Technology

Services

Resources

In an industry marked by high penetration—nearly all US adults have bank accounts—and consequently fierce competition, enticing new clientele while retaining existing customers is critical for financial services advertisers. While 84% of US customers say they’re “satisfied” or “very satisfied” with their primary bank, a smaller but influential 34% say they’d be willing to switch over to a new financial institution—demonstrating that efforts curated towards both retention and acquisition are equally important.

To navigate this landscape successfully, advertisers must understand consumer behavior and address their goals and concerns through creative served on the most impactful media channels. So, what exactly are those goals and concerns, and how can advertisers meet consumers with the right messages, in the right places and the right times? Let’s start with an exploration of today’s banking consumer:

Consumer trust in traditional banks and credit unions is high relative to other financial services providers such as tech companies and neobanks, and they’re generally satisfied with their primary bank, to the point where six in 10 customers have held their primary accounts for more than six years.

In light of that trust, satisfaction, and entrenchment, what motivates banking customers to shop around and ultimately switch? The top reasons include increases in fees, poor customer service, and better rates elsewhere. Generally, customers’ biggest industry concerns aren’t that different: increased fees, high interest rates, the possibility of data theft, and overall bank stability affecting the safety of their money score highest in impacting their financial services decisions.

Once consumers are on the hunt for a financial institution, their top drivers are online banking capabilities, brand reputation, online customer service, and the ability to help customers achieve their financial goals. What goals, you ask? Topping the list are saving for the short-term and the long-term, improving credit scores, and paying off credit card debt.

These factors show the importance of meeting consumers’ expectations around both banking features—especially online—and staff expertise. By addressing their needs and issues directly, financial industry marketing teams can increase customer trust and satisfaction, leading to improved retention of existing customers and acquisition of bank switchers.

Touting benefits and addressing concerns without a strategic plan to distribute those messages along the customer journey is as good as shouting into a bank vault—and then shutting and locking the door. Industry marketing teams can uncover paid media opportunities when they understand where and how consumer banking customers perform their research.

As customers seek information about their finances and explore products and services that can help them save money and tackle debt, they’re turning to a variety of sources: friends, family, and financial advisers, of course, along with bank websites, social media, and TV and online advertising. Similarly, they become aware of financial products and services through bank websites, apps, and branches; word of mouth; and communication tools like social media, direct mail, and search.

Demographics do play a role in media preferences: Consumer banking personas aged 55 years and over tend to layer newspapers and magazines onto their search, social, and convergent TV consumption, while those younger than 55 are nearly exclusively digital media consumers, with social, streaming audio, and CTV comprising their favorites.

Realizing the personal nature of finances and many of the sources customers trust, consumer banking marketing teams can find success with similarly personal channels like social media, and by using recommendation-based messaging such as reviews and testimonials. Beyond that, knowing the array of resources used by such a wide swath of people during their research, an omnichannel advertising approach grounded in thorough, customer-centric research can help teams craft a holistic experience with efficient reach and outcome-driven loyalty and acquisition results.

The financial services industry continues to go digital, from all points of view: customers and their online banking expectations, financial institutions and their digital innovations, and industry marketers and their digital media spend. Consumer banking marketing teams who follow this digital trajectory can both reach customers and keep up with—if not find ways to innovate and surpass—their competition.

The number of digital banking users in the US—about 82% of the population and rising—is making online banking the new normal, with mobile banking making up the lion’s share of online banking activity. But there’s increased competition outside of traditional banking: Consumers, especially younger ones, are showing interest in doing business with nonbanks, saying they’d open a financial account with the likes of PayPal, Amazon, Walmart, and Apple, and use of nonbank peer-to-peer payment platforms like PayPal, Venmo, and Zelle continues to grow. That sort of industry disruption could cost financial institutions market share at a highly competitive moment in time.

As customers rely on digital media for financial information and digital platforms for banking, financial services marketers are realizing the value of digital advertising to reach varied audiences with varied needs. The majority of the total industry’s $5 billion ad spend is digital, as monitored by Vivvix, yet consumer banking’s $1 billion budget leans slightly in favor of traditional advertising.

Marketing teams looking to reach digital-minded audiences and intercept people who are eyeing disruptive competitors can capitalize on the not-fully-realized potential of online advertising to meet consumers where they are—and, for critical customer acquisition, where some competition is not.

Consumer banking institutions have an opportunity to grow their market share despite near customer saturation. While most existing customers are generally satisfied with their primary banks and feel a high level of trust in them, a significant portion say they’d be willing to switch primary banks for specific reasons.

Financial services marketers who combine consumer media preferences, including digital media, with creative that speaks to their financial goals, online banking expectations, and general industry concerns can all but bank on retaining their firmly rooted customers while cashing in on new customer acquisition.

—

Want to make your campaigns work smarter? Connect with us to discuss how our automated advertising technology and media strategy and activation services can increase efficiency, reduce complexity, and solve your biggest advertising problems.

From raw materials to professional services, from healthcare supplies to technology, and everything in between, the business-to-business (B2B) industry boasts a truly vast spectrum of categories. And while B2B buyers are also varied, they’re all ultimately looking for the same thing: a product or service that provides a solution to their problem.

But the characteristics of those B2B buyers are changing, as is their path to purchase. Perhaps the most noticeable changes stem from their evolving demographics, which has contributed to the shift towards digital across all aspects of the B2B buying journey. As a result, the best ways B2B advertisers can reach their ideal customers are also evolving.

Looking to understand what the B2B buyer of today and their path to purchase looks like? Read on for the insights B2B marketers need to foster deeper connections in this relationship-based industry.

