Caitlin Clark broke viewership records. Simone Biles became the most decorated US gymnast in history. Ilona Maher built a social media following larger than any rugby player in the world. These athletes, among many others, have dominated their fields and fueled a rise in women's sports viewership, opening new pathways for advertisers to reach highly engaged audiences and key demographics.

Women's sports have experienced unprecedented growth in recent years: Average ratings for the WNBA regular season have skyrocketed, with the latest season marking the most-viewed ever on ESPN networks; the 2024 NWSL Championship set a new viewership record for the league, with audiences increasing by 18% compared to the 2023 championship; and more than 1.3 billion people worldwide tuned in to watch women's events at the 2024 Paris Olympics. At the same time, a new generation of athletes is reshaping fan engagement, with stars like Coco Gauff and Paige Bueckers using social platforms to build personal brands and connect directly with audiences—and creating valuable opportunities for brand partnerships in the process.

The bottom line? Women's sports audiences are growing rapidly and rewarding brands that show up. Here are three key things advertisers need to know about this audience to craft podium-worthy strategies:

The audience for women's sports is deeply invested. Half of avid fans demonstrate strong loyalty to individual athletes, and this group is 27% more likely to purchase from brands that partner with popular female athletes.

This brand-responsive behavior extends across the broader fan base. In fact, nearly one-third of all women's sports fans say they're more likely to buy from brands that support women's sports or partner with female athletes. Among female fans, that figure climbs to 36%.

Beyond direct purchases, women's sports fans are 53% more likely than the average consumer to recommend products to others. This turns brand loyalty into powerful word-of-mouth marketing that continues well beyond the initial sponsorship investment.

Put simply, women's sports fans aren't just watching. They're actively rewarding brands that show up authentically in the space.

While women’s sports fans span all generations, they skew younger. People between the ages of 16 and 24 are 18% more likely than average to follow women's sports, and the 25-34 demographic represents the largest portion of the audience. WNBA fans exemplify this trend: Nearly half fall within the 18-34 age range, while 32% are ages 35-54, and 21% are 55 and older.

Gen Z is particularly —and increasingly— engaged: In 2025, over half of 18-to-24-year-olds report interest in watching or attending women's sporting events, up from 41% in 2022. These younger fans also follow their favorite athletes across social platforms, with at least 40% of Gen Z US sports fans following women’s sports and athletes on social media.

This younger, digitally native audience represents a significant opportunity for advertisers looking to build long-term brand loyalty. Advertisers should consider campaigns that reach these fans on Instagram and TikTok while also leveraging live CTV, where audiences of all ages are increasingly tuning in.

While some might assume otherwise, women’s sports fandom extends well beyond female viewers.

Men and women watch women's sports at nearly equal rates, with roughly three-quarters of each demographic tuning in at least a few times annually. Male fans watch more frequently, however, with 23% viewing weekly or more, compared to 15% of female fans. When it comes to the WNBA specifically, men make up the majority (56%) of fans, though women represent a still-substantial 44% of the fan base.

These viewership patterns highlight an important strategic consideration: Women's sports audiences are more diverse than many assume. Advertisers should base their targeting strategies on actual viewership data rather than demographic stereotypes.

Women's sports has evolved into a robust media ecosystem with engaged, brand-responsive audiences. The combination of rapid viewership growth, high fan engagement, younger demographics, and gender diversity create a compelling case for advertisers to invest in this space.

With momentum and brand investment accelerating, now is the time to build meaningful, lasting connections through women’s sports.

—

Looking for more insights around how to harness the live sports opportunity? Check out Going Deep on Live Sports Advertising Opportunities for actionable insights on maximizing your investment.

As the final quarter of 2025 takes shape, marketers face a paradox: Consumer spending appears resilient, yet caution is everywhere. Inflation is proving sticky. Tariffs are driving up costs. And confidence in the economy is slipping.

Still, the holiday season—one of the most critical revenue periods of the year for many brands—is underway, and will offer a real-time read of where demand is holding and where it’s softening. It’s an ideal time to focus less on what consumers say they’ll do and more on what they’re actually doing, a distinction that will be increasingly important heading into 2026.

While this mix of signals can make planning feel uncertain, it also offers valuable insight into what’s ahead. The trends taking shape now will help set the tone for 2026. While no forecast is perfect, paying attention to a few key indicators can help marketing leaders cut through the noise, anticipate shifts in consumer behavior, and refine how they allocate budgets as they look to the new year.

Inflation may have cooled from its 2022 highs, but it has remained persistent throughout 2025. Prices continue to hover around 3.0% higher year-over-year (YoY), and new tariffs are adding another layer of pressure—raising the cost of both consumer goods and the equipment businesses rely on. Many companies are passing those price increases along to consumers, eroding purchasing power and testing price tolerance across income groups.

Because many of the new tariffs only took effect in the past few months, their full impact has yet to be felt. As these costs work their way through supply chains, pricing pressures will likely intensify in 2026.

For brands and marketers, this means price sensitivity isn’t likely to fade anytime soon. “Consumers are spending more carefully,” says Kelly Boyle, SVP of Strategic Business Outcomes at Basis. “However, that doesn’t always mean less. They’re asking whether what they’re paying for is really worth it and focusing on quality and value.”

Keeping an eye on monthly inflation reports, developments around tariff impacts, and how competitors adjust pricing can help teams understand where consumer budgets are tightening and which audiences are feeling pressure first. Those insights can reveal where to adjust messaging around value, quality, and necessity as consumer priorities continue to shift.

Consumer confidence has remained weak throughout 2025. The Consumer Confidence Index has stayed below the 80-point threshold that often signals recession risk since February, and it declined again in September. The University of Michigan’s Index of Consumer Sentiment shows a similar pattern: It held nearly flat at 55.0 in October 2025 (vs. 55.1 in September), down 22% YoY, while consumer expectations fell more than 30% during that period.

Despite confidence slipping, spending hasn’t yet followed suit. “A lot of research shows consumers saying they’re going to spend less, but we’re not actually seeing spending go down yet,” says Boyle. “People might plan to spend less, but when they see the product, the price, or the deal in front of them, that’s when the real decision happens.”

For marketers, that means these dips in confidence are important to track, but not always predictive. Watching real behavior—like changing shopping cart sizes, shifting web traffic patterns, or slowing engagement—can give marketers a truer picture of demand. In many cases, confidence data reflects emotion more than genuine intent, so interpreting it alongside behavioral evidence can reveal whether concern is translating into real restraint.

