Key Takeaways:

That video advertising playbook you relied on last year? It’s already outdated. Between shifting viewer behavior, emerging platforms, and evolving quality concerns, the video ecosystem is changing fast.

By 2030, connected TV will capture more than 40% of global TV ad investment, reflecting a fundamental shift in how audiences consume video content. Today, however, linear TV still offers mass reach—which means advertisers must strategize around extracting maximum value now while planning for continued viewership declines. Meanwhile, the rise of social video, growing concerns about inventory quality, and complexities around addressability are reshaping what it means to run a successful video campaigns.

For advertisers building video strategies this year, understanding the nuances of this changing landscape is critical. Read on for six insights to guide your TV and CTV planning in 2026:

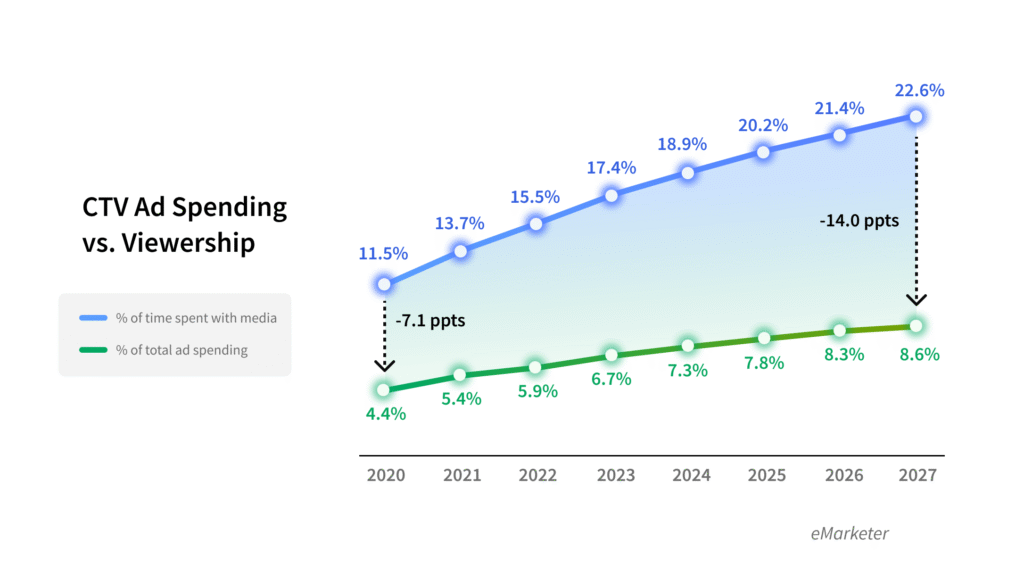

With nearly seven in 10 advertisers planning to increase their CTV spend in 2026, the industry’s commitment to CTV is continuing to accelerate. However, there's still an increasingly wide gap between ad spend and viewership: In 2027, there will be a 14-point gap between the percent of time US adults spend with CTV per day and the percent CTV ad spend makes up of total US ad spending.

CTV's advantages make this gap notable. The channel combines television's high-impact storytelling with digital precision targeting, superior completion rates, and direct attribution to consumer actions. In fact, three-quarters of American CTV owners prefer targeted ads to enhance their viewing experience, and more than one in five viewers have used their CTV devices to complete a purchase after seeing an ad. Add to this the emergence of new CTV ad formats and expanding inventory options, and it's clear that advertisers who match their spend to viewership now stand to gain significant competitive advantage before the market catches up.

But don’t write off linear TV just yet: While connected TV continues its steady climb, traditional television still delivers the kind of mass reach that many campaigns need, particularly those focused on driving brand awareness.

And no, this isn’t just your grandparents watching Jeopardy (or you watching Jeopardy, if Jeopardy is your thing!). Audiences across all age groups still tune in to traditional broadcasts, though younger generations are doing so less frequently than their older counterparts.