In order for industry marketers to be visible and influential throughout a B2B consumer’s path to purchase, they’ve got to understand the shopping habits and purchase motivations of the more than 15 million buyers that make up the consumer base. And these consumers look a lot different than they used to.

To start, the baton of B2B buying is being passed from boomers and Generation X to more digitally fluent generations. Millennials, totaling 60% of all buyers, now hold the greatest purchase influence. As a result, 59% of US buyers—and 77% of global buyers with the highest buying budgets—start their buying processes online. When the buyers of today are looking for inspiration, searching for a product, or making a purchase, all five of their top sources are digital: a supplier’s website, a supplier’s app, a marketplace like Amazon Business, emailing a sales representative, and social. Social media has become the most effective channel for driving B2B revenue: In 2023, 60% of US B2B marketers ranked it as their preferred option, followed by content marketing. Among social channels, YouTube and Facebook are particularly influential.

Despite this shift towards digital, person-to-person interaction is still key for the B2B buyer’s journey. One, B2B buyers prefer to work with people offline to negotiate purchase prices and make product repairs, and they’re equally apt to deal with warranties offline as online. Two, buyers score their in-person relationship with their sales rep higher than any other channel of their B2B buying experience. And three, among the other places buyers find inspiration, search for, or purchase business products, in-store and in-person are hot on the tails of the previously mentioned digital channels.

It’s also worth noting that the shift to digital hasn’t been without its hiccups: Case in point, 38% of US buyers say they’re “frustrated” with the online buying experience. They want better ease of product discovery, aided by features like enhanced search filters, personalized recommendations, and better product details. They also want a better experience on mobile—three out of the top four areas where buyers want businesses to invest and innovate are mobile apps, mobile sites, and mobile payment options.

Beyond wanting a more streamlined digital experience, what do B2B buyers care most about? Throughout their research, they’re most heavily influenced by customer ratings and reviews, as well as promotions and marketing. And, their most important consideration factors when purchasing online are price, payment terms, product availability, fulfillment speed, and ease of return.

What this means for advertisers: In order to evolve with the industry and meet their buyers’ needs, B2B marketers should refresh their strategies and prioritize investing in digital tactics, as the majority of buyers are now younger, digital-first shoppers.

As B2B buyers devote more time to online research and purchasing, industry marketers must focus on utilizing strategic digital advertising channels and tailoring messaging to address consumers’ needs during their buying journey. A robust digital advertising presence will help with reaching consumers where they’re at, and keeping up with competitors.

Programmatic advertising with an omnichannel approach allows for efficient use of media budget to connect with consumers throughout that broad, deep journey. Using programmatic will allow brands in the space to spend their media budget and reach target audiences efficiently.

Other tactics can elevate advertising relevance, like using a data management platform for audience segmentation and personalization, and pulling in web-based product catalog feeds for dynamic product insertion to enhance product discovery.

From an inventory standpoint, along with running display ads for reach and tapping into preferred social channels YouTube and Facebook, online video can create impact thanks to its visual storytelling capabilities.

Creative is another key aspect, which marketers should tailor to B2B buyers’ preferences and pain points. Options to consider in creative messaging include:

What this means for advertisers: B2B marketers must consider what today’s buyers value and tailor their creative messaging to answer those needs. Emphasizing customer reviews, competitive pricing, and technology features will capture buyers’ attention and allow brands to stand out in a cluttered environment. Consistent messaging will help establish brands and engage potential prospects throughout a long buying process, driving conversions and growth.

The B2B buyer and their process has changed, and B2B marketers must change along with them. These consumers expect businesses to create a more seamless, B2C-like shopping experience that fuses digital autonomy and personal attention. A strategic approach in a growing digital advertising space that considers relevant ad inventory and creative appeal will benefit B2B marketers who strive to be part of the solution.

—

Advertisers today have a lot of noise to sift through. Advice, insights, headlines… much of it valuable, some of it hype that diverts attention from strategies and tactics that count. Knowing what to tune out and where to focus is critical. Our 2024 digital advertising trends report, Future in Focus, highlights the trends that advertising pros should follow and notes the hype they can safely watch from afar.

A look at the most popular privacy-friendly advertising solutions among marketers today—and the challenges awaiting those who won't adapt to the cookieless future.

Signal loss is more than just a buzzword. It’s the evolving challenge to connect meaningfully with audiences amidst a heightened focus on user data privacy, fueled by consumer demands, regulation, and major changes from tech giants. In 2024, signal loss is a pressing issue for all advertisers, but it’s particularly urgent for those who aren’t already actively adapting privacy-friendly strategies and solutions.

This year, signal loss will hit an inflection point as Google restricts third-party cookie access in its market share-leading Chrome browser. Advertisers have had quite a long runway to prepare for this pivotal year—so how well prepared are they for a world without the targeting and attribution afforded by cookies?

