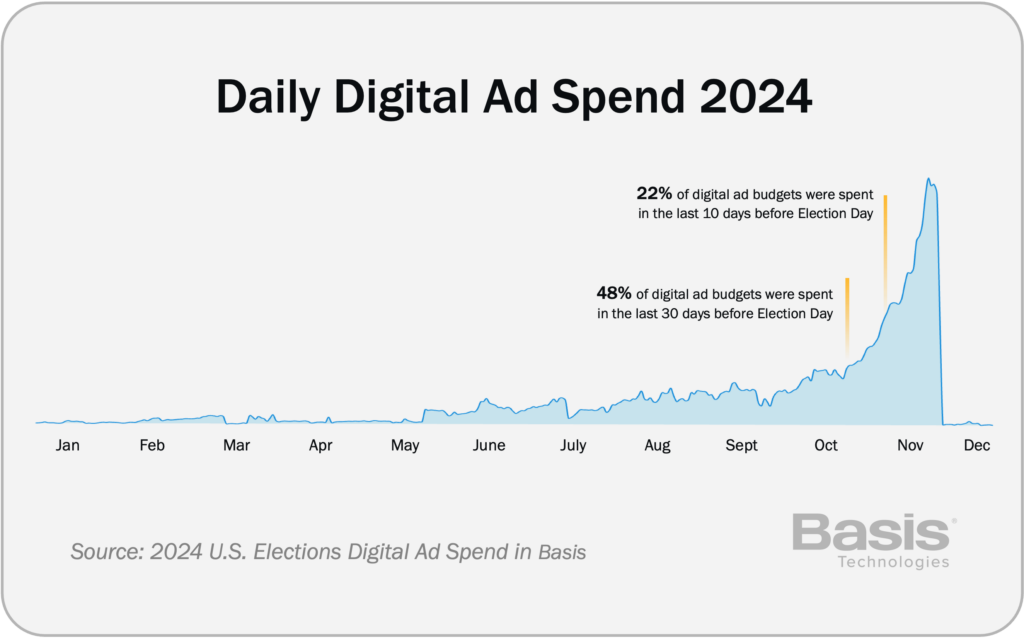

Political campaigns are saving half of their money until the end to reach undecided voters and get out the vote. This is the same pattern as in previous election years. However, as voters gain more opportunities to submit ballots early, this number eroded slightly this cycle—even when the country was energized for a presidential election. A pattern to watch for the future is whether or not campaigns will continue to encourage early voting.

Key Takeaways:

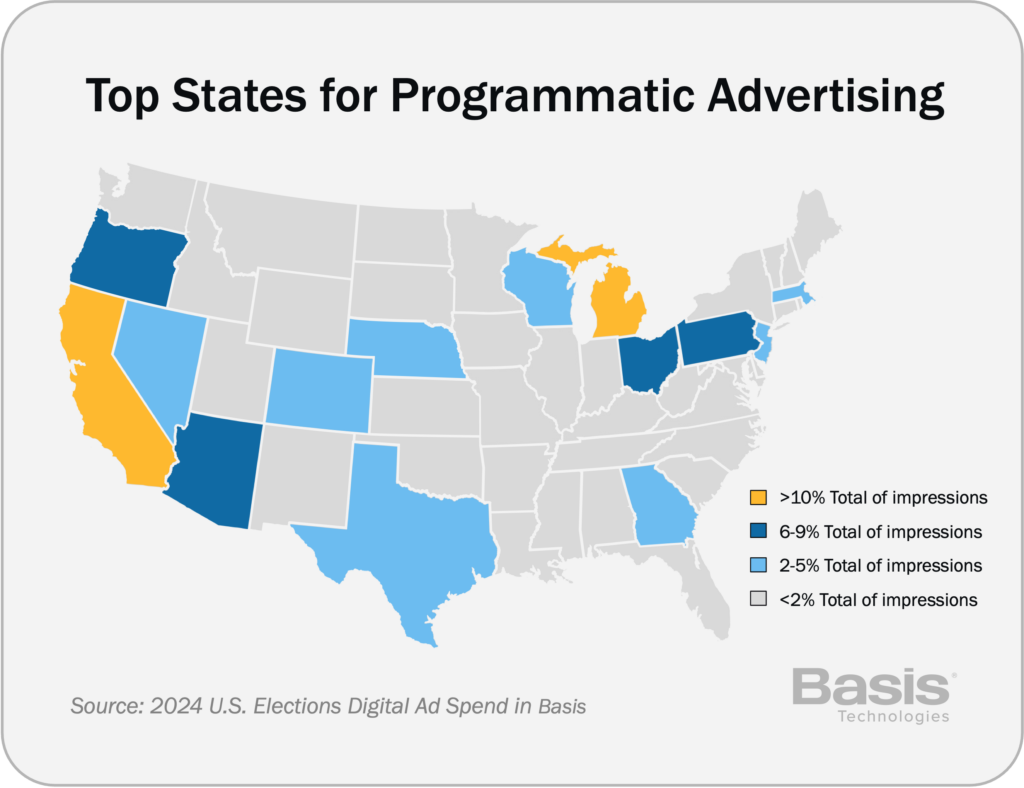

California and Michigan garnered the most ad impressions. Of note, California had large proposition campaigns in 2024 and Michigan consistently has been a swing state for the past few cycles. They were followed closely by battleground states, as well as Washington.

Beyond the top 14 states, the rest of the country’s states received minuscule shares of ad impressions, even in populous states such as Florida, New York and Illinois.

Basis served more than 560 million programmatic ad impressions in the final 10 days of the election cycle and served more than 800 billion programmatic CTV ad impressions for the entire 2024 cycle.

The collision of programmatic and CTV has transformed elections advertising. The next evolution of these trends will revolve around the use of private marketplaces, programmatic guaranteed buying and curated inventory. The targeting within these methods is poised to improve, setting the stage for significant use of audience data in the next election.

-----

Basis has been trusted by agencies and consultants in politics, public affairs, and advocacy for over 17 years. Basis is a comprehensive advertising automation platform with an integrated suite of modular applications, each specializing in unique areas such as planning, operations, reporting, and financial reconciliation across programmatic, publisher-direct, search, and social channels. Since 2007, Basis has helped power digital media for thousands of political campaigns, independent expenditure committees, and issue advocacy advertisers. Basis is headquartered in Chicago with clients throughout North America, South America and Europe, including in Washington, D.C., with its Candidates + Causes team.