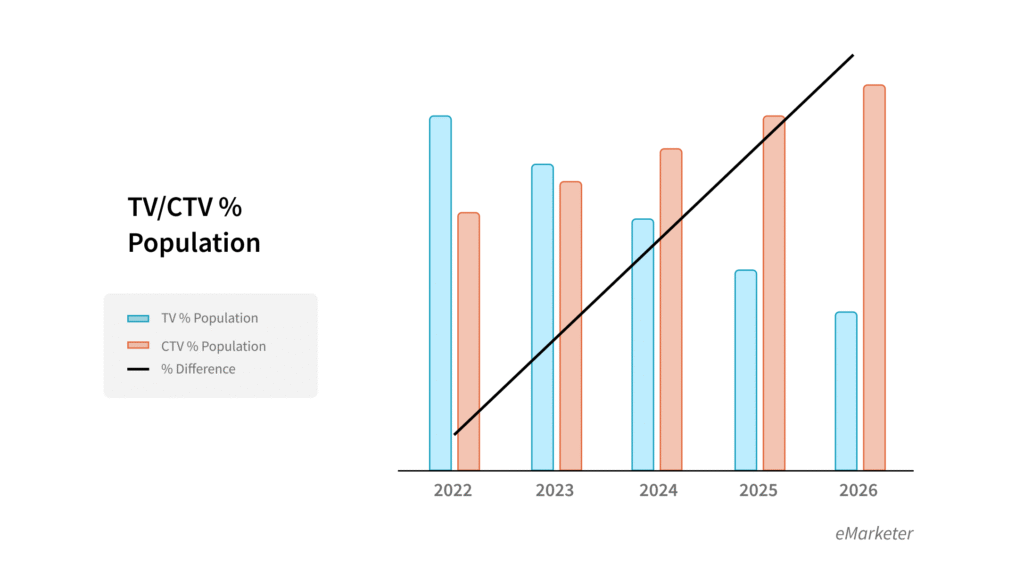

However, linear TV’s reach is eroding as more viewers shift to streaming alternatives: In 2026, CTV offers access to 15% more of the US population than linear. Advertisers must ensure their linear and CTV strategies complement each other in the short term, while planning for linear’s decline and the continued rise of CTV and social video.

This might look like running broad awareness campaigns on linear TV during high-profile events like live sports, then using CTV to extend reach to cord-cutters and younger viewers who don't watch traditional TV. Or, it could look like managing CTV campaigns with a platform that offers Open Addressable Ready (OAR) capabilities, which enable consistent, addressable campaigns across both linear and streaming using unified audience data and measurement. Advertisers should also allocate budget dynamically—shifting spend to CTV as linear reach declines, while maintaining traditional TV presence where it remains cost-effective.

Ultimately, success lies in treating linear and CTV as complementary tools in a holistic video strategy that evolves alongside viewer behavior.

The boundaries between TV and social media are dissolving faster than audiences can scroll to the next video in their TikTok feed. This is especially true among younger audiences, with nearly 80% of young people aged 10-24 reporting that they watch movies or TV shows on social platforms.

Sports content, in particular, is driving social video engagement (as well as live CTV engagement): Between 2020 and 2024, the percentage of Americans who reported they watched live sports games on social media platforms in the last month grew by 34%.

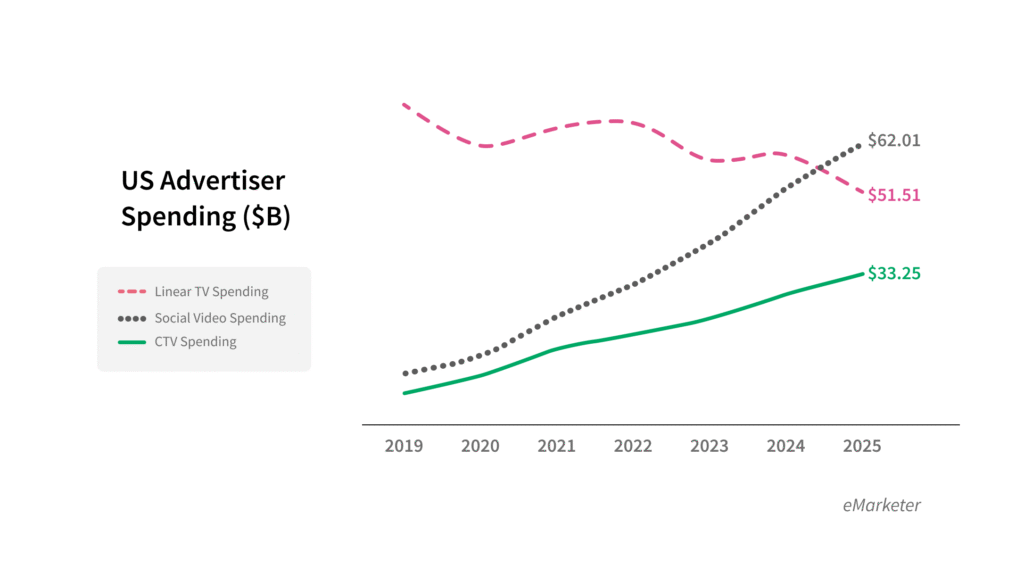

Following these viewership trends, US advertisers invested more than $10 billion more in social video than in linear TV in 2025.