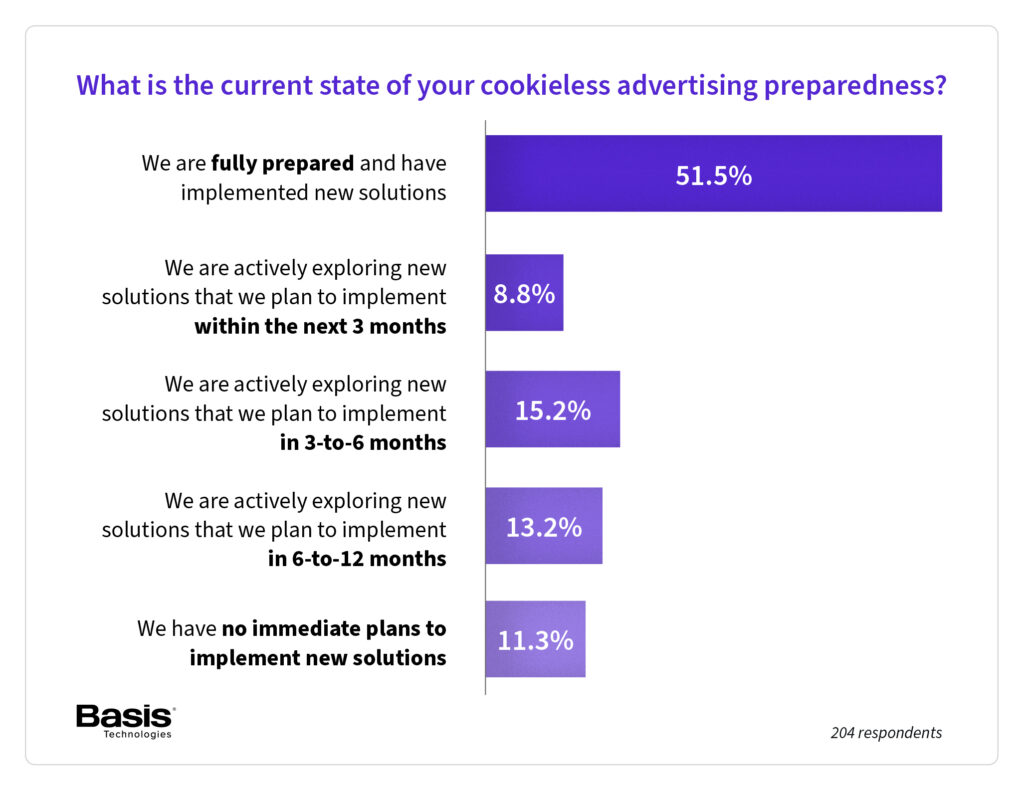

In surveying more than 200 marketing and advertising professionals from top agencies, brands, non-profits, and publishers, we found that 51% of marketers and advertisers feel their organization is fully prepared to succeed in a cookieless world. However, that leaves another 49% who don’t feel fully prepared—some say they’ll be actively exploring new solutions for as long as the next 12 months, and others have no immediate plans to implement new solutions at all.

So, how has that 51% of advertisers prepared for the death of cookies in Chrome? And what challenges are on the horizon for those who don’t implement privacy-first solutions as soon as possible? Read on for all the answers.

Let’s set the stage by exploring how we got here in the first place. In recent years, the issue of signal loss has grown due to factors including third-party cookie deprecation in browsers like Safari and Firefox, Apple’s App Tracking Transparency (ATT), and privacy-minded digital advertising regulations. Even before Google began cookie deprecation, these developments, driven by widespread consumer demand for increased control over personal data and more transparency over how it’s activated, stifled advertisers’ ability to target and track between 50 and 60% of internet users.

The loss of cookies in Chrome will further exacerbate signal loss, and the urgency of the matter seems clear to most advertisers: Close to 60% say they feel it’s extremely important to implement new identity solutions in the next six months.

Again, many marketers say they’re fully prepared for this seismic shift, with cookieless solutions in place today. What might advertisers who aren’t prepared learn from those who are?

Overall, addressing signal loss includes testing some of the privacy-first tactics that are helping marketers overcome targeting and attribution hurdles. Three front-runners—first-party data, lookalike audiences, and contextual targeting—are each already being used by 75% or more of surveyed marketers, and for good reason.

First-party data could be seen as the gold in the hills of the digital marketing landscape. By its nature, the act of collecting first-party data is privacy-friendly, and the process to activate it isn’t reliant on cookies. The efficiency it affords, not to mention its high level of relevance and opportunity for personalized messaging, makes it an attractive option. Further, the cookieless analysis of first-party data in a data management platform can be used for lookalike modeling, allowing advertisers to increase their addressable audience pool. And no less than 80% of marketers surveyed have begun using contextual targeting to serve targeted messages to prospective customers based on their content-based interests and intents.

Knowing these options are available, how can marketers best begin to embrace them? If the adage that “you can’t manage what you don’t measure” holds true, applying a test-and-learn mindset can help advertisers learn what cookieless solutions work best for their specific clients or brand. Here are a few examples of what advertisers in specific industries might try:

Ideas like these are cookieless, but they still reach all funnel stages, and their results can be compared to historicals or used as benchmarks for future campaigns.

As our digital world hurtles toward its cookieless destination, many advertisers have concerns about the efficacy of privacy-first and cookieless advertising. They’re anticipating the continued erosion of audience targeting and addressability, plus a path to measurement and attribution that’s littered with obstacles. But at the macro level, advertisers’ hesitancy to adopt the right solutions for the right reasons will only prolong their signal loss, with major efficiency and efficacy implications. These include:

The takeaway? Early adopters who invest in privacy-first solutions will set themselves up for competitive success, protect themselves from regulatory action, and build trust with privacy-conscious consumers.

As Google deprecates third-party cookies in Chrome, 2024 will be a pivotal year for signal loss, and advertisers can no longer delay adopting privacy-friendly and cookieless solutions for targeting and attribution.

The just-over-half of marketers who say they’re fully prepared for cookieless advertising have set themselves up for long-term success. On the other hand, for marketers who don’t identify and apply the right solutions soon, there will likely be consequences in store for their signal fidelity, their advertising campaigns, and even their bottom lines.

—

Want more insights on how marketing and advertising leaders feel about the state of signal loss? In our report, Identity vs. Privacy: Digital Advertising in a Cookieless World, we share results from our survey of more than 200 industry professionals, exploring the urgency to prepare now, beliefs about future advertising effectiveness, and how well current solutions truly address consumer and regulatory privacy concerns.

Historians say the act of setting New Year’s resolutions dates back some 4,000 years to the ancient Babylonians. Since those early years, the evolution of New Year’s resolutions has maintained one commonality: future improvement.

