Grace Briscoe is SVP of Candidates and Causes at Basis Technologies

The 2020 U.S. elections were the most unique of our generation -- bringing record turnout, billions of dollars in marketing and two intense runoffs for control of the U.S. Senate.

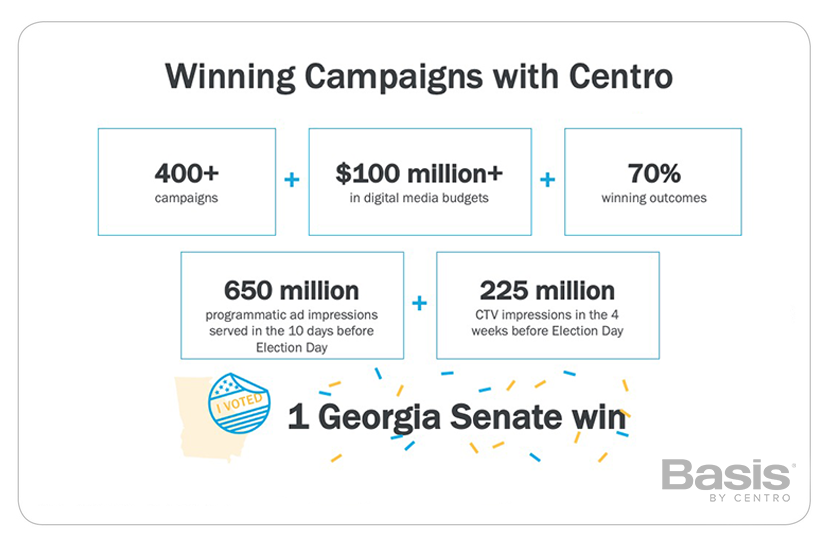

More than 400 campaigns for state, local and national races managed their digital ad buying through Basis' intelligent process automation platform, encompassing more than $100 million spent across display, video, native, search and social media.

Basis' experience in this category has been honed by more than a decade working with candidates and advocacy groups at all levels, from Presidential to local elections. Our activity in 2020 gives us a diversified view on how digital media was utilized and what trends have emerged.

This report is the second time Basis researched how U.S. elections spent on digital ads. The first report (https://basis.com/blog/blog-midterm-adtech-mvps) unveiled the digital MVPs that delivered winning strategies and tactics of the 2018 midterms. At the time, programmatic buying revealed itself as a tactic of choice offering speed and agility to launch campaigns, optimize on the fly, and reach audiences on high-performing media. Now with data from another cycle, the game-winning playbook seems to be set for aspiring 2022 midterm campaigns. This is fortunate because they’ve got less than a year to prepare.

Section 1: Programmatic Advertising Wins the Votes (Dollars) Again

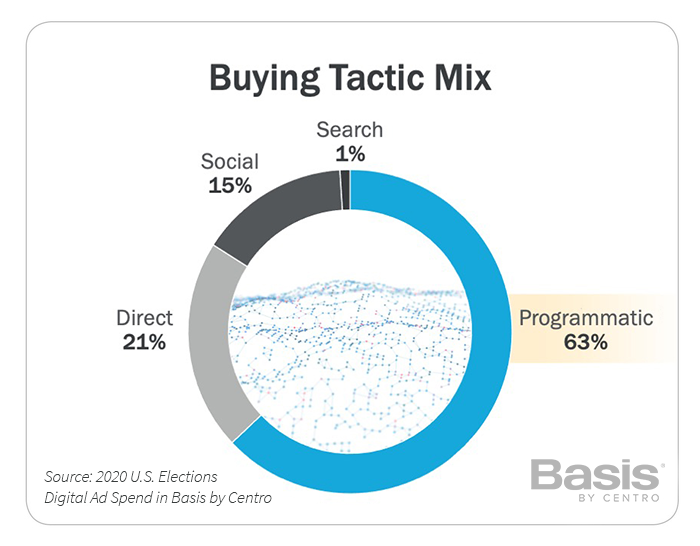

The interest in programmatic advertising for political campaigns aligns with the general market trends across the industry—nearly two-thirds of digital ad inventory was sold programmatically in 2H 2020, according to eMarketer (subscription required).

Connected TV helped drive share gains for both programmatic and direct buying, as advertiser interest and inventory availability continually increased across the digital ecosystem. The share of social advertising declined, with Twitter’s political ban and YouTube’s restrictions having a major effect. Additionally, Facebook’s shifting policies and political ad ban immediately before Election Day (and then after) diverted a big chunk of spend to other channels, as campaigns showed immense ad activity in the final days before ballots were counted. The next election will likely see an even greater dominance of programmatic. The question is what other budget bucket will it take from?