Despite declines in confidence, consumer spending has stayed strong through 2025. However, that foundation is starting to shift. Recent data shows that growth is increasingly driven by higher-income households, while job openings are decreasing and hiring is slowing. The number of people voluntarily quitting jobs has fallen to its lowest level since December, a clear sign that confidence in finding new opportunities is waning.

Younger consumers are feeling the strain most. Gen Z spending fell 13% between January and April of this year, and Zoomers plan to cut 2025 holiday purchases by 23%. Unemployment among new entrants to the workforce—many of them Gen Z—remains elevated, and more than 40% report running out of money each month. Taken together, the slowdown in hiring and Gen Z’s spending pullback point to a growing generational divide in consumer resilience. Boyle notes that brands should dig deeper into what’s driving those shifts rather than assume every cutback signals disengagement. Understanding whether younger shoppers are trading down, delaying purchases, shopping secondhand, or spending on experiences versus products can reveal where opportunity still exists.

Tracking labor trends by income and age throughout Q4 can help marketers anticipate where confidence, and eventually spending, may weaken first. If employment continues to cool, discretionary categories and younger shoppers are likely to feel it soonest.

Economic uncertainty often drives caution. Earlier this year, 94% of US advertisers expressed concern around the impact of tariffs, and 45% said they planned to reduce their budgets as a result. Those adjustments are now starting to surface as the effects of tariffs flow through supply chains and margins tighten.

But history shows that brands that maintain visibility during downturns tend to emerge stronger. Monitoring competitors’ share of voice and promotional activity through Q4 can help marketing leaders spot where attention is up for grabs. Discovering opportunities to leverage relative advantage—investing in audiences, channels, and timing where competitors leave space—can help teams stretch budgets while gaining ground.

At the same time, Boyle notes, “If competitors start pulling back, a brand’s share of voice naturally increases—even without upping spend. That’s often when it’s worth holding your ground or leaning in a bit more if the timing is right.”

Continuing to invest strategically during periods of retreat not only preserves awareness but also builds momentum that compounds once conditions improve. Marketers who stay alert to these shifts can shape their 2026 plans with clearer visibility and stronger positioning.

Each of these indicators can guide practical planning for 2026. Keeping a close eye on rising prices, shifting consumer sentiment and behaviors, changes in the relationship between spending and the job market, and evolving competitor strategies will help leaders navigate the market more effectively. By paying attention to these signals throughout Q4, teams can refine priorities for the year ahead based on consumer and competitor behavior. Treating these signals as ongoing inputs—rather than one-time data points—will help ensure plans are crafted as strategically as possible.

“When things feel uncertain, the best thing you can do is stay clear on your strategy and your audience,” says Boyle. “The teams that succeed amidst turbulence are those who stay focused on what matters most to their business.”

__

Looking for more insights on how marketing leaders can navigate economic uncertainty? Basis’ CMO Katie McAdams shares her expertise in How Marketing Leaders Can Earn Executive Buy-In During Economic Turbulence.

Picture this: The weekend is finally here, it’s game time, and you’ve got your homemade nachos all set to go (your secret ingredient: home-pickled jalapenos!). You plop down on the couch, crack open your first beer, turn on the big screen and...shoot. Where’s the game? Didn’t you read something about Amazon securing the rights for this season? No wait, that was Peacock...or was it Apple TV+? ESPN+? Maybe TBS? Or TNT? One of the Ts? Fox? CBS? Hulu? YouTube TV? Is this one of the games on Netflix? Why can’t you find it?! Was there ever even a game today? THE NACHOS ARE GETTING COLD!

Tuning in to live sports used to be so simple. And we’re not even talking about 50+ years ago, when that meant “going to the game” or “turning on the radio” for 95% of your live sports consumption. As recently as the 2000s, when it came to sports broadcasts, there were the major networks, ESPN, an occasional game on one of the Turner channels, and that pretty much was it.

Today, sports leagues are scattering their broadcast rights around like digital Johnny Appleseeds, adding to an already-complex CTV and streaming video environment and creating new challenges for advertisers and consumers alike. The clear reason for this shift? Money—big money. US sports TV and streaming rights are forecast to reach $30.5 billion in 2024 and are forecast to reach nearly $35 billion by 2027—almost double what they were just a decade earlier. All this has taken place in the face of (or, perhaps, helped fuel) cord cutting that drives essential revenue away from traditional broadcasters and into the pockets of streaming services.

In light of these dramatic shifts, how can digital advertisers effectively reach and connect with sports fans? And is navigating the disparate live sports landscape worth all the trouble? (Spoiler alert: yes, yes it is!) Read on to learn all about it.

First off, let’s look at some of those new (or, at least, new-ish) sports broadcast partnerships, an area that’s seen some significant departures from the “old normal” in recent years:

The fact that so many major American sports entities have granted exclusive broadcast rights to streaming platforms marks a significant shift in the industry. And with digital live sports viewership surpassing linear TV in 2023—a gap that’s only widened since—it’s clear that the streaming-first revolution in sports broadcasting has arrived.

Just as meaningful is the price those companies paid for their live sports streaming rights: $200 million per year from Disney, Amazon Prime Video, and NBCUniversal for WNBA games; $5 billion over the next ten years from Netflix for the WWE “Raw” programming; $1 billion per year from Amazon for their weekly regular season NFL matchup; a reported $2+ billion per year from Google for Sunday Ticket; and $150 million from Netflix for its two Christmas day NFL games in 2024.

To make up for these kinds of skyrocketing costs, linear broadcasters and streaming video platforms alike are turning to two main revenue sources: subscription price hikes and—you guessed it!—advertising. So, without further ado, let’s take a look at how (and why) advertisers can make the most of this evolving landscape.

Roughly two-thirds of Americans are sports fans. And people who watch sports aren’t going to catch a replay of the game once it hits Netflix in a few months—they’re going to watch it live. This is a valuable “guaranteed” audience upon which platforms and advertisers alike can place outsized value compared to other broadcasts (no wonder sports tend to dominate lists of the most-watched US broadcasts year after year). When brands want to ensure they are meeting a large, built-in audience all at once, there are few opportunities quite like live sports.

Which is not to say that brands can’t benefit from advertising against other sports content, such as highlights, clips, and replays (more on this in a bit!). Those often represent prime contextual advertising opportunities, whether via contextual partners like Comscore and DoubleVerify, or with specific publishers such as the AP, Gannett, or (of course) ESPN.

On the more local level, no matter what embarrassment, scandal, or years-long losing streak might afflict their favorite team, fans tend to “root root root for the home team” through thick and thin. For advertisers that want to geotarget, sporting events often post remarkable ratings in specific markets—and fan loyalty can translate to brand loyalty. No wonder organizations of all kinds pay out top dollars to be the official beer, official pizza, official bank, official cryptocurrency platform, or even official HR/payroll provider of your hometown team.