Our resolutions capture our aspirations for the futures we want to live. We aim to stop bad habits, start healthy ones, or make big changes that stretch us out of our comfort zones—setting goals to reach, creating strategies to achieve them, and identifying ways to track our progress.

Of course, advertising industry professionals are no strangers to goal setting, strategy development, and performance measurement. We need those skills to fuel 2024’s forecasted ad spend growth, which follows 2023’s rocky start but generally stable finish. So, in the spirit of the New Year and of helping marketers improve their campaign efforts in 2024 (and beyond), we asked three Basis media experts—Page Kelley, Jared Rosenbloom, and Dan Wilson, our Group Vice Presidents of Integrated Marketing Solutions—to provide some suggestions for New Year’s resolution that advertisers can embrace to improve campaign outcomes in the coming year.

Page Kelley: Now that Google has started phasing out third-party cookies from users’ internet browsers, marketers should start to test and understand new cookie-proof ad targeting tactics to gain an understanding of their performance. There are many solutions and approaches to addressing a cookieless future, and marketers will remain a step ahead if they have data-driven learnings to minimize the impact.

Take the opportunity to test the effectiveness of activating your customers’ first-party data, using data modeling to create look-a-like audiences, and enhancing ad relevance with contextual targeting. You may find you’re able to make more out of your opted-in customer data and even increase your data pool, and you might learn more about certain audience segments, ad placements, or creative approaches that help you purge underperformers and focus on winners. The unknown can be frightening and intimidating, but using your own findings to create an action plan can ease the dramatic impact to your bottom line.

Jared Rosenbloom: Consider test-and-learn budgets with new and fast-growing channels. Digital out-of-home (DOOH) and dynamic podcast advertising are two channels that are growing leaps and bounds post-pandemic. In the past, marketers were nervous to advertise on novel channels due to a bit of a “Wild West” ad supply stigma. The reality is that DOOH and dynamic podcast advertising have consolidated their ad supply, making the inventory seamlessly available. Measurement of these channels is also far more interesting today, with options to track impression delivery by audience/geography and to use visit lift studies for brands with brick-and-mortar locations. A test-and-learn approach means not putting all your eggs in one unknown basket, and it means measuring effectiveness and investing more in what works while not overspending on what doesn’t.

Dan Wilson: Watch out for getting stuck using an overly simplified view of defining and achieving marketing objectives. If you’ve spent any time recently in industry forums or professional social networks, you will quickly find that the industry is abuzz debating which types of marketing strategies lead to the greatest revenue impact: brand-focused or performance-focused. Though these are certainly thought-provoking and relevant discussions, don’t let them lead you to a “one or the other” mindset. It is important to ensure your approach is mindful of the multiple touchpoints of the consumer journey and the objectives you can reach throughout, that it stays nimble, and that it’s rooted in a test/learn/optimize philosophy. With the availability of new and innovative channels and a constantly evolving measurement landscape, there is no need to pick only one approach.

JR: Use automatic content recognition (ACR) technology to strategically determine broadcast spend versus convergent TV spend for 2024 and beyond. ACR is a technology that is built into smart TVs to recognize content, including ads, being played on your television. And, from an advertising standpoint, that helps to target ad placements and measure ad performance. Studies using ACR data provide advertisers with an impressive analysis tool to recommend what level of broadcast-to-digital spend makes the most sense for your brand and/or your competition. These studies are done with reputable companies like TVAdSync and Samba, who work directly with TV manufacturers like Vizio, Samsung, and others. Marketers should not fear the sticker shock of these ACR studies, because they can provide long-term benefits for reach, frequency, relevance, and overall performance.

From the ancient Babylonians to modern-day marketers, people have long embraced the tradition of using New Year’s resolutions to kickstart self-improvement. They’re often the things we commit to stop doing, start doing, or sometimes drastically change in our efforts to better ourselves.

Similarly, marketing and advertising professionals constantly seek out ways to improve their ad campaigns—from planning to performance to measurement. By resolving to start to test cookie-proof targeting tactics and emerging channels, to stop using an “either/or” dichotomy of brand vs. performance, and to leap into innovative data use like CTV’s automatic content recognition, advertisers will start the New Year off on a path toward success, both in 2024 and beyond.

—

Want to learn more about how to make the most of your New Year? Download our 2024 digital advertising trends report to learn more about how capturing attention, navigating the upcoming election, and riding out hype cycles can influence your plans and strategies in the months ahead.

Retail and e-commerce advertisers have long depended on third-party cookies for audience targeting and campaign success attribution. After all, with so many product categories falling under the retail umbrella, and significant variation within each category (size, color, material, etc.), marketers needed a way to target audiences with personalized ads for specific products and to then measure the impact of their efforts.

But with signal loss across the digital advertising ecosystem as a result of increased regulatory action, consumer demand for data privacy, and now the rollout of cookie deprecation in Google Chrome in 2024, retail marketers must shift towards privacy-first advertising strategies for targeting and attribution. Those who adapt by building expertise in cookieless solutions, prioritizing first-party data, and adopting automated targeting and measurement methods will cut to the front of the line when Chrome’s third-party cookie finally crumbles.

But what exactly should those efforts look like? Below, Andrew Barbuto, Senior Agency Lead at Basis Technologies, highlights industry marketers’ top considerations and challenges in a cookieless world, explores potential solutions, and provides examples of cookieless approaches for different types of retail businesses that can lead to retail advertising success.

Andrew Barbuto: I’d say there are two major considerations. The first is targeting. Specifically, I’m talking about the ability to target to serve personalized advertising. It will be challenging without third-party cookies to track interests, behaviors, and habits.