Section 2: Challenger CTV Flexed Some Muscle; Watch Out in the Midterms

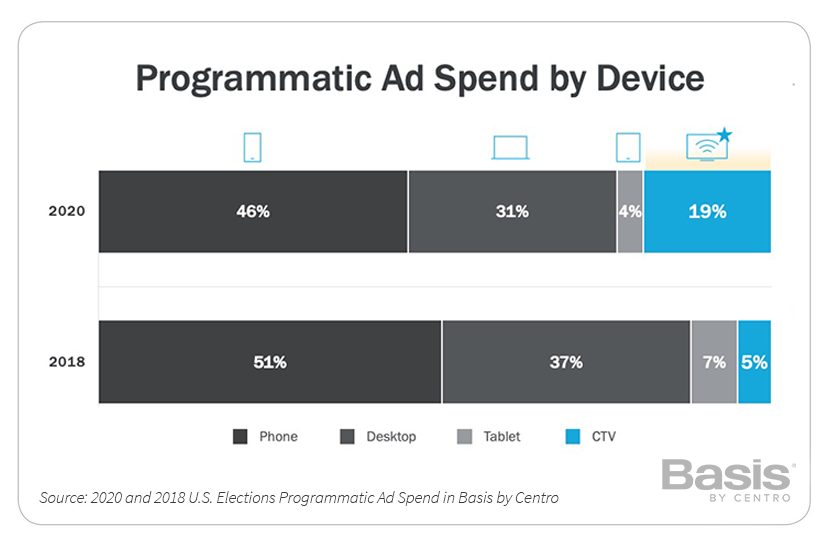

Basis' Spring 2020 political advertiser survey indicated that CTV was the most promising development among political marketers (63%), which bore out in spend. 2020 saw nearly a 3x increase in portion of overall programmatic spend allocated to CTV over 2018.

Among share of impressions, CTV only increased from 3% to 6% of overall impressions. The delta between spend and impressions share growth speaks to the premium that advertisers pay for quality CTV placements: eCPMs for CTV averaged 3.5X that of other platforms/devices. Advertisers have determined that the format – typically unskippable and on the “big screen” – is worth the premium, carrying the emotional power of TV combined with greater targetability.

Besides programmatic, the CTV surge also contributed to many larger trends in digital video and direct buying. Much of this interest from marketers aligns with the growing audience turning to this digital channel as they were stuck at home because of the COVID-19 pandemic.

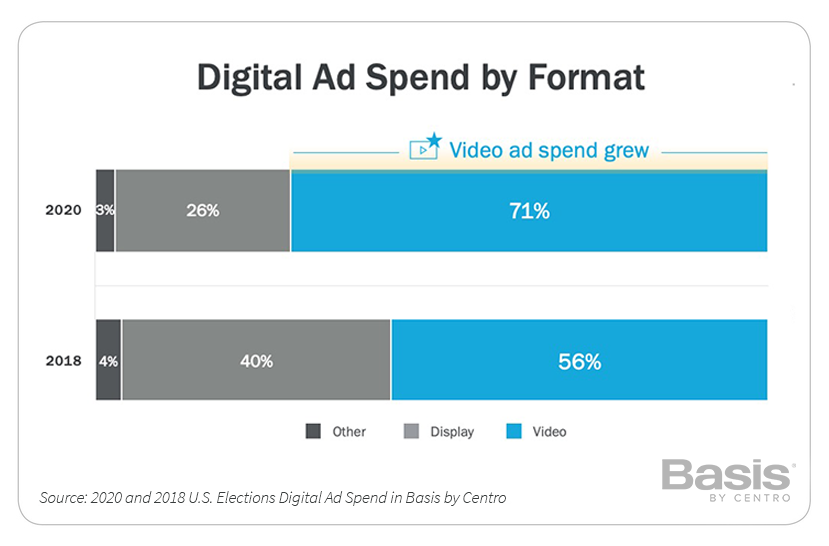

Section 3: Video Ads Gained Super Majority Control of All Ad Spend

Video receives the most digital ad investment from political campaigns. This is boosted by the usage growth trends for programmatic advertising and in CTV interest. Because most political campaigns already prioritize TV spot production as the central element of creative strategy, it’s natural to utilize those assets in digital channels. Transitioning a linear ad to CTV is a given. Doing the same for an ideal mobile or a desktop experience requires some extra work that can be a challenge for campaigns. The variances in screen-size and user mindset necessitate shorter video lengths for these digital channels. And often, less-highly produced “raw” video ads generate greater impact than repurposed :30 TV spots.

