Zero-click search is accelerating. Learn how advertisers should rethink attribution, search performance, and cross-channel strategy.

For much of its history, the digital advertising world has been something of an iceberg: its surface shiny and bright, lighting up internet users’ screens while supporting organizational growth and powering the digital economy. Adtech largely ran out of the public’s site—back before the average Joe understood the connection between a morning Google search for lampshades and an afternoon ad for a home goods store.

But further down, below the surface, cookies and third-party data and a web of interconnected platforms and ad networks and publishers and advertisers intertwined to serve targeted ads to customers who had little idea as to why they were seeing them—and even less of an idea of how much of their personal data was being used in the process.

For better or worse, it sure seems like those days are behind us for good.

While the mechanics of digital advertisers long stayed out of the spotlight, most modern consumers now have at least a baseline understanding of how cookies work, how apps try to track them on their mobile devices, and how their social media and search activities are the fuel that powers the data economy. And, with that knowledge in hand, the majority of those consumers are increasingly invested in the privacy and ethical use of their data: Between March 2022 and March 2023, 85% of consumers reported deleting a mobile app, 82% opted not to share their personal data, 78% avoided a certain website, and 67% didn’t make an online purchase as a result of privacy concerns. Regulators, in tandem, have passed and enacted (and enforced) a variety of privacy-minded digital advertising laws in states across the US— from California, to Virginia, to Connecticut.

Of course, data privacy isn’t the only aspect of digital advertising that’s being pulled into the spotlight. A slew of Justice Department lawsuits and FTC activity now show that the world is paying very, very close attention to the inner workings of digital advertising and many of its major players. And while the coming deprecation of third-party cookies might seem like all the massive change that advertisers can handle right now, marketers will need to read the writing on the wall if they want to position themselves for success in this new era of heightened scrutiny.

For those keeping track at home: Trust + Advertising = Essential. Anti-trust + Advertising = Huge, Existential Problem.

A handful of high profile antitrust lawsuits are currently poised to impact two of digital advertising’s biggest players—tech titans Google and Amazon—and, depending on the results of those suits, reshape the entire industry.

Let’s take a closer look at each:

The US Justice Department, together with 11 state Attorneys General, is taking Google to court over its alleged violation of US antitrust laws, claiming the company—which owns a 90% market share in search—made anticompetitive deals to secure and maintain its status as the preeminent search engine on phones and web browsers. These included multibillion-dollar agreements with Apple and Firefox-maker Mozilla ensuring their products would use Google as the default search engine on consumers’ phones and browsers. The Justice Department’s argument is that Google's made these deals to maintain its dominance and eliminate opportunities for competition from other search rivals. Meanwhile, Google maintains that the company’s longtime search market supremacy is due simply to the fact that its search engine is just better than everyone else’s, and that consumers are going with the best option out there.

A key part of the government's case is focused on how Google has long leaned on its search dominance to fuel its $162.5 billion paid search empire and to harvest reams and reams of consumer data, which it then uses to power its larger ad business and, of course, to keep people using its platform and its products. But it’s that overall ad business that’s the focus of yet another lawsuit facing the tech giant.

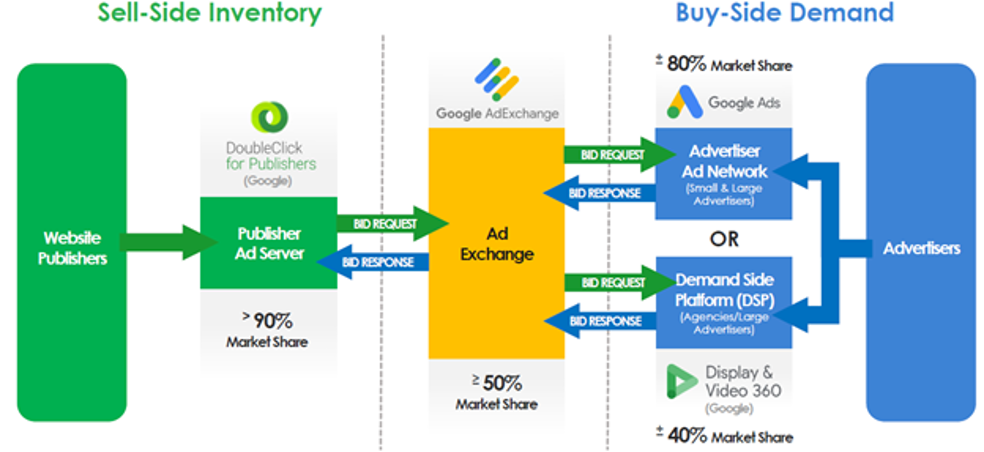

The Justice Department’s second suit against Google (which, like the other case, is also supported by several state Attorneys General) pertains to the company’s digital advertising presence more broadly. In this case, the Justice Department is arguing that Google is so deeply involved with every aspect of the digital advertising ecosystem that they have an anticompetitive and monopolistic hold on the space. The following visual from the Justice Department illustrates Google’s dominating presence on both the sell-side and the buy-side of the digital advertising business (and, for good measure, its ad exchange):

If the Justice Department is successful in either of these antitrust cases against Google, the outcome will likely result in massive fines or, potentially, the forced breakup of Google’s advertising business. Whether that means a negotiated deal with prosecutors where Google spins off some or all of their ad business into its own separate entity, or whether it means that selling certain parts that ad business to other folks in the industry, remains to be seen. But no matter the outcome, if the Justice Department is successful, it will mean monumental implications for everyone in the digital advertising industry.