Then there’s the measurement of that advertising. Part of the value proposition in digital advertising has long been the ability to tie an individual impression to an action or an acquisition. Without third-party cookies, that’s going to be a challenge for a couple of reasons. First, view-through conversions will go away completely, which will impact almost everything except the click-through conversions. Second, advertisers will likely up their investments in retail media networks, as they have treasure troves of first-party data that can be used for targeting. However, the ways these networks attribute sales are siloed and not standardized, and the biggest players like Amazon and Walmart don’t have much incentive to share their data. That means that results will be coming in from a variety of sources, which makes it difficult to get a holistic view of campaign performance. Retail advertisers will benefit from considering solutions that tie all of these approaches together—tools like data clean rooms, CRM solutions, CDPs, and click-based conversion attribution systems will be key.

AB: Prioritizing the collection and maximization of first-party data will be key to success for retail and e-commerce advertisers. Marketers can collect first-party data through things like promotions and loyalty programs, and then utilize it to create those personalized touchpoints. Customer data platforms (CDPs) are particularly useful for these tasks, as they can organize first-party data for targeting, and help with attribution as well by giving marketers a look into the customer journey and what tactics were most impactful on conversions in a given campaign. Marketers can also use the cookieless analysis of a data management platform like TransUnion for lookalike modeling based on first-party data to grow their addressable audience.

Contextual targeting is another big one for retail and e-commerce. It’s particularly relevant because people are researching products, doing shopper comparisons, and reading reviews on their phones and desktops. To be able to influence them while they’re researching in a contextually relevant environment is well worth the investment.

Next, Connected TV is a great, cookie-free place for retail advertisers to get premium inventory on private marketplaces, and it’s good for awareness all the way down to conversion. Within their creatives, advertising teams can include a QR code, which customers can scan to go to their website. At the same time, they can be running a digital campaign with a similar message to reach audiences while they’re on their desktops or mobile devices consuming shorter-form content.

A few other solutions that come to mind:

AB: Let’s take a large sporting apparel retailer as the first example. They’d want to consider onboarding first-party CRM data into a CDP like LiveRamp for precise ad targeting that doesn’t require third-party cookies. Based on the data they gather about a given consumer’s shopping behavior, they can advertise to them around the web for repeat purchases, new products, or related accessories, across different channels like video, native, or display, from upper- to lower-funnel ad placements. They could also utilize a DMP like TransUnion, which also doesn’t rely on third-party cookies, to build lookalike models off their CRM data and deploy awareness advertising to obtain new customers. Last, they could send people to their brand website and retarget off that site, or they could direct them to a landing page that promotes sales at a retailer partner like a big box or sporting goods store—but, of course, generating traffic to your own site comes with the added benefit of potentially increasing your CRM pool.

For a retail business that has brick-and-mortar stores, a geotargeted campaign can target people in proximity of their retail locations in a way that’s not cookie-reliant. Then, advertisers can use a footfall attribution partner like Cuebiq to measure physical store visits based on advertising. For a more specific example within this category, let’s take a business that sells diamond products in different luxury diamond stores. Their target customers will do research online, but the majority of that industry’s sales happen in person at their local jewelry store and not online. So, advertisers can target people with a combination of proximity and geotargeting, past website visits, as well as people who have visited a physical jeweler. The business could also switch its KPI from “website visits” to “in-store foot traffic,” which is where sales are more likely to happen and, again, isn’t based on third-party cookies for measurement.

Third-party cookies may be going away, but consumers will still become aware of products, visit brand websites and apps, browse options, buy online or in-store, and spread the word about their experience—good or bad. And they’ll still hand over email addresses and join loyalty programs in exchange for discounts, points, and perks.

With all that online behavior, retail and e-commerce advertisers shouldn’t dread the deprecation of the cookie. Contextual targeting, first-party data activation, and making the most of premium inventory on emerging platforms can provide a holiday catalog-sized array of options for cookieless campaign targeting and attribution.

—

Want to learn more about the state of identity in 2024? We surveyed over 200 marketing and advertising professionals to discover how they’re navigating signal loss, third-party cookie deprecation, and the shift towards privacy-first digital advertising. Check out all the latest data and insights in our in-depth report.

We hate to say “restaurant and dining” in the same breath as “cookies going away”… but at least it’s only the third-party kind of cookies, right? We know—that’s not much consolation, given the critical role third-party cookies have historically played in digital advertising functions. But Google Chrome’s cookie deprecation isn’t the only force pushing digital advertisers towards a privacy-first approach: marketing teams have already had to deal with signal loss in recent years due to factors like the uptick in digital advertising regulation, Apple’s App Transparency, and consumer demands for data privacy.

In 2024, however, the pressure will really be on for industry marketers to implement privacy-friendly solutions that not only identify, target, and convert potential or repeat diners at key decision-making moments, but also make up for the attribution capabilities enabled by third-party cookies. Moreover, marketing teams will need to maintain the personalization that consumers crave.

To help advertisers find their footing this year, we called on restaurant and dining marketing expert Vanessa Allen, Basis VP of Integrated Client Solutions. Read on for her insights into navigating the cookieless landscape, as well as her top recommendations for cookieless advertising solutions that can turn prospects into customers and visitors into regulars.

Vanessa Allen: In today’s digital age, cookie deprecation and signal loss are leading to an eroding internet-based identity. To mitigate this, my top piece of advice for marketers going into the cookieless future is to prioritize the collection and use of first-party data in a compliant, privacy-friendly way. The good news is, the restaurant and dining industry has several consumer touchpoints where businesses can collect first-party data: point-of-sale systems for transaction data, loyalty platforms for behavior and interest tracking, and reservation systems for timing and frequency of visits. Marketers can then use a customer data platform (CDP) like LiveRamp to turn that data into audience segments for ad targeting and to find lookalikes of existing customers.