Another key factor that’s fueling sports viewership? Gambling, which has gone from being largely prohibited under federal law (except in Nevada) before 2018 to being all over American sports coverage today. After the Supreme Court struck down the federal ban that year, individual states began legalizing sports betting, and total consumer spending on gambling has since skyrocketed—surpassing $100 billion for the first time in 2023, and expected to exceed $200 billion in 2027.

This growing excitement around sports betting is delivering new, passionate audiences to live sports, with over a fifth of US adults reporting that they have personally engaged with sports betting within the last year. And if someone is spending money on the game, they’re a whole lot more likely to tune in, with 85% of sports bettors saying it makes them more interested in watching the games.

As for where and how they're watching...

164 million Americans regularly watch live sports—nearly 50% of the total population. Perhaps even more notably, more than 114 million of those viewers currently tune in on digital devices, and that number is projected to rise to 137 million by 2029. Yep: Just like the rest of the video world, the future of live sports advertising is digital.

Of course, as is the case with that larger digital video environment, the increasingly disparate nature of sports broadcast agreements (even in light of new offerings like ESPN’s new direct-to-consumer streaming service) is only adding to the complexity and fragmentation that mark the digital video and CTV space. Among avid sports fans, 69% feel it’s a hassle to navigate multiple providers to watch the same sport and 59% feel it’s gotten more difficult to find what they want to watch, and you can only imagine how frustrating that must be when the start of the game is rapidly approaching (and your nachos are getting cold...) And for advertisers, the evolution from a few reliable live sports hubs to numerous broadcasters across multiple channels can mean added complexity in campaigns targeting these audiences. So as streaming becomes the norm for live sports, advertisers and viewers alike are adapting to some growing pains.

That said, to their credit, the big tech companies that have waded into the live sports streaming wars are taking crucial steps toward optimizing benefits for advertisers. Prime Video, now a major home for NBA coverage, is rolling out interactive tools like “key moments,” advanced stats, and personalized bet tracking for NBA broadcasts. Meanwhile, NBCUniversal and Walmart launched integrated shoppable experiences across both linear and streaming sports inventory in late 2024, bringing retail media into live broadcasts. On the measurement front, Nielsen’s Big Data + Panel tool now includes live sports as a core category, and leagues are pushing for streaming platforms to share first-party metrics to support accurate ad pricing.

Even the more traditional homes of live sports have readily embraced the potential of streaming those events for maximum impact. Fox, for instance, included viewership across its broadcast network, Fox Deportes and Telemundo, the NFL's digital networks, and Fox's ad-supported streaming service, Tubi, when it reported the ratings from Super Bowl LIX—the most-watched US broadcast in history. And annual events like the Masters golf championship and NCAA men’s basketball tournament have long had authorized (and ad-filled) streams as part of their overall broadcast packages. As viewers increasingly flock to OTT and CTV for their live sports consumption, brands will have new ways to personalize and target these consumers as part of their cross-channel marketing strategies.

Speaking of which...

The digital evolution of live sports broadcasts goes beyond individual devices.

More and more fans are watching the game on digital platforms, particularly bigger screens like CTV. Sports viewership on YouTube’s connected TV app grew by 30% in 2024—a clear signal that connected TV (CTV) is becoming a major player in sports advertising.

But the real secret weapon for advertisers may be resting in your pocket (or your hand) right now: smartphones. Sports broadcasts present a unique cross-platform marketing opportunity, with viewers often using second screens to look up players and team statistics, use social media to engage with others, watch other games on a separate device, place bets, and more—all while watching live sports at home.

This multi-device behavior creates valuable targeting opportunities that extend well beyond game time. Sports fans are a widely targetable audience segment through private marketplaces (PMPs) like Tapjoy, and they can be further segmented via top data providers like Alliant (golf), eXelate (NBA), and Cuebiq (NHL). These tools help advertisers continue to market to viewers even after the game clock hits 0:00. Put it all together, and sports programming offers a powerful way to consistently reach and remarket to specific target audiences across multiple devices.

Beyond retargeting viewers across devices during and immediately after games, there's also a significant opportunity to build upon the momentum of live sports and continue the conversation long after the final whistle. Sports fans are often ideal audiences for marketers as they are deeply engaged when it comes to their favorite teams. Considering the fact that 41% of fans are already locked into their favorite pro sports team by the age of 12 (and 62% by the age of 17), it’s clear that sports fans are an active, impassioned audience ripe for engagement. By leaning into this passion and connecting with these fans within relevant content related to their favorite teams, marketers can further deepen brand loyalty and drive meaningful engagement.

Whether by running ads alongside clips and replays, within sports shows, or even alongside social media content, advertisers have ever-expanding opportunities to engage with sports fans beyond live events themselves—and perhaps even to persuade more viewers to tune into live games. The power of such placements is underscored by deals like the 2024 NBA and Warner Bros. Discovery agreement which includes the studio show Inside the NBA, as well as other NBA content like Bleacher Report and House of Highlights, a social media network that distributes sports clips and content.

In addition to using ad placements within gameday-adjacent content, brands and marketers can also harness the power of sports by working with athlete influencers. Take, for instance, rugby star and Olympian Ilona Maher. She rose to fame not only for her powerful presence and performance on the field, but also for her active presence on social media—where she now has over five million followers on Instagram and works with major brands like Barbie and Maybelline. Additionally, many athletes have also started their own podcasts (like Angel Reese’s “Unapologetically Angel” and the Kelce brothers’ “New Heights”), offering brands the opportunity to place high-impact ads that connect with fans within their shows.

Sports offer brands a unique opportunity to connect with deeply passionate and engaged audiences, both during and outside of the game. By leveraging gameday-adjacent content and collaborating with athlete influencers, brands and marketers can tap into the enthusiasm of sports fans to build stronger connections, deepen brand loyalty, and drive meaningful engagement across a variety of platforms.

Sporting events are a fixture of American culture. From Super Bowl Sunday every winter to the WNBA Finals every summer, live sports are a reliable way to bring people together in front of their TVs, laptops, and other streaming devices to catch the action (and, of course, the commercials). And even as the way fans consume their sports continues to evolve hand-in-hand with the rest of the video realm, advertisers will look to live sports as a pillar of their omnichannel marketing strategies. In short: It’s a home run opportunity for brands to hit their goals, assist in the revenue-driving process, and score some big wins.

(And yes, there were seven sports puns in that last sentence. Touchdown.)

__

The role of CTV in live sports advertising is expected to dramatically increase in the years ahead. Check out our CTV advertising guide for tips on everything from CTV campaign best practices, to safeguards against CTV ad fraud, to effective targeting tactics, and much, much more.

