Introduction: Strategies, Channels, and Insights for the 2026 US Midterm Elections Political advertising has never been a simple undertaking. It ...

SECTION 1: DIGITAL MEDIA EXCITEMENT

In April 2020, Centro surveyed 65 progressive, conservative and non-partisan agencies, consultants and advocacy organizations specializing in political marketing. According to their responses, connected TV and programmatic advertising are poised for a big election year. Of the respondents, 63% consider connected TV (CTV) as one of the top five most promising developments for their digital campaigns. CTV had the highest vote total by a wide margin, whereas in our 2018 survey it ranked as the fifth most promising development, selected by less than 40% of respondents.

As enthusiasm for CTV rises, excitement around programmatic advertising is holding steady—and was selected by 53% of respondents this year, and 42% in 2018.

The use of programmatic ad tactics is still new for many marketing professionals—however, the use of data will continue to be a key element for any digital campaign. In our 2018 polling, the top five developments that received the most votes were audience data, technology for connecting offline-online audiences (no longer in the top 5 this year), digital media confidence spurring more spending, programmatic advertising, and CTV. One consistency from two years ago is that social ad products ranked last again. While social channels undoubtedly play a role in most campaigns, their ad offerings don’t appear to enthuse political marketers.

SECTION 2: HOW MUCH IS ENOUGH

When asked what portion of overall media spend goes to digital, a majority of respondents said that digital budgets make up less than half of total media spend, with 62.5% reporting digital allocations under 40%.

This is in line with industry predictions that digital will account for 19-30% of total political ad spending in the 2020 cycle. This also confirms that political investment in digital still lags well behind other industries, as digital is expected to make up more than 50% of all US ad spend in 2020 according to various studies.

However, in our survey there were a significant number of respondents (30%) for whom digital makes up the majority of their ad spend.

While no one believes digital is getting an outsized share of spending within their budgets, respondents were nearly equally split between feeling their digital budget allocations are ‘too low’ and those who say it’s ‘just right,’ while the remaining 11% are ‘just guessing.’

A majority (65%) of respondents who had 24% or less budget allocations felt this is too low. For the group that indicated a budget of 25-39%, it was evenly split between those who said it is ‘too low’ and those that say it’s ‘just right.’

A majority (68%) of respondents who had a 40% or more digital budget allocation said it was ‘just right.’

SECTION 3: CASHING IN ON CONNECTED TV

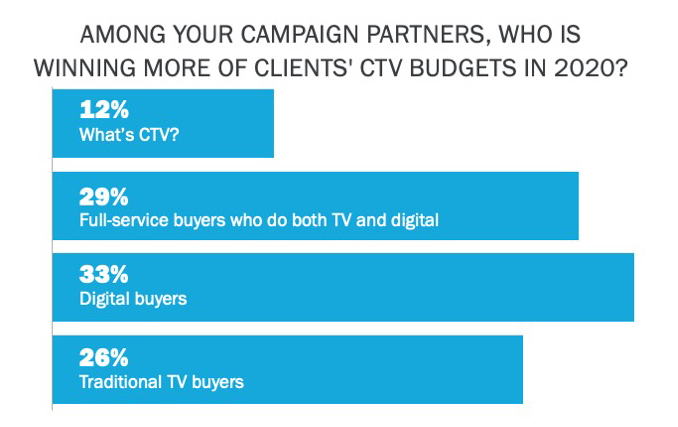

The growth of CTV (consumer use and ad dollars funneled through it) is leading to battles to win budgets. A continuing industry question is who is best equipped to manage CTV budgets—is CTV digital or TV?

According to Centro’s 2018 election ad spend data, only 5% of political spending was channeled to CTV. But allocation is projected to grow dramatically this year.

Although there is perceived parity in winning CTV ad dollars, respondents from advertising agencies (vs Political consultants, Public Affairs Communications, Media Buying Agency, or Non-profit Organization) strongly believe (70% of them) that digital buyers were winning more.

SECTION 4: PROGRAMMATIC IS A POLITICAL AD STAPLE

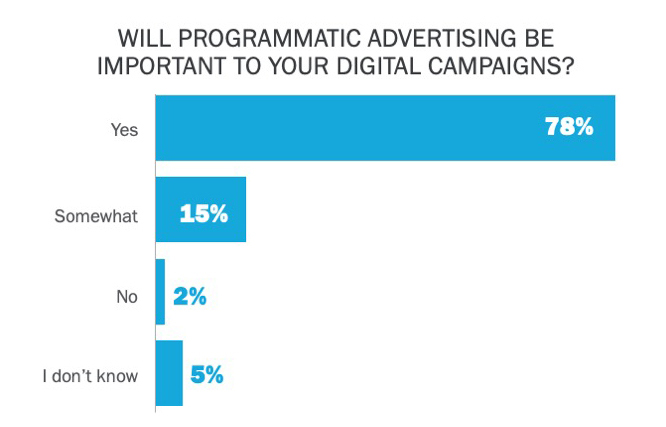

The overwhelming majority of professionals feel that programmatic advertising has some level of importance to their campaigns this year. Overall, 78% said ‘Yes’ programmatic will be important, which is consistent with the response to our 2018 survey, when 77% chose Yes. The shift over the last cycle was that ‘I don’t know’ responses dropped to under 5% this year (from 13% in 2018), and respondents selecting ‘Somewhat’ important increased from 9% to 16%.

Presently, programmatic is how most digital impressions are transacted. The question is how political operatives choose to access this, whether it’s through self-serve platforms or contracted as a managed service from a partner.

In programmatic buying channels, the importance of data (whether it’s 1st or 3rd party) for an election campaign is evident because of the need to scale impressions with precision, to reach the right people.

Illustrating its general popularity, CTV (along with other forms of digital video) looks to be a highly utilized programmatic channel for political marketers.