VA: In addition to first-party data, there are quite a few cookieless and identity-friendly strategies available for restaurant and dining marketers.

Contextual targeting provides a great opportunity to capitalize on clear customer signals. For instance, the person reading a blog post about the best restaurants in Denver will get value from seeing ads for dining options in Colorado’s capital, and the aspiring cook reviewing online pasta recipes might be convinced to order in from the Italian restaurant advertising its delivery options. Contextual targeting can be especially effective for lower-funnel activities: There’s a lot of intent behind researching menus and reviews, as people are viewing that content at or near the moment of decision. Another benefit of contextual advertising is that it tends to be less expensive to deploy programmatically than other solutions, but still allows marketers to measure lower-funnel metrics—like cost per acquisition to generate orders for fast-casual or quick-serve restaurants, or cost per landing page view for fine dining.

Geotargeting a relevant location is another cookieless solution that is ideal for prospecting, as it can make locals and travelers aware of nearby food and drink options. It can even cause a change in buying behavior, as advertisers can geofence their competition and advertise on their customers’ phones. For example, the coffee lover who’s in line at a coffee shop could see a geofenced mobile ad for a discounted drink across the street, which could potentially intercept that sale.

Attribution is going to change, too, once the third-party cookie is gone, but there are solutions when all the stakeholders learn how to work together. For instance, businesses can share sales data with their advertising partners, and with the right formatting and FTP setup, that sales data can blend nicely with ad campaign data in the same dashboard to show how advertising efforts are influencing sales.

VA: Let’s take a fast-casual restaurant as the first example. To collect and activate their first-party data effectively, they can collect data at the time of purchase and send it into a CRM. That data can then be activated strategically based on dining behaviors—for example, fast-casual customers aren’t likely to dine there again for about a week, so they can be put into a seven-day lookback window. They aren’t targeted programmatically or on social media until a week after their last purchase, which ensures budget is spent efficiently. When they see your ads a week later, they’re ready to buy again.

Next, let’s look at a fine dining restaurant. A marketer for this kind of business can generate awareness with location targeting, which reduces reliance on cookies, and Census data, which can show customer affinity for these restaurants. Contextual targeting is also effective for finding people researching tentpole events like Valentine’s Day, Mother’s Day, graduations, and other times when people might spend more money on a nice dinner out. If some of that research happens on more premium websites, a private marketplace deal can use a certified publisher’s first-party data to create interest with the right audience. For a cookieless attribution method, advertisers can measure cost per booking, including calls, which are also prominent in search ads, or online reservations, which are often two of the biggest success signals. Then, retargeting can kick in, with longer lookback windows of around 21 days or 30 days, since most people aren’t dropping $200 on fine dining takeout once a week.

The loss of cookies in Chrome means that the need for restaurant and dining marketers to adopt privacy-first advertising will reach a boiling point in 2024. By collecting and activating first-party data and leveraging privacy-friendly media tactics such as contextual and geotargeting, and by using the examples outlined above to tailor their strategies to specific businesses, industry marketers can place themselves at the head of the table.

—

Want to learn more about the state of identity in 2024? We surveyed over 200 marketing and advertising professionals to discover how they’re navigating signal loss, third-party cookie deprecation, and the shift towards privacy-first digital advertising. Check out all the latest data and insights in our in-depth report.

Heading into 2024, financial services marketers are facing an unenviable list of challenges: from convincing people to borrow money at today’s record-high rates; to communicating product value and service expertise in an ultra-competitive market full of disruptors; to reaching and converting unbanked, underbanked, or alternative-banking customers.

Not making things any easier? Ongoing signal loss, Google’s deprecation of third-party cookies in Chrome, and the Consumer Financial Protection Bureau’s interpretive rule that put responsibility for abiding by digital marketing regulations on both financial institutions and their agencies and partners.

But the financial services industry has proven resilient in the face of change. It’s better positioned for greater regulatory scrutiny. First-party consumer data is available, attainable, and actionable. And solutions abound for targeting and retargeting potential new customers and attributing their conversions—including inquiries, online applications, scheduled appointments, and more—to advertising campaigns.

To help financial services advertisers prepare for the cookieless future and adapt to signal loss, we spoke to Julia Hewitt, Basis VP of Integrated Client Solutions, about some of her top recommendations and insights.

Julia Hewitt: The main consideration has to be how you’re reaching your audience online, which will look so much different next year than it did five years ago thanks to cookie loss, regulations, mobile ID erosion, and Apple’s App Tracking Transparency. Whether it’s through targeted advertising, organic content, or community sponsorships, financial services marketers need to cut through the noise to reach their ideal prospects at key moments of intent.

Then, once you reach them, what are you doing to help them connect with your brand and, ultimately, entice them to provide you with their first-party data? If people are clicking on your ad or going to your website, what content are you providing? Do you have tools they can use—let’s say, to calculate the cost of a loan? Or comparisons with other financial services? Do you have a newsletter they can sign up for that includes information that’s highly relevant to them and their needs? These are the sorts of things that could generate an inquiry or an opt-in that gives you the data you need for targeting, personalization, and attribution.

Of course, the challenges that come from this signal loss will affect reach and personalization. There are regulations that require you to comply with how you’re targeting people and how transparent you are with how you plan to use their data; we’ve seen it with programmatic advertising, we’ve seen it with Meta, we’ve seen it with Google. As cookies and the ability to track app data erode, timing and relevance gets more difficult. The important thing for finserv marketers is protecting these audiences. But the good news is we’re used to change. We’re used to adapting. This is just another wave to get through.

