Marketers face a pivotal choice in 2026: to frame their use of AI around driving business growth, or around cutting costs.

In SEM, past performance data alone does not tell us everything we need to know about future performance. Even the smartest machine-learning algorithms backed by years of prior data are fundamentally limited. You often need to also know something about real-time present conditions, and these are just as often unpredictable by nature.

For example, you need to know about your current competition. If you bid the same way every day and it results in exactly the same performance, then you will bid the same way tomorrow, too. But what if tomorrow your competition intensifies? Or what if it slackens? Your historical performance data won’t clue you into this. To react to this effect, savvy marketers use “Auction Landscape Data” to divine the prevailing relationship between you and your competitors.

In the roiling industry of Lead Generation, there is another present condition that must always be accounted for: Lead Capacity.

At its core, every Lead Generation business is a conglomeration of contracts with local partners. I’m a small business owner in the service industry and I need to find people who need my service, but I don’t have a robust advertising network to do so efficiently. Multiply that story by a thousand or so and you have yourself a case for a Lead Gen business.

But this is where it turns sensitive. At your scale, you’re set up to supply way more leads than your partners are able to support. How do you make sure you get each partner exactly as many leads as they require in a given time frame - no more and no less - and that you pace those out at peak efficiency? In this sense, Lead Capacity can be thought of as analogous to its retail cousin, inventory. Whereas inventory is products on the shelf, Capacity is leads to-be-delivered across your partner network. Think of Capacity like inventory that must be put on the (figurative) shelf over some agreed-upon span of time. What, then, are the constraints of such a model?

1. The shelves are only so big

You’re picking up leads from your large-scale ad network and carrying them over to your local partner’s shelf. What happens if you pick up a lead and carry it over to the shelf, but the shelf is full? That’s a wasted lead.

2. Leftover shelf space is bad

While you can’t put too many leads on the shelf, you also can’t leave it sparse. You must keep your partners’ happy with well-stocked shelves.

3. How much stuff is already on the shelf matters

It costs you something to pick up each lead. If you’re running out of time before the shelf needs to be full and there’s still a lot of empty space, you’ll grope for even the most overpriced leads. Conversely, if the shelf is almost full and you still have lots of time left, you probably reached on a few overpriced leads too early.

These are the challenges that Lead Capacity Bidding is designed to solve.

The Shelves Are Only So Big

The Level One solution is a cost-saving measure. Let’s call it the “On/Off Switch”. Very simply, when a partner can no longer support any leads (or more accurately, per your contractual agreement, they won’t pay you for any more leads), you cease spending for that partner. The goal is to minimize wasted leads.

In practice, there are some restraints that make this slightly complicated to implement. How do we shut down for one maxed-out partner and not for his lead-starved neighbor? Since SEM is moderated by the publishers, we have to play by their rules. We can’t pre-filter for only those searches with intent to use a particular partner, nor decide after the lead matures whether or not we want to pay for the clicks that caused it. In other words, there is no “On/Off Switch” at the individual per-partner level. And we certainly can’t tell Google “I wasn’t able to monetize this lead, can I have a refund on my clicks?” So, we have to abstract within the edifice of location bid adjustments, under the assumption that more proximal leads are more likely to monetize.

That is, instead of toggling traffic for a particular partner, we have to do so by geo-target using bid adjustments (0% for On, -90% for Off). There are a couple of ways to do this, each with their own intricacies.

1. By Location (Zip Code, City, DMA, etc)

The publishers support traditional location targeting (and bid adjustments) per campaign as granular as the zip code level. If you have several partners within that zip code, then you’ll have to treat their Capacity as a combined total. With this approach, a question to ponder...

What happens when a partner is willing to accept leads from more than one Zip Code/City/DMA? How would that factor into the aggregate ‘total capacity’ of those Zip Codes/Cities/DMAs?