The pitch process is one of the most debated rituals in the agency world. What once felt like an adrenaline-fueled showcase of creativity has become exhausting and inefficient, marked by weeks of unpaid work, teams stretched thin, and rising costs for agencies and brands alike. These challenges are only magnified by the reality that pitching remains central to how agencies grow, compete, and win new business.

This puts leaders in a difficult position: The pitch isn’t going away, but the way it’s run needs to evolve to meet today’s demands. With clients asking for more ideas and faster turnarounds, agency leaders are under pressure to modernize how they approach the process. AI is also reshaping how work gets done, and clients increasingly want to understand the operational capabilities behind the strategic vision. This shift gives agencies that demonstrate tech-powered efficiency and AI readiness a distinct edge.

By building operational efficiency, demonstrating tech and data readiness, and using those capabilities to establish trust, agencies can transform the pitch from a resource drain into a competitive advantage. The pitch process may never be easy, but it can be managed in a way that benefits both agencies and their clients.

Pitches today demand a significant quantity of resources with little certainty of return. This imbalance of effort and reward leaves teams stretched thin and leaders struggling to balance growth opportunities with organizational wellbeing. “Agencies often feel like they’re giving away ideas, creative, and strategy—pouring their heart and soul into pitches with no guarantee of return,” says Michael Thill, Basis’ VP of Agency Development.

Beyond the time and energy invested, the financial implications are severe. In 2023, the 4As and ANA reported that the average non-incumbent pitch cost agencies more than $200,000, while brands typically spent more than $400,000 on the same process.

These costs are compounded by client expectations for faster turnarounds and more upfront ideas, resulting in a cycle that drains time, money, and energy on both sides. Without better systems in place, agencies must pour resources into a process that often undermines the very efficiency clients are asking for.

Pitches expose a critical tension: Clients expect more, faster, while inefficient processes, siloed systems, and shrinking profits put additional strain on agencies—pressures intensified for many by recent workforce reductions.

These challenges make efficiency one of the most compelling advantages in a pitch. Optimized team structures, Thill observes, offer a concrete way to demonstrate this efficiency. “If I’m an agency and I can show you that what a typical agency might need 10 FTEs for, I can do with seven—that money talks,” he says.

But efficiency doesn’t just come from cutting headcount. Without changes to workflows and data management, trimming staff only drives burnout and makes pitches harder to win. Agencies that are finding success often take a more strategic approach to operational improvements. Common strategies include using automation to reduce time spent on repetitive tasks and applying AI to strengthen recommendations. “Automation and AI are parallel. They’re different tools, but together they free up time so agencies can actually focus on the pitch,” says Thill.

The key to making AI tools work, however, is quality data. Clean, unified data systems allow AI to learn faster and deliver more accurate results, making it significantly more effective at driving efficiency. This frees up team capacity to focus on the strategic work that wins competitive pitches.

One of the biggest hurdles in pitch prep is simply getting to the right information. Too often, agencies struggle to pull past performance data, publisher insights, or resource models because systems are disconnected. Instead of drawing on a clear record of what’s worked before, teams can spend hours digging through spreadsheets or emailing partners for numbers. For instance, when adtech and martech platforms don’t work together seamlessly, agencies waste 12% or more of their time, budget, and employee effort.

Such losses show up acutely during a pitch. Pitches are fast-paced, with little room for delays or vague answers. “Even large agencies often don’t have a way to quickly access their own data for a pitch,” says Thill. “They’re forced to RFP partners and cobble insights together manually.” The result is a story that can come across as incomplete, no matter how strong the creative may be.

This is where tech can become a true differentiator. Agencies that work to unify data into a single source of truth often find they can surface insights more quickly, build accurate projections, and enter pitch meetings better prepared. For clients evaluating partners, this operational readiness signals both potential cost savings and—crucially—the ability to deliver measurable results. And since 90% of brands say ROI and outcomes matter more than cost when evaluating agency partners, demonstrating operational readiness and data maturity can be an advantage in a competitive pitch.

However, achieving this level of readiness requires more than just adopting new tools. Auditing existing tech stacks to identify gaps and redundancies, evaluating whether current platforms can integrate effectively, and determining what changes would genuinely improve workflow efficiency are critical steps many agency leaders overlook. The goal isn’t simply to have more technology, but to ensure the technology in place works together to support the team’s actual needs during high-pressure moments like pitches.

Earning trust in the pitch process is both critical and challenging. Clients want to see not just ideas, but proof those ideas can translate into performance and real business results. When agencies showcase past work, demonstrating how creative execution and media performance informed one another can be a powerful differentiator. Yet this is often difficult when creative and media teams—whether housed within one agency or operating as separate entities—work in silos without shared access to timely campaign insights. “Clients are frustrated that media doesn’t talk to creative. If you can connect those dots, you’ll stand out,” says Thill.

Some agencies are working to address this by investing in tech infrastructure that makes campaign performance accessible across all teams and partners. The goal is to create systems where insights can flow consistently, whether between in-house media and creative teams, or across separate agency partnerships. When this works well, it changes how teams operate. “If you have a centralized source of truth, every team—media, creative, finance, leadership—can leverage it to make better decisions,” Thill notes. During pitches, agencies that can demonstrate they’ve built this kind of operational capability may stand out by showing they’ve solved a problem many brands find frustrating.

Additionally, a strong tech stack today includes AI as a core component, and clients increasingly want to understand how agencies are implementing it responsibly. Agencies that have consolidated disparate data sources into a clean, reliable foundation can demonstrate—not just claim—AI readiness during pitches. This operational proof point builds credibility by showing both technical competence and thoughtful implementation, addressing client concerns about AI hype versus AI capability.

Agency leaders may not be able to fully eliminate the stress of pitching, but they can reshape the process to work in their favor. Tech isn’t a silver bullet, but automation, consolidated data, and strategic AI adoption can help make it possible to run pitches with greater efficiency and clarity. The result is a process that builds trust and shows clients that agencies can pair strategic and creative capabilities with operational excellence and tech readiness. As client expectations continue to evolve, agencies that invest in these proficiencies now position themselves to win and retain business over the long term.

__

Looking for more insights on how AI is impacting agencies and the advertising industry as a whole? We surveyed marketing and advertising leaders from leading agencies and brands for our third annual AI and the Future of Marketing report. In it, you’ll find data on the most common and effective applications of AI today, the critical role of first-party data in maximizing the technology, how AI is reshaping jobs and teams, and more.

In an age defined by automation, data, and algorithmic precision, the strongest advantages a marketer can cultivate may also be the most human.