JH: Contextual targeting is a huge opportunity for financial services marketers and brands to lean into. When people are researching homes and home loans, cars and auto loans, home or auto insurance, credit card rates, and they’re researching because they intend to buy, borrow, or inquire. Advertising next to this content can strengthen awareness or trigger a decision to click and engage with these financial services companies. A big thing with contextual advertising is identifying the content, keywords, publishers, and/or private marketplaces that will connect your brand with moments that are important to your potential customers.

And, of course, using first-party data will be key. But to be able to use it, you first have to collect it. A company website can offer lots of places for that data collection, including inquiries, appointment schedulers, content downloads, or e-newsletter signups. The right martech can then help segment that data to apply it strategically so you’re not advertising home mortgage ads to 18-year-olds in college.

When collecting first-party data, it’s critical to keep regulations and customer expectations around data privacy top-of-mind. Inform users about how you’ll use their data, and make sure they have access to your data usage policies on your website to be compliant.

Finally, we can’t forget attribution, which will evolve over time. Finserv marketers who segment their audiences well and build relevant campaigns should be able to see what advertisements are being clicked on, and which websites and placements are providing the best ROI. Google Analytics or other web analytics dashboards can help, and there are several other attribution APIs in the works (including from Google) that will replace the “cookie trail” from ad exposure through event-level metrics to conversion. In general, marketers should have some quality options available to determine which sites and campaigns are driving the best quality traffic.

JH: Imagine a financial advisory brokerage that needs more financial advisors on staff, so they might decide to advertise to recruit a highly qualified type of person to provide that specific type of service.

They’ll want to set up their adtech stack well to be able to measure and analyze click-through data from their digital advertising campaigns with tactics like custom URL code instead of cookies, then determine the best-performing websites for ad placements and strengthen those partnerships. Then, they’ll use their first-party data to validate the type of professional they want to reach. And with that validation, they can get more hyper-targeted on LinkedIn, which is where the professionals are!

A similar process could apply in B2C marketing, too, measuring clicks on ads to determine high-performing placements and personas, then using machine learning and predictive modeling to find those personas and more who look like them, and targeting products or services that make sense for those personas.

There are also opportunities to use your website to identify specific audience behaviors and feed that information into a CRM for better segmentation. For example, web visitors might submit their email address when downloading an online guide to home-buying or to follow up on the results from an auto loan calculator. That can create first-party data sets that pull in more personal data. That category-level information can also enrich a person’s CRM record with zero-party or interest-level data, which can then be used for a more personalized, relevant ad experience.

The deprecation of third-party cookies doesn’t mean the depreciation of the value of advertising. In fact, taking a strategic approach to signal loss could yield higher gains. Finserv advertisers who collect first-party data intentionally, use contextual targeting, and leverage data analysis for segmentation and optimization can achieve targeting and message resonance at rates that would make the Fed jealous.

—

Want to learn more about the state of identity in 2024? We surveyed over 200 marketing and advertising professionals to discover how they’re navigating signal loss, third-party cookie deprecation, and the shift towards privacy-first digital advertising. Check out all the latest data and insights in our in-depth report.

There were a lot of things to obsess over this past year, from “Barbie” to “Oppenheimer” to Pope Francis and Snoopy wearing (or not wearing) puffer jackets. And don’t get us started on Beyoncé’s Renaissance tour or Taylor Swift’s Eras tour, both of which were as in as #GirlDinner on TikTok.

Practically equal in their popularity: The following Basis blog posts, which, thanks to your viewership, proved they have a ton of rizz. You were particularly interested in data privacy, artificial intelligence, and convergent and connected TV—all topics that will undoubtedly maintain their relevance in the new year. So, set yourself up for success by joining us for this walk down memory lane:

Staying up to date on digital advertising regulations and their implications for advertisers isn’t easy, so when you found information on privacy-first marketing, you opted in.

New regulations on digital advertising continue to pop up in the US and around the world, moving the digital advertising industry in the direction of privacy-friendly advertising. Here, learn the latest on these regulations and their impact on the advertising industry.

Since passing the California Consumer Protection Act (CCPA) in 2018, California has established itself as a leader in consumer privacy and data protection in the US. And with the recent passage of the California Privacy Rights Act, those protections have expanded. Learn how these laws protect consumer data and how advertisers can stay compliant in this piece.

Noor Naseer, Basis’ VP of Media Innovations and Technology, traveled to the hub of all things digital, South by Southwest, in Spring 2023. There, she shared insights on cookie deprecation, identity solutions, and consumer expectations. Find the video of Naseer’s presentation—as well as a download of her jam-packed slides—right here.

Artificial intelligence was as hot as UGG slippers in 2023, as more and more advertisers began to adopt generative AI. Your favorite posts focused on the technology’s potential impacts to the future of digital advertising as a whole, as well as on search engine marketing specifically.

This Q&A with three AI thought leaders addresses recent developments in the industry and explores AI’s potential impact on media, marketing, and digital advertising.

Search engines are awfully smart, and that intelligence—artificial or otherwise—will only continue to evolve. Here, an expert on paid search discusses how AI impacts search engine analysis, results, and generative content—and outlines how advertisers can prepare for an even more AI-driven future.

2023 was a big year for streaming and convergent TV advertising, with linear TV usage dropping below 50% of all TV viewing for the first time ever in July 2023. You spent the most screen time with these two posts:

With more and more people owning connected TVs and streaming their video content, the CTV advertising opportunity is booming. Here, we tune into best practices for strategic planning, precise targeting, and measuring success on this ever-evolving and impactful channel.

One of the biggest movements away from linear and into streaming comes from the live sports arena. This piece takes a closer look at how advertisers can reach live sports viewers given this shift, and explores the omnichannel advertising opportunity that comes with it.