Before we dive into all of those implications, though, let’s look at one final antitrust lawsuit for good measure, this one targeting Amazon:

Lastly, we have the lawsuit against Amazon by the Federal Trade Commission (FTC). Here, the FTC has filed a suit against Amazon alleging an anticompetitive hold of the online “e-tail” space, where Amazon has an enormous advantage over most of its “competitors” (if you can even call any other American online retailers “competitors” to Amazon). While this case only just filed, Amazon will likely point to brands like Walmart or Kroger as suitable adversaries and question why those retail and grocery giants aren’t being sued, too. It remains to be seen how this case will play out, but it's certainly worth keeping an eye on, especially given Amazon's Prime dominant position in the retail media space.

The convergence of these three cases, along with the increased scrutiny over data privacy in digital advertising and Meta’s ongoing struggles with regulators in both the US and the EU, reveals some inconvenient but essential truths about the current state of digital advertising and the larger digital ecosystem in which advertisers participate.

First, it shows that regulation of digital advertising is starting to pick up here in the US, much more so than we have seen in previous years or under previous administrations. Combined with the continued rollout of state-level privacy laws (not to mention the industry’s own self-regulation in cutting down on third-party cookies), we are starting to see more regulation in the US around these platforms and large tech companies in a way that could lead to an industry-wide sea change.

Second, it shows that the digital advertising industry has a big, bright spotlight on it for the first time since…well, pretty much ever. Historically, much of digital advertising industry has felt like a black box, and that has led to some fairly understandable criticism—from complaints about insufficient transparency within programmatic advertising, to the too-often-covert ways in which many companies have gathered user data, to the subsequent difficulties users have had in trying to manage that data. But with government entities and consumers alike showing new levels of interest in the digital advertising ecosystem, how it works, who the main players are, and what exactly they’re doing with people's data, that black box is being pried wide open for the world to see.

Add it all together, and it’s very possible that we’re entering a new era of digital advertising—one defined by a level of scrutiny this industry has never before had to feel. Consumers are pushing for increased transparency, and regulators are cracking down on giants like Google and Amazon in ways that could significantly reshape the landscape. Advertisers will need to prepare accordingly.

So, how can digital advertisers best situate themselves for adapting to all this change? A few recommendations:

At a minimum, digital advertisers should make sure they’re keeping an eye on regulatory developments. It’s not yet clear how these three cases will play out—they could lead to anything from the indefinite continuation of the status quo up to (and including)a radically and permanently altered digital advertising landscape. Regardless, it's critical for digital advertisers to keep tabs on what’s going on so that they can make informed decisions based on the latest developments.

Next, advertisers must prioritize consumer data privacy—not only because of the challenges posed by signal loss, but because consumers (and government regulators) are demanding it. Marketers would do well to examine the questions behind the identity crisis, integrate privacy-friendly solutions like contextual and first-party data-based targeting, and make sure their teams invest in learning everything they can about privacy-friendly advertising. Investments in first-party data hygiene (and things like CDPs) are likely to prove particularly critical—especially if advertisers end up needing to work with new partners due to the result of these antitrust suits—and finding reliable partners with access to lots of high-quality inventory and data will be essential in the years ahead.

If these lawsuits do, in fact, lead to a world in which there is even more media fragmentation and complexity, marketers will need to ensure they have the requisite tools and systems to navigate that complexity efficiently and effectively. And don’t forget the importance of the company you keep: Finding and establishing good relationships with your vendors, and aligning with future-forward partners (aka people who value data compliance and consumer trust as much as you do), will be key.

Finally, this spotlight on digital advertising creates a great opportunity for advertisers to step back and take stock of their strategies, partnerships, and systems to ensure that they’re not just using whatever the default partner or technology is simply because it’s the default. If advertising via Google or Amazon makes sense for you and your organization, that’s great! But it's still worth taking that step back to identify whether and where there might be other opportunities. And in a world where we may end up seeing major changes at major players in the digital advertising space, now is the perfect time to start that evaluation process with the comfort of knowing that it will likely be at least a year or two before the result of these cases start having real world implications.

With a variety of forces at work to put a spotlight on the industry, the scale of all these potential changes to the digital advertising ecosystem can feel a bit overwhelming. But with change comes opportunity, and this new focus on our industry offers marketers a rare moment to take that aforementioned step back and ensure that all their advertising practices are aligned with what consumers are asking for and, ultimately, are what make the most sense for you and/or your clients.

At the same time, this is an enormous opportunity for the industry as a whole. If the Justice Department and the FTC win their cases against Google and Amazon, the digital advertising world could well wake up to a more competitive playing field, ushering in new space for challengers to generate more of the thing that’s driven our industry from the very start: innovation.

—

Want to ensure that you’re regularly keeping tabs on all the most important industry developments, with just one click? Sign up for the Basis Scout newsletter to get a monthly digest of all the best digital marketing articles, POVs, and reports delivered straight to your inbox each month.