2. By Radius (Location Extensions)

Google offers “Location Extensions”, by which you can target a radius around a coordinate pair (i.e. the exact physical location of a partner). In concept, this more directly allows you to adjust for the capacity of each individual partner, without aggregation. What if, though, you have partners that are close to one another such that their radii overlap? And what if those partners have very different capacities from one another such that their respective radii have very different bid adjustments? And then what if I’m smack dab in the middle of them searching for a plumber? Which bid adjustment will I receive: the 0% for the guy who’s dying to plumb or the -90% for the guy who’s already plumbed plenty?

As long as you can approximate your partner network to a set of geo aggregations, the “On/Off Switch” is a quick, high upside win. Where you were previously spending money on leads that can’t monetize, now you aren’t. Less cost, same return.

Leftover Shelf Space Is Bad

Now that we’ve saved all that money, we have to attend to our partners. We do this, of course, by fulfilling our contractual obligations to them, which most likely takes the form of providing them with all the high-quality leads they ask for. We don’t want to give them excess leads they won’t pay for, but - perhaps of equal or even greater importance - we don’t want to give them too few. The long-term health of our business relies largely on a happy partner network.

Doing this is super easy. Assuming the demand exists in the market, all we have to do is go and get it. And we can ensure we’ve got it by ratcheting up to +900% all bid adjustments to geos with remaining ‘total capacity’. Position 1.0, 100% Impression Share, 0 antsy plumbers.

But alas! For you have budget and efficiency goals.

How Much Stuff Is Already On The Shelf Matters

‘Lead Pacing’ is optimizing for a minimum spend to acquire a certain number of leads per geo (Capacity) over some time frame. Implicit in this definition is the priority that you do still need to get all those leads, no matter the cost. If a geo is slow, pace up. If it’s hot, pace down.

There is a fundamental paradox in this: what might be good for your business long-term may not necessarily be the best thing for it in short-term. Put another way, it’s a competition between happy partners with high lifetime value and peak SEM performance efficiency now. To illustrate this, consider the following example of two cities.

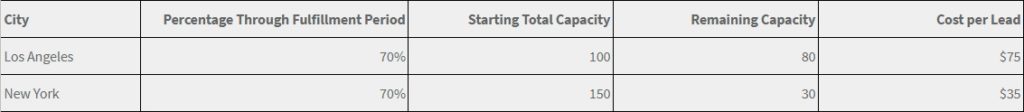

Let’s say your contracts with your partners are to provide ‘Starting Total Capacity’ of leads per ‘Fulfillment Period’. And let’s say our ‘Fulfillment Period’ is the week. Then if we’re 70% through, it’s roughly Thursday. Los Angeles has only received 20% of its Capacity for the week whereas New York already has 80%. Using Capacity as our guide, we would give Los Angeles a high bid adjustment and New York a low one - all in service of our partners getting the number of leads they asked for.

But how much will those marginal leads cost us? Counterintuitively, a lot more in the area where we’re getting more aggressive. If we were instead to apply bid adjustments based on cost per lead, they’d be in reverse: Los Angeles would get the low bid adjustment and New York the high. And because it’s increasingly more expensive to manufacture leads where demand is low, this scenario can be fairly common.

For this reason, it’s imperative that you know where these priorities balance for your business. Are your partner contracts sensitive to leads left on the table or is there some leeway? Is your SEM efficiency largely at odds with your Capacity pacing or is there some harmony? Expected Revenue must be at the forefront of every decision you make. Only then can you appropriately optimize to your particular medley of considerations.

~

For those who want to dive deeper, here are some additional questions to grapple with:

1. What happens if a partner is right on the border between Zip Codes/Cities/DMAs? More commonly, what happens if they’re anywhere but the exact center? How would that factor into the expected value of leads originating from adjacent Zip Codes/Cities/DMAs?

2. What is the relationship between ‘Remaining Capacity’ (either as an absolute or a percentage) and Conversion Rates? Based on this, at what points in the ‘Fulfillment Periods’ is it advantageous to bid higher or lower?