Amid the excitement (and uncertainty) surrounding AI, many marketing leaders are beginning to recognize that technology alone cannot create differentiation. What will separate the good from the great is the ability to use that technology in authentic and trust-based ways that enhance empathy, creativity, and emotional connection.

That perspective shaped many of the discussions taking place at Advertising Week New York this year. While much of the content detailed ways brands and agencies are beginning to leverage AI for creative and operational benefits, a number of sessions also explored how marketers can balance efficiency with authenticity, and why the next phase of AI-driven innovation will rely as much on people as it does on platforms.

According to a new report, 96% of CMOs say they are prioritizing AI adoption, but just 65 percent of teams have begun making meaningful investments, and a mere 18 percent of marketers said AI has reduced their reliance on developers or data teams. This “optimism/execution gap” captures the reality of where many organizations stand. Leaders are eager to explore the possibilities of AI, but the transition from intent to impact remains slow.

The obstacles are not purely technical. Teams are grappling with unease about how AI will reshape roles, creative processes, and organizational structures. Adoption requires both trust and alignment—qualities that develop only when leaders ensure they have the right tech stacks in place to help minimize fragmentation and complexity and, simultaneously, communicate openly and give their teams room to experiment.

But once people see real results, their fears tend to subside: A 2025 Basis report found that 94.9% of decision-makers say their teams have embraced the use of AI in their marketing/advertising work, up significantly from just last year. Leaders can help build employee confidence in their teams’ AI adoption by celebrating early outcomes and small wins instead of waiting for perfect results and organization-wide transformation.

Many marketing organizations remain tangled in complex, overlapping systems. Elizabeth Maxson, CMO of Contentful, described this phenomenon as “platform purgatory,” a state in which too many tools create more friction than flow. Years of adding technology to fix inefficiencies have often had the opposite effect.

“We’ve all been trying to figure out how to use technology to fill gaps, fill places, do things differently,” Alice McKown, Publisher & CRO of The Atlantic. “But then we have a whole host of technology partners (and) vendors that maybe don’t all speak to each other, much less groups within our organizations that don’t speak to each other. So how can we really think about evaluating and prioritizing those things that work for us, and what can we be doing to mitigate this purgatory?”

Ultimately, the best way to do so begins with clarity of purpose and desired results. Marketers should start by defining the outcomes they hope to achieve and then identify the specific technologies that make those outcomes possible. This mindset shifts attention away from tool acquisition toward business results and collaboration.

Achieving this kind of clarity sometimes requires hard decisions about retiring outdated systems or integrating functions under a single, connected framework. Technology such as unified advertising automation platforms can help reduce complexity and allow teams to devote more energy to creative and strategic work.

Modern marketing demands speed. Campaigns must respond rapidly to trends, market shifts, and customer expectations, yet constant acceleration can also erode quality and authenticity.

The antidote to this conundrum is a strong brand foundation. When a brand’s purpose, tone, and values are clearly defined, teams can create localized and personalized work that still feels cohesive. Those shared guardrails can provide marketers with the confidence they need to experiment without sacrificing their identity.

Leaders should also think carefully about how they use the time AI gives back to them. Automation can streamline production, but the hours it saves should be reinvested in reflection, curiosity, and creative thinking. The human experiences that shape our perspectives ultimately make campaigns resonate.

In earlier eras, data served mainly as a post-campaign scorecard. Today it has become an active partner in creativity.

“This is an infinite loop,” said Maxson. “Data lives at every part of your cycle—from creation to publications, what channels you’re using, what audiences you’re speaking to—and having that data to be able to drive those decisions forward is going to be really important.” By harnessing the power of clean, unified data, marketers can harness new insights to generate new evidence-based creative ideas for specific audiences, then use the findings from the execution of those ideas to generate new data, and then repeat that cycle indefinitely.

When teams use insights to inspire creative direction from the beginning, they move from intuition alone to evidence-based storytelling. Each iteration strengthens both the analytical and imaginative muscles of the organization.

This fusion of logic and intuition is at the heart of modern marketing. Data is an indispensable guide, but human judgment is still crucial in determining how to best translate those numbers into meaningful outcomes.

Personalization remains one of marketers’ top priorities, yet only 25% of teams say they are currently using AI for audience segmentation and personalization. AI has made it easier to tailor messages, but personalization without empathy risks feeling mechanical.

Brands need to have a strong foundation, with brand guidelines and a clear idea of what makes you ‘you.’ With those guidelines and that voice at the core of any subsequent AI initiative, brands can then work to discern between what distinguishes their brand across different audience segments.

“From the outset, those guidelines need to be super clear, and then, you can really go off and play,” said McKown. “But you need to have those guidelines.”

The most effective brands are using AI to deepen understanding of their audiences rather than simply expanding their reach, focusing on identifying the right moments to connect with consumers and delivering the right message in those moments while striking a tone that feels genuine. In an AI-driven marketing age, authentic communication depends on knowing when automation and AI can enhance the user experience, and being able to discern them from those moments when technology detracts from it.

Lastly, the entirety of the process must be built on a foundation of trust—which, once lost, is exceedingly difficult (if not outright impossible) to recover. A 2025 Salsify report showed that 87% of shoppers will pay more for a product from a brand they trust, while a Mozilla study found that nearly 90% of marketers believe their brand benefits from a trust halo effect when advertising on trusted platforms.

The brands that capitalize and succeed here will be those that treat personalization as an authentic conversation, rather than treating it as a mere sequence of automated outputs.

“Users trusting a platform is extremely important,” said Suba Vasudevan, Chief Operating Officer at Mozilla. “In my mind, it’s very simple that trust results in conversion, it results in longer value from these users, longer engagement, (and) more lifetime value from those users.”

One of AI’s most promising potential benefits stems from the ways it lowers the cost of experimentation. Teams can now test creative approaches, audience segments, and formats at smaller scale and faster pace. Each experiment, be it big or small, provides learning that sharpens intuition and strategy.

This environment should invite curiosity, rather than fear. Leaders who celebrate incremental progress help their teams gain confidence and see experimentation as part of everyday practice. Progress often comes from trying, observing, and adjusting, and AI can meaningfully shorten that cycle.

One of the most tangible benefits of automation is the time it returns to creative professionals, reducing or outright removing much of the administrative work that has long dominated marketing operations. In a more automated marketing ecosystem, what will grow increasingly important is how teams use that reclaimed time to focus on the things we actually want to be doing.

With the right systems in place and the right guidance from leadership, automation and AI can allow marketers to devote more time to the activities that make them more insightful: listening, observing culture, and living experiences outside the office. Those lived moments fuel the kind of real-world empathy and storytelling that algorithms alone can’t effectively reproduce.