Recent spending trends show social video and CTV budgets are climbing while linear investments decline: In 2025, CTV and social video dominated the priority list for video advertising budgets, setting the stage for continued growth in 2026.

The living room TV? Still relevant. But today, it’s far from the only screen that matters for reaching video-watching audiences.

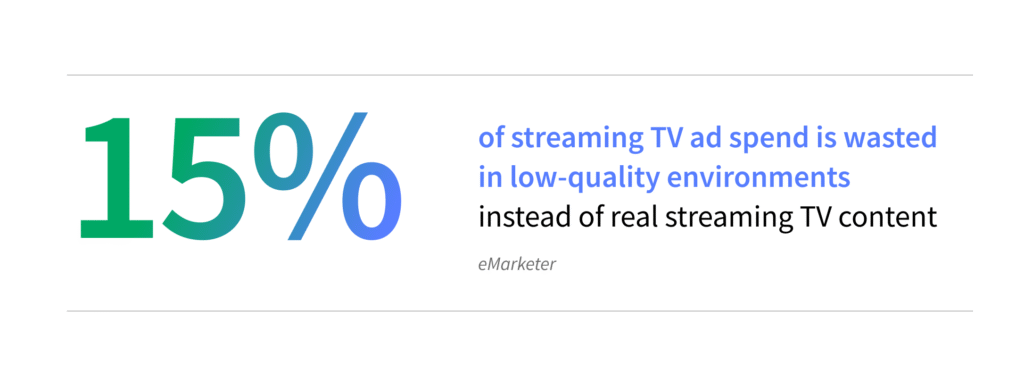

In 2026, buying inventory from a recognizable streaming service doesn’t guarantee your ads will appear in brand-safe, high-quality environments. As the streaming ecosystem has matured, the term “premium” has been applied so broadly that it’s lost much of its meaning. Spoiler alert: Slapping a well-known logo on an ad buy doesn’t automatically make it premium.

Much of what advertisers purchase on major platforms runs within long-tail apps, user-generated content channels, or bundled placements that offer minimal transparency. As a result, 15% of streaming TV ad spend is wasted in low-quality environments rather than premium streaming content.

Considering this, it’s critical that advertisers demand transparency from their CTV providers. Just as important is implementing quality controls when buying CTV inventory to ensure spend isn’t wasted on low-quality placements—for example, by checking in on campaigns midstream to make sure ads are showing up where intended. Overlaying ACR (automatic content recognition) data into CTV buys can also help by offering more precise visibility into placements, verifying exactly what content appeared on-screen when your ad ran.

Ultimately, premium placement in streaming comes from verification and control, not brand recognition alone.

While video strategies of the past focused on specific channels and distribution methods, the video strategies of the future will focus on following engaged audiences wherever they’re consuming content, regardless of the screen.

This means treating CTV, social video, and linear TV as complementary tools in a unified strategy rather than competing channels. Advertisers must align their content objectives with inventory-specific tactics across platforms. Broad awareness campaigns might justify run-of-content purchases, but performance-focused initiatives demand curated placements and app-level visibility.