In addition to posts on digital advertising regulation, AI, and convergent and connected TV, you were a big fan of posts that cover everything you need to know about specific digital advertising topics. Makes sense to us—if you’re going to learn about something, why not go all in?

When you add the targeting, optimization, and trackability of “digital” to the real-world impact of large-format out-of-home, you get a powerful and increasingly popular advertising platform. This piece on digital out-of-home (DOOH) dives into the channel, reviews its formats, explores its capabilities, and illustrates its benefits for advertisers.

What’s in a name? In the case of the “guaranteed” in “programmatic guaranteed”, quite a lot—including locked-in impressions and CPMs through an automated DSP. Check out how PG works, how it compares to direct buys and PMPs, and what steps are needed to run a programmatic guaranteed deal.

The transparency and control afforded by programmatic in-housing is attractive for many brands. Indeed, many big players, like Procter & Gamble and Coca-Cola, have brought media buying inside their walls. For advertisers who aren’t sure whether—or what type of—programmatic-in housing makes sense for them, this piece breaks down all the key considerations.

—

Well, that’s a wrap on your top blog posts of 2023! You prepared for big policy changes, turned your interest in artificial intelligence into real intelligence, made a connection with convergent and connected TV, and went in-depth on DOOH, programmatic guaranteed, and in-housing. Here’s to a year of learning and improvement, and more to come in 2024!

—

Want all the best digital advertising content delivered straight to your inbox? Sign up for Basis Scout, a monthly newsletter highlighting new and essential resources for digital marketing and advertising professionals.

“Remember These Child Actors From The ‘80s? You’ll Never Believe How They Look Today!”

If you’ve ever clicked on a link like this, you’ve likely found yourself transported to a digital space that looks more like a carnival midway ride than a normal website: ads flashing, inventory refreshing, and call-to-action buttons leading you to other websites with even more pop-up ads. Worst of all, it takes dozens of clicks to find out what happened to those child actors!

These digital spaces are called made-for-advertising sites (MFAs), and a recent study found that brands spend about 15% of their programmatic ad budgets on them. But do MFAs help advertisers reach their business goals, or are they simply generating revenue for the people who build and manage them?

To help advertisers break through the clutter, we spoke with Ayse Pamuk, Manager of Platform Operations at Basis Technologies. Below, Pamuk breaks down how MFAs work, and shares insights on how advertisers can avoid low-quality ad inventory before a campaign starts.

Ayse Pamuk: An MFA is a generic website that is not the result of any quality content creation or journalistic effort. These sites are built just to generate traffic: They usually pay for traffic to their site and then generate multiple ad impressions on each page. So, good old arbitrage (buying website traffic for a low cost and monetizing it via higher-paying advertisements).

It starts with a clickbait headline. Once a user clicks on that headline, the site tries to make them scroll down or click through a slideshow to reach the promised content, thus generating even more ad impressions. In the end, the user gets almost nothing out of the content, so they often leave frustrated.

AP: Technically speaking, an MFA is a real website and there are real ad impressions being served—so they don’t necessarily fall under the category of ad fraud. However, MFA sites are definitely low quality, and they certainly don’t drive any actual performance. Just because ads served on these sites are displayed on the screen for more than five seconds and people technically see them doesn’t mean those ads create awareness for a brand, or that they drive sales or anything else an advertiser would want from an ad placement.

AP: Wasted budget is the biggest risk associated with spending on MFAs. Again, it’s not fraud, but it could pose some brand safety and brand suitability issues. This is an especially important topic to understand now, because with more and more digital content being generated by AI, we are going to see MFA sites popping up by the dozen almost every day. And when money gets funneled to them, that’s money wasted on websites and inventory that aren’t helping brands meet their campaign goals.

AP: I think it’s about understanding the real mathematics around this, and using those insights to set the right goals and KPIs. As an advertiser, I can either try to achieve very low CPMs and generate a substantial number of impressions, but get low to no action as a result; or I can spend the same amount of money and generate fewer impressions, and get much better performance and much more beneficial action.

If you only care about spend and how many impressions you generated, then maybe you do want to spend on MFAs. But if I were a business owner working with an agency, I would ask, “OK, you generated this many impressions, but what impact did they make?” I would want that connection between objectives and KPIs to be clear.

AP: Not surprisingly, since MFAs’ only goals are to make money from advertising, they include some distinguishable characteristics, like having a large number of ads on the screen, ad inventory that auto-refreshes at a higher-than-average frequency, and numerous links to other MFAs. By working with partners who prioritize strong brand safety protocols and tools, advertisers can avoid having their ads end up on these sites. For example, Basis Technologies’ partnership with Jounce media gives users the ability to use a dynamic MFA block list to avoid serving ads on those sites.

AP: One responsibility of adtech providers is to give advertisers access to high-quality inventory. The advertiser should be able to get the most out of their budget: They should be able to spend one dollar and generate a thousand. So, their money should be spent on ads that will show up in places that provide the outcomes advertisers want.

Adtech providers also have a responsibility to create an efficient environment for clients and to seek out solutions that help advertisers more easily avoid MFAs. Getting the best impressions for advertisers takes historical data, machine learning optimization, and algorithmic optimization. Those tools allow advertisers to spend less time, effort, and energy to create high ROI.

I always say it takes a village to combat industry problems like MFAs. Advertisers, data and inventory partners, and adtech providers should keep each other informed because each new topic presents new avenues for fraud, or gaming the system, or other shady practices. It’s an ongoing battle. Everyone involved must be proactive to prevent these things from becoming bigger issues.

—

Need help navigating the world of MFAs and avoiding low-quality digital ad inventory? Connect with our experts to learn how to build your most efficient and impactful digital advertising strategy.