“I think the best marketers are people are out gaining lived experiences—you’re seeing real things come to life, and that fuels those ideas,” said McKown, “And so if we can get more time to be more human, I think we’re going to be more creative and be better marketers.

When taking a long-term view, the rise of AI is not a threat to creativity, but a challenge to use that creativity more intentionally. Technology can enhance speed and scale, but true differentiation and meaningful brand relationships still come from authentic human insight.

Differentiation in the years ahead will depend on how leaders combine automation with imagination and precision with empathy, and successful marketing will stem from using AI as a tool for amplifying human potential, rather than replacing it. The task now is to lead with empathy and to shape a future where technology supports the marketer’s curiosity and gives imagination more room to grow.

---

For marketing and advertising leaders, the question is no longer whether to adopt AI, but how to do so responsibly and strategically. Our 2025 AI and the Future of Marketing report is designed to help industry leaders navigate that journey. It contains data-driven insights on adoption patterns, efficiency gains, risks and concerns, and workforce implications of an AI-powered future. Together, the findings highlight how AI is shaping marketing today, while illustrating how it is poised to redefine the industry in the years ahead.

No matter the industry or product, one ambition sits at the heart of every business: growth. When crafting strategies to drive that growth, one of the key levers marketers must consider is balancing loyalty marketing with customer acquisition.

Many marketers default to focusing on loyalty-focused strategies, and for understandable reasons. As signal loss increases, it’s an effective way to capitalize on the gold standard of customer data with readily available CRM lists. Focusing on existing customers is often more economically attractive than acquiring new ones, as existing customers tend to generate more value per customer. And as measurement challenges persist, targeting existing buyers often leads to clean attribution numbers that look good on a report.

Still, metrics that look efficient on paper don’t always reflect real business growth. A retargeted customer may convert, but that doesn't always mean marketing drove the sale—loyal customers often buy again regardless, inflating attribution metrics without creating incremental revenue. As such, when brands lean too heavily into loyalty marketing, they risk artificially boosting short-term metrics at the expense of true growth.

At the same time, for products where usage frequency is limited, there’s only so much room to grow by nudging existing customers to buy a little more often. How often can someone be convinced to buy new running shoes or a new mattress? For these brands, trying to squeeze more purchases out of existing customers is often a wasted effort.

Ultimately, while focusing on loyalty may seem like the safe, efficient play, it can funnel time, effort, and money into strategies that don’t meaningfully expand the business. Loyalty strategies can feel safer and easier to justify, but growth depends on reaching new customers, not just retaining existing ones.

Across categories, market penetration—not loyalty—is the primary driver of brand growth. Even more, marketing tactics aimed at new customer acquisition tend to support retention as well.

The payoff is clearest when reaching potential new buyers, for two main reasons:

There is one exception to this rule: Smaller brands, with a limited customer base and higher churn, often need to lean more on retention tactics to offset brand switching. But for most advertisers, acquisition should be the priority if the goal is meaningful, sustainable growth.

Real growth happens when brands focus less on deepening loyalty and more on expanding their customer base. Loyalty marketing remains a crucial part of any marketing strategy, but when the goal is expansion, acquisition should lead.

Consider a regional furniture retailer with a $100,000 quarterly media budget. They could allocate a portion of that budget to strategically retargeting the 50,000 customers in their CRM who've purchased in the last two years. But the bulk of their investments should focus on reaching the hundreds of thousands of potential customers in their market who've never visited their store. Shifting to acquisition-focused strategies may be a more challenging sell to leadership, as the metrics may look less efficient on paper and require larger budgets to reach new audiences. But in the long term, such an approach builds net-new customer relationships that drive more meaningful long-term growth.

One way to balance efficiency with acquisition is to utilize lookalike audiences. The retailer can use their CRM data to find people who share characteristics with their best customers but haven't purchased yet. This leverages first-party data while still prioritizing new customer acquisition, helping to efficiently convert prospects who are likely to respond.

That's the difference between looking efficient and actually growing. Marketers should ask themselves: Are we chasing attribution metrics that flatter short-term performance, or investing in strategies that build long-term growth? In most cases, the latter means putting acquisition front and center.

Loyalty marketing will always have an important part to play in marketing strategies. It builds trust, strengthens retention, and helps brands stay top of mind. But when growth is the goal, focusing on customer expansion is the best course of action.

—

Leveraging relative advantage is another approach marketers can take to drive growth—especially when budgets are tight. Check out my article, The Power of Relative Advantage in a Turbulent Economy, to learn how marketers are gaining ground by spending smarter when they can’t spend more.

How AI will reshape work for advertisers is one of the biggest questions in the industry today.

AI use is climbing fast: In just one year, team use of the technology jumped from 74.6% to 94.9%. And investment continues to grow, with many organizations planning to increase spend on AI tools in the months ahead.

Still, adoption has outpaced outcomes in many ways. “Artificial intelligence is an incredible tool, and organizations should be thinking about and using it in a variety of ways,” says Dan Wilson, Group VP of Integrated Client Solutions at Basis. “However, there’s still a gap between the bold expectations for AI and the results these tools are currently capable of delivering.”

With adoption climbing rapidly but uncertainty still high, three key dynamics are emerging: AI is automating routine tasks, some jobs are being replaced while others evolve, and professionals’ confidence in their own job security doesn’t always align with leaders’ perspectives. Understanding these shifts is critical for marketers navigating what comes next.

Task replacement is accelerating as marketers embrace AI. For many teams, this has meant greater efficiency and the ability to shift time toward more strategic contributions. But these benefits come with a caveat, as many AI outputs still require human prompting and quality checks to ensure accuracy and brand alignment.

Content generation illustrates this dynamic particularly well. Wilson notes that while it can be tempting to use AI to produce content faster, cheaper, or in higher volumes, without human oversight it often adds noise rather than driving meaningful engagement. “Consumers are getting better at sniffing out AI content, and their tolerance for it is decreasing,” he says. “Given where AI capabilities are right now, human curation determines whether these tools add value or just create more clutter.”

This principle applies across task categories. Whether AI is being used to draft reports, analyze campaign data, or optimize media buys, the technology can automate parts of the work—but it rarely eliminates the need for human judgment.