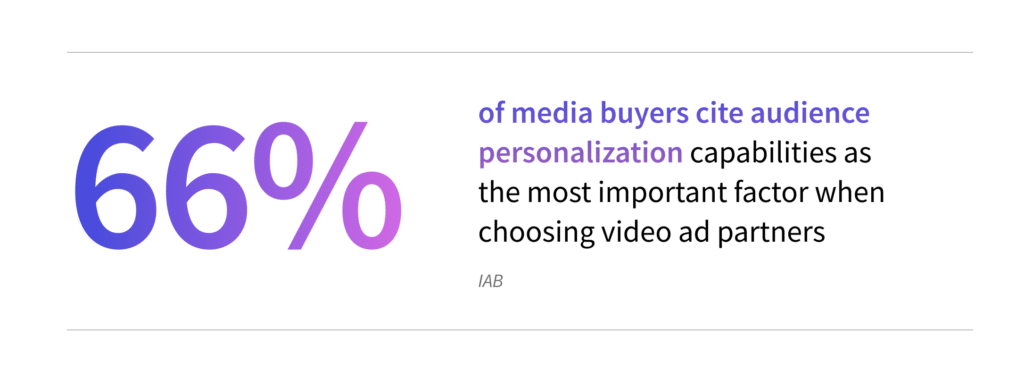

The shift from channel-first to audience-first planning is showing up in how advertisers choose their partners: 66% of media buyers cite audience personalization capabilities as the most important factor when choosing video ad partners.

Marketing teams are implementing this audience-first approach by leveraging CTV targeting parameters including behavioral and demographic segmentation as well as content-level contextual targeting to connect with viewers in high-quality environments—then extending those learnings across social video and other channels. AI-powered, all-channel platforms can help with this by automatically applying these learnings to optimize buys across channels.

Streaming TV’s promise of precise, addressable advertising faces a critical data quality challenge. Many platforms claim they can offer addressability, but the accuracy varies significantly based on the kind (and quality) of data powering it.

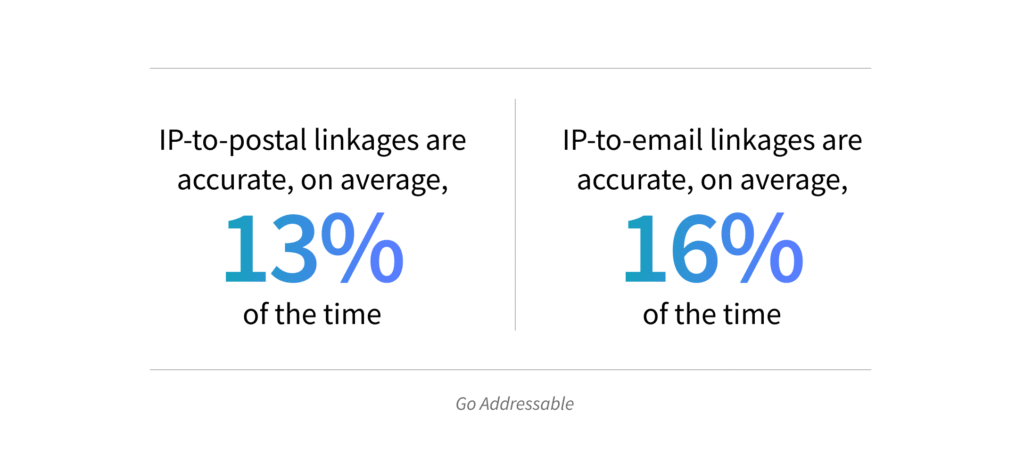

IP-based targeting, which many platforms rely on, suffers from significant accuracy problems. IP-to-postal linkages are correct just 13% of the time on average, while IP-to-email connections hit the mark only 16% of the time. Yes, that means they’re wrong a whopping 87% and 84% of the time, respectively! These error rates undermine the targeting precision that makes addressable TV attractive in the first place.

As the addressability landscape develops, advertisers must understand what kind of addressability the platforms they invest in offer. To accomplish this, teams should ask their CTV partners specific questions: What data sources power your targeting capabilities? How accurate is your addressability, and how do you measure it? Do you primarily use deterministic data or probabilistic data? Platforms that can’t answer these questions transparently may not offer the precision they promise. And to enhance precision, advertisers should layer first-party and deterministic data—which offer the highest level of targeting accuracy—into their buys.

Today’s streaming landscape offers tremendous opportunities for advertisers willing to navigate its complexities. Success requires moving beyond assumptions about premium inventory, channel effectiveness, and targeting precision, and crafting strategies grounded in audience behavior, content quality, and data transparency.

Six Key Takeaways:

—

Want to dive deeper into what’s shaping the future of advertising? Check out Rewinding to Fast Forward: The 2026 Digital Advertising Trends Report for more insights into how the media landscape is evolving and what it means for your marketing strategy.