More than half of respondents are excited about hyperlocal ads—a coincidence, with Centro’s 2018 numbers showing that the same percentage of political clients used this tactic for election campaigns.

Holistic reporting, a new concept, is not specifically associated with programmatic (because programmatic is normally activated in a silo); but 40% of respondents added it their top five list.

Notable laggards are native advertising and private marketplaces.

SECTION 5: THE COVID-19 FACTOR

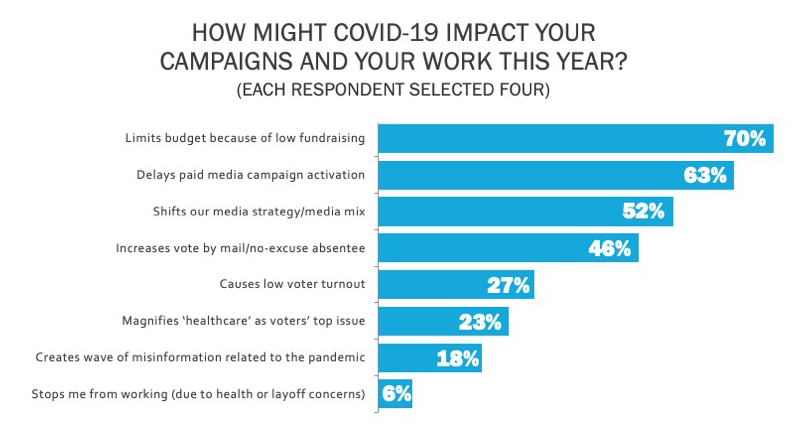

Political marketers are not concerned about job loss or inability to work during the COVID-19 pandemic.

Regarding the pandemic, the biggest concern is campaigns running and ad budgets, because there’s only one event and only one desirable outcome.

Vote by mail and education around it is a new concern brought on because of the current state of the country.

SECTION 6: AREAS OF CONCERN

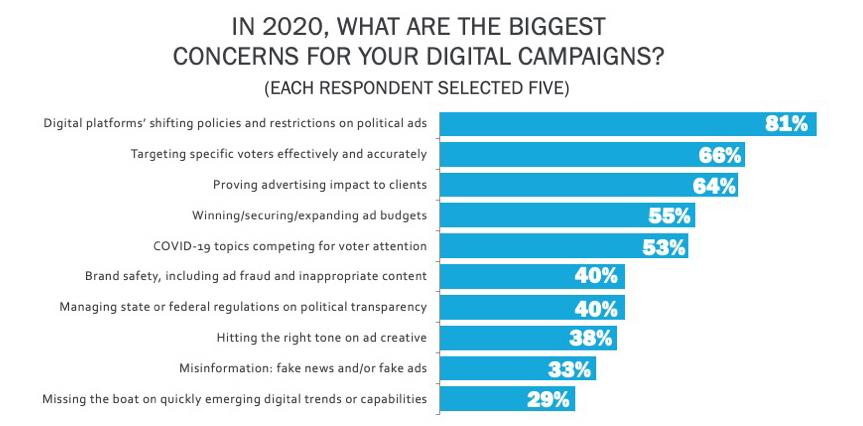

When it comes to overall concerns in digital media for political campaigns, 53% of respondents think COVID will distract from key issues.

The shifting policies of digital platforms is the biggest concern – they take up most of the spend while causing more complexity and confusion for the industry.

Targeting voters, proving ad impact, and winning budgets are also top of mind for marketers.

Misinformation and the factors around it are not much of a concern.

SECTION 7: UNCERTAINTY

Uncertainty is a common theme for 2020 and that is reflected in the outlook for political campaigns.

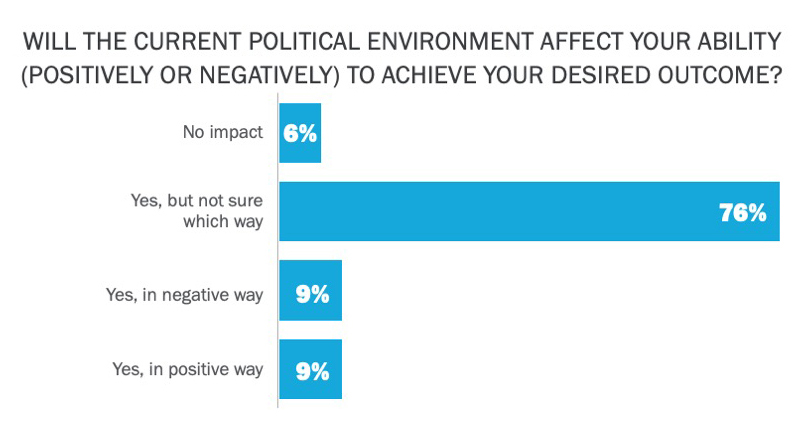

76% say the political environment will affect their desired outcome but are not sure whether it will be positive or negative. This is up considerably from 2018 when only 50% of respondents answering this way.

In 2018, 21% guessed that the political environment would have no impact, but this year, only 6% feel this way.

Acknowledgments

As a thank you to our industry peers and partners, Centro is donating $2 to Feeding America for each respondent of our survey.

About Centro’ Candidates and Causes Group

For more than a decade, Centro’s technology and services have been trusted by agencies and consultants in politics, public affairs, and advocacy. Throughout the years, Centro’s Candidates + Causes group has collectively worked with 1000+ political campaigns and independent expenditure committees, and 1000+ issue advocacy advertisers. Our proficiency for driving perception in government, in the public sphere, or among specific audiences is a differentiated and valuable asset in this field. Centro is headquartered in Chicago with 43 offices covering North America, South America and Europe, including a Washington, DC, hub for its Candidates + Causes team.