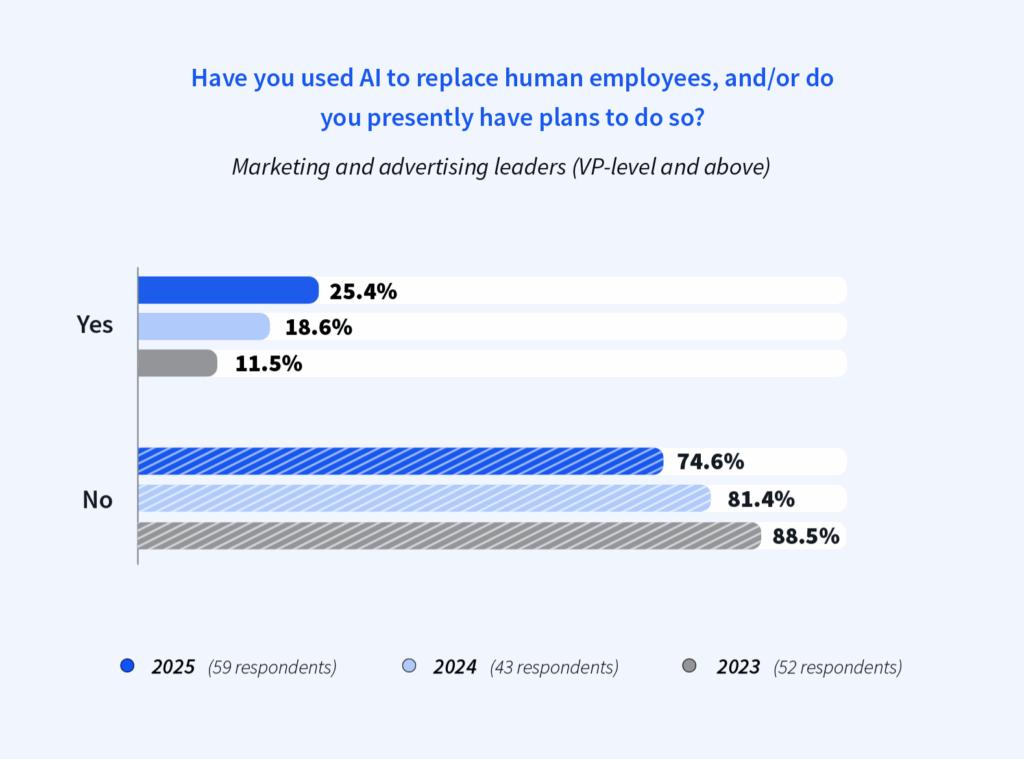

More than a quarter of marketing and advertising leaders have used AI to replace employees or plan to do so—a figure that has more than doubled since 2023. The trend marks the early stages of a meaningful shift in how the industry’s workforce is structured.

So far, however, the changes remain targeted rather than sweeping. “Everyone’s afraid of AI taking jobs, but if you actually test the tools, you’ll find they still require an incredible amount of human intervention,” Wilson says.

In this context, organizations are identifying specific functions where AI can operate with minimal oversight and making strategic choices about where to invest in tools versus human talent. How this balance evolves will depend both on the pace of AI’s advancement and on the strategic decisions leaders make in response.

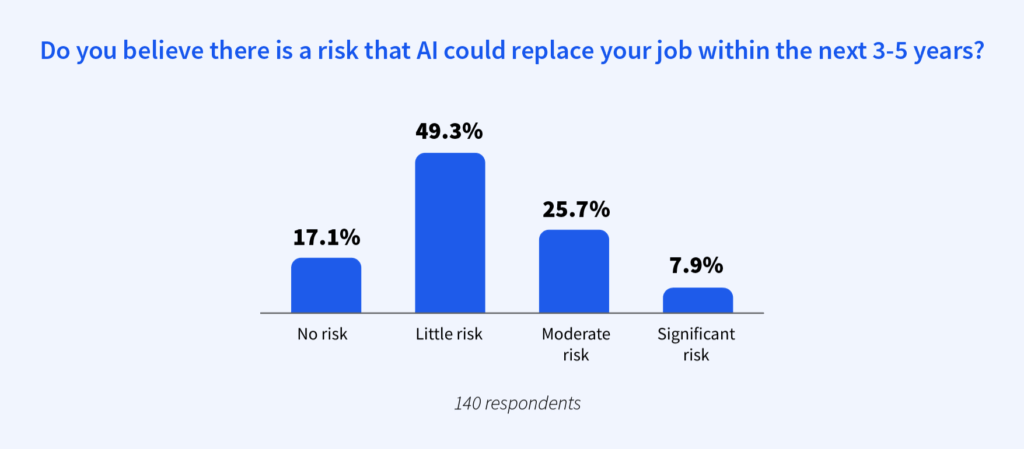

Despite the fact that more than a quarter of organizations have used or plan to use AI for job replacement, over 66% of industry professionals believe there is little or no risk that AI could replace their jobs within the next three to five years.

This confidence gap tells a complex story. While professionals working directly with AI understand its current limitations and recognize where human expertise remains essential, individual experience doesn’t always predict organizational decisions. Leaders make workforce choices based on cost pressures, competitive positioning, and long-term automation potential.

For instance, a media planner who uses AI to speed up research may feel secure in their role because the technology still requires human judgment to optimize and finalize strategy. For some, that confidence is justified—they could shift into higher-level strategic work as AI handles routine data analysis. For others, leadership could decide to restructure a team so fewer planners manage the same workload. As AI continues to evolve, professionals who understand both the technology’s limitations and their organization’s strategic priorities will be better positioned than those who rely on confidence alone.

AI is driving efficiency across advertising, and roles are evolving alongside the technology. Tasks are being increasingly automated. Some positions are being eliminated. And professionals’ confidence in their own security doesn’t always align with the strategic decisions being made at the organizational level.

The path forward depends on how AI’s capabilities evolve and how effectively marketing organizations are able to harness them. With so much still in flux, the only certainty is that keeping a close eye on these trends will be essential for advertisers navigating the future of the industry and of their careers.

__

Looking for deeper insights on how AI is impacting jobs across marketing and advertising? We surveyed professionals from leading brands and agencies to gauge how the technology is transforming the industry’s workforce and how it could change advertising jobs in the years to come. Download the full report to see how AI is changing roles, where human curation remains essential, and what comes next.

In the span of just three years, AI has gone from experimental novelty to an ever-present behemoth across the advertising industry. It is increasingly embedded in the very core of creative, media, and strategy functions, reshaping workflows and redefining skill sets.

While much of the focus on AI has been a celebration of its efficiency benefits, its impact extends far beyond speed. AI is now performing tasks once thought to be the sole domain of human talent, including copywriting, analysis, data optimization, strategic planning, and more. For some, this signals a historic opportunity: a chance to reallocate human expertise toward higher-level strategy, relationship building, and brand development. To others, it’s a flashing red warning light, raising concerns around oversight, originality and, perhaps most alarmingly, a potentially devastating effect on marketing and advertising jobs.