Section 4: Facebook and YouTube Restrict Political Ads, Yet Still Top Direct Vendors List

Direct buying provides unique value for campaigns, delivering guaranteed reserved inventory within in-demand content, and delivering ad experiences that are not available through biddable channels.

Direct buying takes on many forms, as demonstrated by the top three. Facebook delivers an automated self-serve experience, though it’s become less user-friendly for political buyers because of additional restrictions and multi-step ad approvals. Hulu provides a white glove experience through a salesperson and service team. YouTube offers a mix of both, though it was hampered by Google’s political targeting restrictions. Nevertheless, these three again showcased their command in political advertising for the past few years, despite their own restrictions.

The new entrants to the top 15 are another indication of CTV’s influence in political advertising. When considering the relatively limited amount of CTV inventory, factored by the massive amounts of spending leading up to election day, vendors offering these ad experiences capitalized on a time of high demand and low availability. Additionally, it’s fair to assume that these companies capitalized on the challenges of political ad targeting on YouTube.

Dropping out of the top 15 were notable publishing brands operating regional and local newspapers, such as McClatchy, Tribune, Gannett and Lee Enterprises.

Pandora’s drop (4th in 2018 to 15th in 2020) as well as Spotify’s complete political ad suspension illustrate the significant decline in digital audio for political campaigns.

Section 5: Unprecedented Elections = VERY Precedented Ad Spend Timing

Despite the noise and dialogue around early voting (in-person or mail-in ballots as much as a month before election day), half of ad budgets were used within 30 days before Election Day. Although many of those campaigns were driving turnout efforts, the fact that 25% of budgets were reserved for the last week of October showed the focus on last-minute GOTV (Get Out the Vote) impact. Considering the record turnout of voters overall, we conclude that many early voting efforts accomplished their objectives, and likely added to high turnout on Election Day.

The Georgia runoffs infused new spending and activity that was not accounted for in most pre-Election ad spend forecasts. Although it didn’t boost November spending heavily, the December spending levels ran very close to February numbers during the thick of the Democratic primary sprint to Super Tuesday.

The data suggests that during a time when the country is heavily polarized and individuals seem to have near certainty on who they would vote for, the biggest challenge for the political marketer is to ensure potential voters take action at the ballot box.

Section 6: Sound Digital Strategies Correlate with Winning Campaigns

With high advertising volume reserved for the ending stages of the elections (and the additional activation for the runoffs), Basis was able to process, before Election Day, 650 million programmatic ad impressions in the final 10 days and 225 million CTV impressions in the final four weeks.

Frequency, exposure, recency and precision were key to driving turnout -- leading to 70% winning outcomes for Basis' campaign partners.

What Basis Clients Say

“We’re able to run our own highly targeted digital advertising campaigns in Basis with speed and flexibility that keeps our clients coming back time and again. It has also cut the time we spend on billing and reconciliation by half.” – Managing Partner, Public Affairs Firm

“Basis' team provides incredible support and scale during the heat of election season - we couldn't have pulled it off without them.” -- Vice President, Democratic Political Consultant

“Basis gives us the ability to buy sophisticated digital tactics with speed and scale, and increased communication and collaboration across all areas of digital buying. If you’re not working with Basis, you are making a big mistake.” -- Managing Director, Republican Digital Buying Agency

Georgia Runoffs on Your Mind

The Georgia runoffs culminated Basis' political advertising work in 2020. We collaborated with our agency client to win a U.S. senate seat through a combination of activating voters early, deploying CTV advertising at scale, engaging social media audiences through alternative platforms, and reaching a diverse electorate. Georgia was the highest turnout for a senate runoff in the state’s history, with our Candidate being named one of the newest U.S. senators. According to the Fox News Voter analysis, a key factor was the increased turnout of Black voters, which made up 32% of the runoff votes.

About Basis' Candidates + Causes Group

For more than a decade, Basis' technology and services have been trusted by agencies and consultants in politics, public affairs, and advocacy. Basis' Candidates + Causes team has collectively worked with 1500+ political campaigns and independent expenditure committees, and 2000+ issue advocacy advertisers over the past 15 years. Our proficiency for driving perception in government, in the public sphere, or among specific audiences is a differentiated and valuable asset in this field. Basis is headquartered in Chicago with 44 offices covering North America, South America and Europe, including a Washington, D.C., hub for its Candidates + Causes team.