Regardless of sentiment, the shift of responsibilities between humans and AI is taking place in real time—and the pace is accelerating.

For this special report, we surveyed marketing and advertising professionals and conducted interviews with thought leaders from top agencies and brands to gauge how AI is transforming the advertising industry workforce, and to identify those ways the technology is poised to further affect advertising jobs in the coming years. It contains exclusive data, insights, and recommendations for navigating the AI revolution that is transforming the advertising industry.

Download your copy of the report today.

First-mover advantage is rare in marketing. But for brands in sectors like finance, healthcare, and B2B, influencer marketing presents an opportunity to claim it.

By building trust with audiences and delivering highly engaged, targeted reach, influencer marketing has reshaped how brands across sectors like beauty, travel, and fitness connect with consumers and drive business results. For marketers in industries that have yet to embrace the approach, early adopters can use creator partnerships to differentiate their brands, establish credibility with target audiences, and capture attention in new ways. However, success requires a thoughtful approach that considers measurement challenges, effective team management, and strategies for handling media complexity.

Influencer marketing has experienced explosive growth in recent years. In 2025, creator-generated revenue is expected to increase 20% year over year, and by 2030, the market is projected to more than double, reaching $376.6 billion.

This growth is driven, in part, by creator content’s ability to accelerate the customer journey, condensing awareness, interest, and consideration into a shorter path to action. Consumers are also significantly more likely to search for additional information and actively engage with creator content compared to studio-produced alternatives.

The impact of influencer marketing is significant, with 83% of industry leaders in categories like beauty, retail, food and beverage, and entertainment reporting that creator content generates higher ROI than traditional digital advertising. That edge is particularly valuable amidst today’s economic pressures, especially considering that creator production costs have stayed relatively steady while the price of traditional digital advertising continues to climb.

For brands in categories that haven't yet fully influencer marketing—such as B2B, finance, healthcare, and automotive—the tactic presents a significant opportunity to unlock a key relative advantage, giving early adopters a competitive edge via strategies their competitors have not prioritized.

Influencer marketing offers several key benefits. First, it provides a new way to create fresh, differentiated content that can be used across multiple touchpoints and platforms. B2B companies, for example, might partner with industry thought leaders to explain complex SaaS solutions, while automotive brands could collaborate with car reviewers to showcase new safety features or electric vehicle technology. Additionally, influencer marketing plays a crucial connector role between owned and earned media, enabling brands to craft a more seamless omnichannel experience for their audiences.

Perhaps most significantly, creator collaborations help brands build credibility with audiences—something that’s particularly hard to earn intoday’s environment of widespread consumer skepticism. Leveraged thoughtfully, influencer marketing can serve as a powerful trust builder for brands: When a financial advisor explains retirement planning or a healthcare professional discusses wellness trends, audiences receive information from sources they already trust and follow, creating a more credible pathway to brand consideration.

That being said, because trust is fragile, advertisers must carefully vet creators for audience fit and brand alignment, and require clear, visible disclosures on every paid post. Additionally, brands in highly regulated industries like healthcare and finance must navigate additional compliance requirements when implementing influencer partnerships. Marketers in these sectors will need to ensure all creator content meets regulatory standards, which can require careful legal review and clear partnership agreements before launching campaigns.

While 83% of industry leaders in categories like beauty, retail, food and beverage, and entertainment believe that creator content drives more ROI than traditional advertising, measurement remains a significant hurdle. Currently, 28% of brand marketers in these industries struggle to capture ROI, highlighting the need for a more strategic approach to measurement and analytics.

To address this, advertisers must first establish a clear learning path for their teams by defining the right questions to understand the value of their investment. Is the goal sign-ups, sales, downloads, or lead collection? Clarifying what a brand seeks to achieve—and what it is reasonable to expect, especially in early tests—is crucial for setting appropriate learning expectations and building scalable programs.

Social listening can also be a critical component of measuring success. This includes tracking conversations about a brand, monitoring sentiment (positive or negative), and analyzing how content is shared and amplified. In practice, it functions as a measure of share of conversation: Within a given category, how much of the discussion is a brand capturing, and does that align with its share of investment?

Finally, advertisers should complement the reporting offered by influencer marketing platforms with media mix modeling (MMM) to understand how influencer marketing is performing in tandem with other channels. This provides a more holistic view of its contribution to business outcomes.

Brands are increasingly facing criticism from consumers for out of touch or poorly executed creator partnerships. Soda brand Poppi, for example, received backlash after sending full-size vending machines stocked with product to 32 influencers, with critics calling out both the extravagance of the stunt and the lack of diversity among recipients.

To avoid missteps such as these, creator partnerships and activations must be executed with intentionality. Campaign concepts must align not only with brand values and messaging, but also resonate positively within the current cultural context. Successful activations require careful planning with clear objectives and creator guidelines. Advertisers may also want to consider running small pilot tests to gauge audience resonance before making larger investments.

Successful influencer programs work best when they're fully integrated across the entire marketing team and often require close collaboration with PR. This integration ensures consistent messaging, aligned objectives, and coordinated execution across all brand touchpoints.

A full-fledged influencer program typically requires several full-time employees, but for those organizations that are dipping their toes in the water, team members who already manage social media investments can begin the testing and learning process.

Brands can also scale these programs by partnering with trusted partners who can serve as a bridge and help manage initial programs while building internal capabilities that can eventually scale. This approach allows brands to learn, optimize, and grow their influencer marketing capabilities systematically rather than jumping in without the necessary support systems.

When selecting partners for influencer marketing initiatives, marketers should carefully evaluate any influencer platforms under consideration. Key factors include measurement capabilities and ease of use, since adding influencer marketing to a media plan introduces operational complexities and another platform to manage.

If testing and learning evolves into larger investments, marketing leaders should assess whether their tech stacks enable teams to manage the complexity of an expanding mix of channels, platforms, and strategies. Investing in technology that streamlines manual processes and unifies disparate systems allows teams to handle the added complexity influencer marketing brings more effectively.

For marketers in sectors that have yet to embrace influencer marketing, there is a clear opportunity to capitalize. With a considered approach to measurement, intentional partnerships, and the organizational infrastructure that enables teams to manage rising media complexity, brands can tap into the full benefits of this rapidly growing tactic.

And for early adopters in non-traditional sectors, the reward extends beyond immediate campaign results. They'll build valuable creator relationships before competition drives up costs while positioning themselves as innovators, rather than followers. The window for gaining competitive advantage is open, but with the market’s rapid pace of growth, it likely won't stay that way for long.